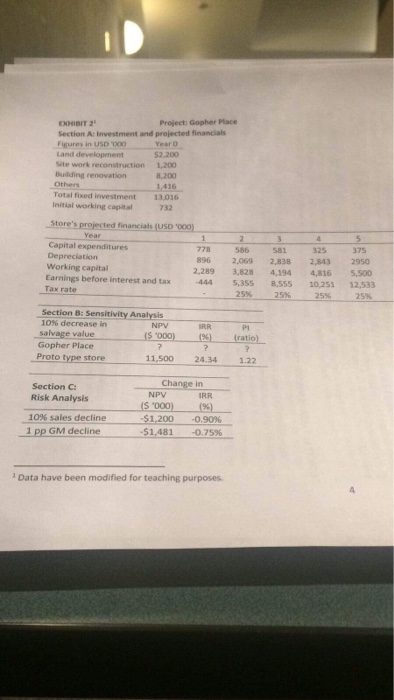

MINI CASE # 1: TARGET CORPORATON Today is February 26, 2018 hin Mulligan, CFO of Target Corporation, h preparing for the March meeting of Capital Expenditure Committee (CEC) Johe is one of five executive officers who are members in part because of of the CEC The CEC is keenly aware that Target has been a strong performing company nvestment decilions and continued growth Each ievestment decision hes long term Target: an underperforming store will be a drig on future earnings and difficult to turn money, whereas a top performing store wiltl add value mplcations for around without significant levestments of time and both financially and projects best St Target's future proposal, "New Store in Gogher Place, proposed project is good enough for fulfiting Target's mission (Exhibit 1) strategicaly for years to come. There is, therefore, a need to determine which stere growth and capital expenditure plans. In reviewing a project coming before the committes, John needs to make sure that the Business Target Corporation (the Corporation or Target) was incorporated in Minnesota in 1902. The corporation operates two main reportable segments: u.S. Retail, and U.S Credit Card. Between these segments, the U.S. Retail Segment includes all of US merchandising operations. Target offers both everyday essentiels and fashionable, differentiated merchandise at discounted prices. The ability to deliver a shopping experience that is preferred by their customers, referred to as "suests" is supported by their strong supply chain and technology infrastructure, a devotion to innovation that is ingrained in their organization and culture, and their disciplined approach to managing current business and investing is future growth. The business is desijgned to enable guests to purchase products seamlessly in stores, online or through their mobile device. The U.S. Credit Card Segment offers credit to qualified guests through their branderd proprietary credit cards: the Target Credit Card and the Target Visa. Additionally, Target offers a branded proprietary Target Debit Card. Collectively, these cards help strengthen the bond with their guests, drive incremental sales and contribute to their results of operations Target consistently strives to support the slogan "Expect More. Pay Less" The carporation focuses on creating a shopping experience that appeals t0 the profile of its "core guest: a with children at home who is more affluent than the typical Wal-Mart customers. This shopping experience is created by emphasizing a store dcor that gives just the right shopping ambience. The company has been highly successful at promoting its brand awareness with large advertising campaigs in fact, consistent advertising spending resulted in the Target's bul's eye logo's being ranked among the most recognized corporate logos in the U.S, ahead of the Nike "swoosh" Capital Expenditure Approval Process CEC considers several factors in determining whether to accoept or reject a project. An overarching objective is to meet the corporate goal of adding new stores every year while maintaining a positive brand image. A new project, however, needs to meet a variety of financial objectives, starting with providinga suitable financial return as measured by discounted free cash-Bow metrics: NPV,IRR, and proability ndex IPll, and thus are ows. Other financial considerations include the possible changes in the above matrices due to changes future cash flows and e NPV is computed using a discount 'atesty%for.nursash. of both NR and IRR to sales and profit yariations, The committee embers are provided with a capital-project request "dash board" for a project that summarizes the tical inputs and/or assumptions used for the NPV, IRR and Pl calculations. Target's required rate urn on investment in any project is 12% Exhlibit 2 includes a dash-board for a proposed project ocat e Gopher Place, This is an investment proposal where finances will be employed to renovate exi ical facility for the store, such as, land development, building renovation and features, etc dashboard provides projected sed i capital requirement in Year O. Rt projecte expenditure, working capital depreciation, years (Year 1 to Year S). The projected nvestments related to store reconstruction as well as initial working aso provides projected financials, including additional annual capital and earnings before interest and tax (EBIT), for the next s eroposal inckudes projected financials of S- year life cycle since the store needs ocation ater 5 years. At that point, Target plans to sell their facilities in the elocated to a diferent location afther 5 years Target plans to Gopher Place to interested buyers. Target estimates that the ny will also be able to recover the full amount of initial working capital in year 5. The store's projected hee cash flows are required to estimate based on the above information. The question, lohn recognizes that each project shoudd represent growth opportunity for Target. however, is whether capital is better project or most growth for Targe considering three scenarios, including base case analysis, sensitivity his decision about the proposed project during the CEC meeting t shareholders. Thus, John feels that he needs to evaluate this project by analysis, and risk analysis, for giving pent on one project or another to create the most value and the ANSWER THE FOLLOWING QUESTION 20 points) Should John recommend the proposed project in Gopher Place for approval to the CEC committee Provide evidence to support your answer. show calculations in detail to justify your answer. Points are allocated for different ev iteria.J IBIT 1: TARGET'S MISSION STATEMENT 'Our mission is to make Target your preferred shopping destination in all channels by delivering anding value, continuous innovation and exceptional guest experiences by consistently Expect More. Pay Less brand promise." EXHIBIT 2 Section A: Investment and projected financials Figures in USD 000 Land development Site work reconstruction 1,200 Bulding renovation Others Total fixed investment 13,016 Initial working copital Project: Gopher Place Year o 52,200 8,200 732 Year Capital expenditures 778 586 581 896 2,069 2,838 2,843 2950 2.289 3,828 4,194 4,816 5,500 325 375 Depreciation Working capital Earnings before interest and tax 444 5,35s 8.sss 30,251 12,533 Tax rate 25% 25% 25% Section B: Sensitivity Analysis 10% decrease in salvage value Gopher Place Proto type store ($ 000) IRR (%) Pi (ratio) 11,500 24.34 1.22 changs Section C Risk Analysis IRR 10% sales decline 1 pp GM decline -S1200-090% -$1,481-0.75% Data have been modified for teaching purposes MINI CASE # 1: TARGET CORPORATON Today is February 26, 2018 hin Mulligan, CFO of Target Corporation, h preparing for the March meeting of Capital Expenditure Committee (CEC) Johe is one of five executive officers who are members in part because of of the CEC The CEC is keenly aware that Target has been a strong performing company nvestment decilions and continued growth Each ievestment decision hes long term Target: an underperforming store will be a drig on future earnings and difficult to turn money, whereas a top performing store wiltl add value mplcations for around without significant levestments of time and both financially and projects best St Target's future proposal, "New Store in Gogher Place, proposed project is good enough for fulfiting Target's mission (Exhibit 1) strategicaly for years to come. There is, therefore, a need to determine which stere growth and capital expenditure plans. In reviewing a project coming before the committes, John needs to make sure that the Business Target Corporation (the Corporation or Target) was incorporated in Minnesota in 1902. The corporation operates two main reportable segments: u.S. Retail, and U.S Credit Card. Between these segments, the U.S. Retail Segment includes all of US merchandising operations. Target offers both everyday essentiels and fashionable, differentiated merchandise at discounted prices. The ability to deliver a shopping experience that is preferred by their customers, referred to as "suests" is supported by their strong supply chain and technology infrastructure, a devotion to innovation that is ingrained in their organization and culture, and their disciplined approach to managing current business and investing is future growth. The business is desijgned to enable guests to purchase products seamlessly in stores, online or through their mobile device. The U.S. Credit Card Segment offers credit to qualified guests through their branderd proprietary credit cards: the Target Credit Card and the Target Visa. Additionally, Target offers a branded proprietary Target Debit Card. Collectively, these cards help strengthen the bond with their guests, drive incremental sales and contribute to their results