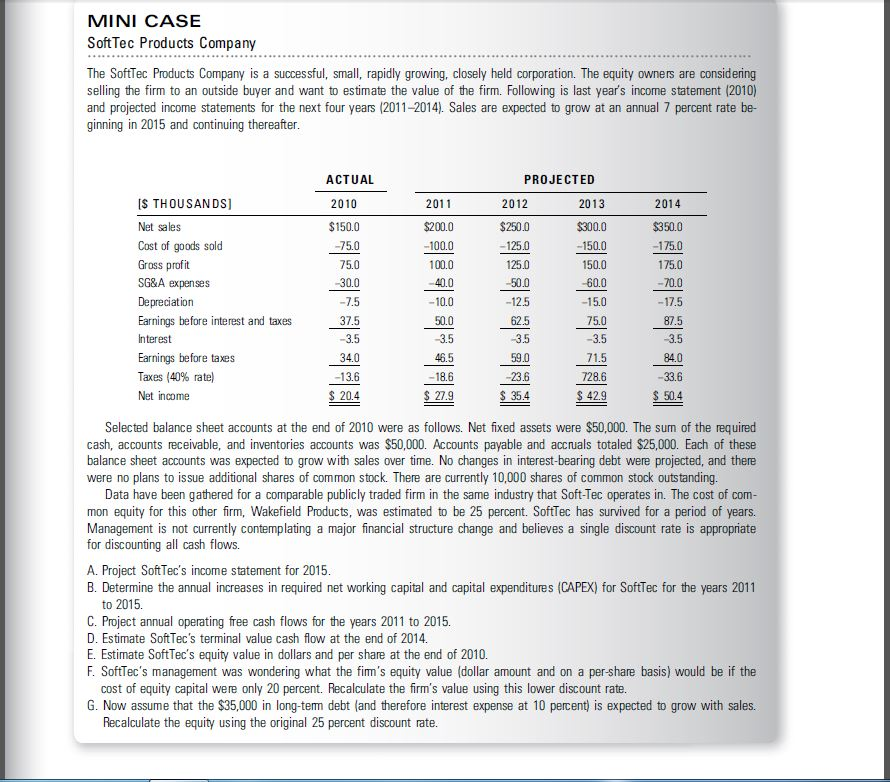

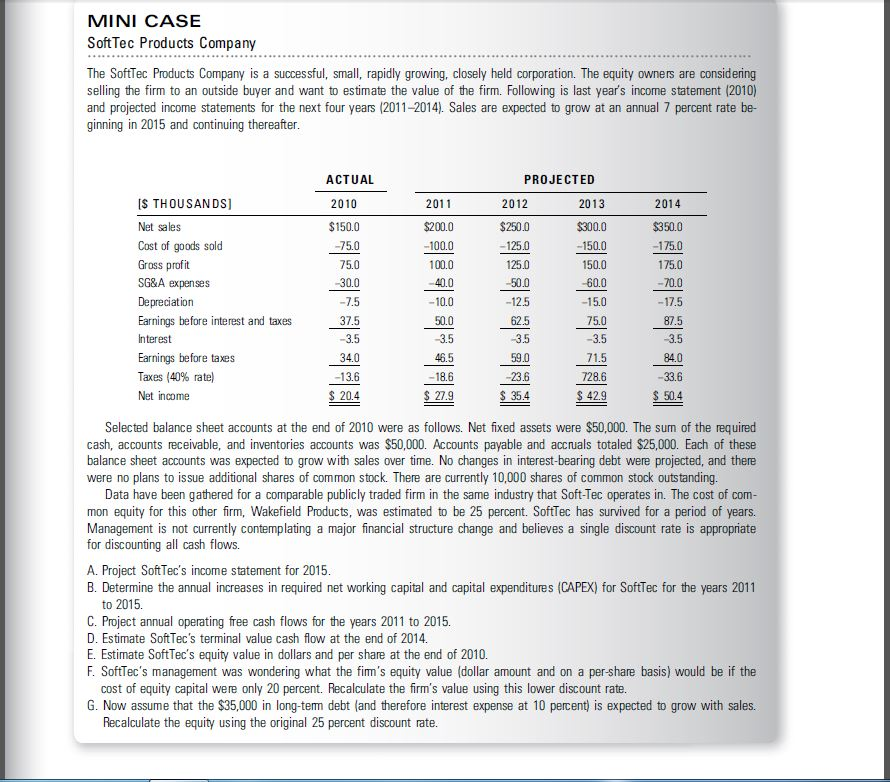

MINI CASE SoftTec Products Company The SoftTec Products Company is a successful, small, ra pi dly growing, closely held corporation. The equity owners are considering selling the firm to an outside buyer and want to estimate the value of the firm. Following is last year's income statement (2010) and projected income statements for the next four years (2011-2014). Sales are expected to grow at an annual 7 percent rate beginning in 2015 and continuing thereafter. Selected balance sheet accounts at the end of 2010 were as follows. Net fixed assets were $50,000. The sum of the required cash, accounts receivable, and inventories accounts was $50,000. Accounts payable and accruals totaled $25,000. Each of these balance sheet accounts was expected to grow with sales over time. No changes in interest-bearing debt were projected, and there were no plans to issue additional shares of common stock. There are currently 10,000 shares of common stock outstanding. Data have been gathered for a comparable publicly traded firm in the same industry that Soft-Tec operates in. The cost of common equity for this other firm, Wakefield Products, was estimated to be 25 percent. SoftTec has survived for a period of years. Management is not currently contemplating a major financial structure change and believes a single discount rate is appropriate for discounting all cash flows. Project SoftTec's income statement for 2015. Determine the annual increases in required networking ca pi tal and ca pi tal expenditures (CAPEX) for SoftTec for the years 2011 to 2015. Project annual operating free cash flows for the years 2011 to 2015. Estimate SoftTec's terminal value cash flow at the end of 2014. Estimate SoftTec's equity value in dollars and per share at the end of 2010. SoftTec's management was wondering what the firm's equity value (dollar amount and on a per-share basis) would be if the cost of equity ca pi tal were only 20 percent. Recalculate the firm's value using this lower discount rate. Now assume that the $35,000 in long-term debt (and therefore interest expense at 10 percent) is expected to grow with sales. Recalculate the equity using the original 25 percent discount rate