Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mini Case 4 . 6 A company has two investment opportunities, replacing an old production line with new one using similar technology ( denoted as

Mini Case

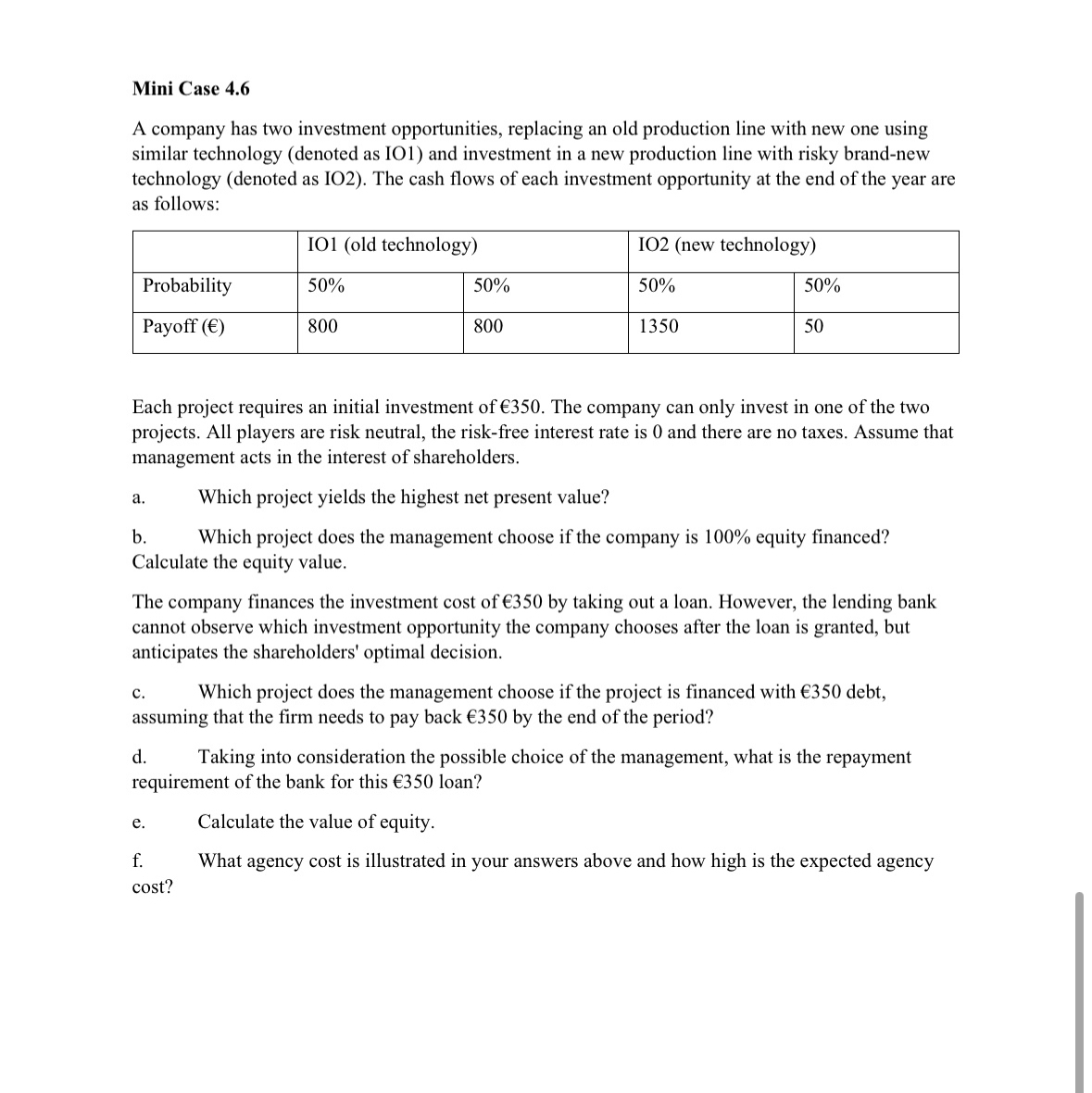

A company has two investment opportunities, replacing an old production line with new one using

similar technology denoted as IO and investment in a new production line with risky brandnew

technology denoted as IO The cash flows of each investment opportunity at the end of the year are

as follows:

Each project requires an initial investment of The company can only invest in one of the two

projects. All players are risk neutral, the riskfree interest rate is and there are no taxes. Assume that

management acts in the interest of shareholders.

a Which project yields the highest net present value?

b Which project does the management choose if the company is equity financed?

Calculate the equity value.

The company finances the investment cost of by taking out a loan. However, the lending bank

cannot observe which investment opportunity the company chooses after the loan is granted, but

anticipates the shareholders' optimal decision.

c Which project does the management choose if the project is financed with debt,

assuming that the firm needs to pay back by the end of the period?

d Taking into consideration the possible choice of the management, what is the repayment

requirement of the bank for this loan?

e Calculate the value of equity.

f What agency cost is illustrated in your answers above and how high is the expected agency

cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started