of operations Target consistently strives to support the slogan "Expect More. Pay Less" The carporation focuses on creating a shopping experience that appeals t0 the profile of its "core guest: a with children at home who is more affluent than the typical Wal-Mart customers. This shopping experience is created by emphasizing a store dcor that gives just the right shopping ambience. The company has been highly successful at promoting its brand awareness with large advertising campaigs in fact, consistent advertising spending resulted in the Target's bul's eye logo's being ranked among the most recognized corporate logos in the U.S, ahead of the Nike "swoosh" Capital Expenditure Approval Process CEC considers several factors in determining whether to accoept or reject a project. An overarching objective is to meet the corporate goal of adding new stores every year while maintaining a positive brand image. A new project, however, needs to meet a variety of financial objectives, starting with providinga suitable financial return as measured by discounted free cash-Bow metrics: NPV,IRR, and proability ndex IPll, and thus are ows. Other financial considerations include the possible changes in the above matrices due to changes future cash flows and e NPV is computed using a discount 'atesty%for.nursash. of both NR and IRR to sales and profit yariations, The committee embers are provided with a capital-project request "dash board" for a project that summarizes the tical inputs and/or assumptions used for the NPV, IRR and Pl calculations. Target's required rate urn on investment in any project is 12% Exhlibit 2 includes a dash-board for a proposed project ocat e Gopher Place, This is an investment proposal where finances will be employed to renovate exi ical facility for the store, such as, land development, building renovation and features, etc dashboard provides projected sed i capital requirement in Year O. Rt projecte expenditure, working capital depreciation, years (Year 1 to Year S). The projected nvestments related to store reconstruction as well as initial working aso provides projected financials, including additional annual capital and earnings before interest and tax (EBIT), for the next s eroposal inckudes projected financials of S- year life cycle since the store needs ocation ater 5 years. At that point, Target plans to sell their facilities in the elocated to a diferent location afther 5 years Target plans to Gopher Place to interested buyers. Target estimates that the ny will also be able to recover the full amount of initial working capital in year 5. The store's projected hee cash flows are required to estimate based on the above information. The question, lohn recognizes that each project shoudd represent growth opportunity for Target. however, is whether capital is better project or most growth for Targe considering three scenarios, including base case analysis, sensitivity his decision about the proposed project during the CEC meeting t shareholders. Thus, John feels that he needs to evaluate this project by analysis, and risk analysis, for giving pent on one project or another to create the most value and the ANSWER THE FOLLOWING QUESTION 20 points) Should John recommend the proposed project in Gopher Place for approval to the CEC committee Provide evidence to support your answer. show calculations in detail to justify your answer. Points are allocated for different ev iteria.J IBIT 1: TARGET'S MISSION STATEMENT 'Our mission is to make Target your preferred shopping destination in all channels by delivering anding value, continuous innovation and exceptional guest experiences by consistently Expect More. Pay Less brand promise." EXHIBIT 2 Section A: Investment and projected financials Figures in USD 000 Land development Site work reconstruction 1,200 Bulding renovation Others Total fixed investment 13,016 Initial working copital Project: Gopher Place Year o 52,200 8,200 732 Year Capital expenditures 778 586 581 896 2,069 2,838 2,843 2950 2.289 3,828 4,194 4,816 5,500 325 375 Depreciation Working capital Earnings before interest and tax 444 5,35s 8.sss 30,251 12,533 Tax rate 25% 25% 25% Section B: Sensitivity Analysis 10% decrease in salvage value Gopher Place Proto type store ($ 000) IRR (%) Pi (ratio) 11,500 24.34 1.22 changs Section C Risk Analysis IRR 10% sales decline 1 pp GM decline -S1200-090% -$1,481-0.75% Data have been modified for teaching purposes