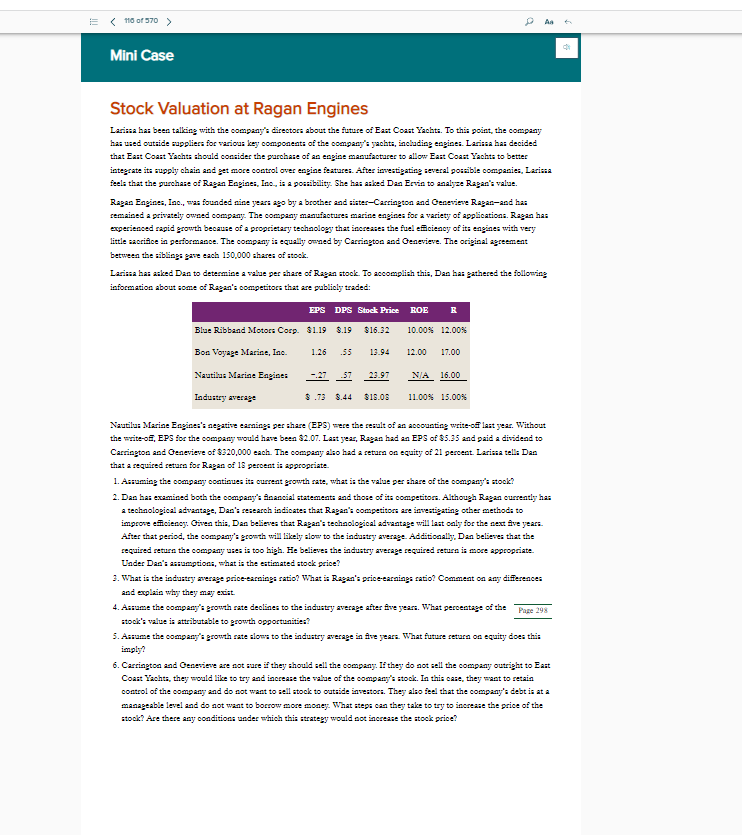

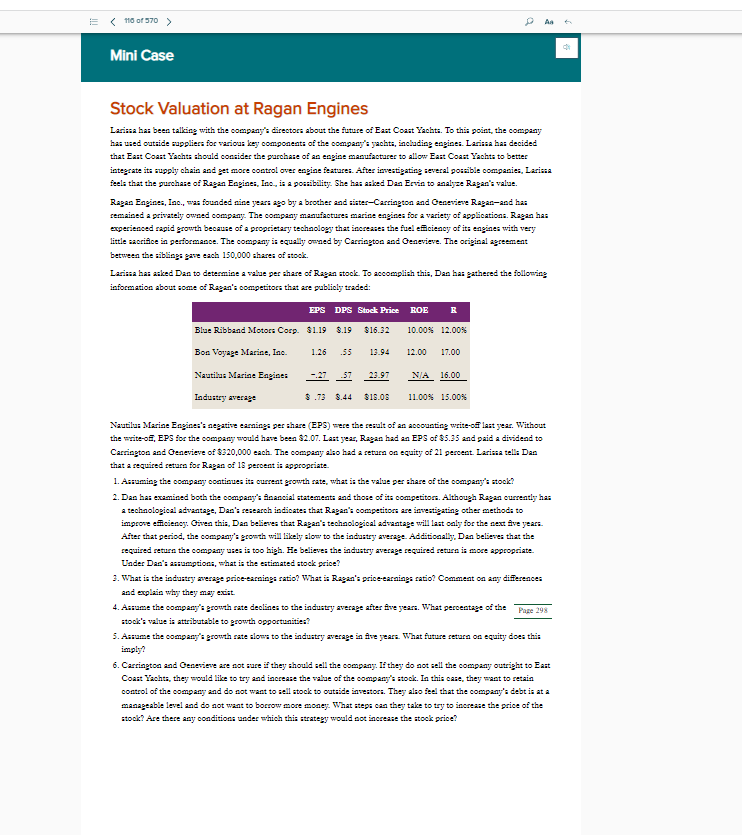

Mini Case Stock Valuation at Ragan Engines Lasinna has been talking with the company's director about the future of East Coast Yachts. To this point, the compaay has used outside appliers for various key components of the company's yachts, including espioLasinna has decided tha: East Coast Yachts should consider the garchase of an engine manufacturer to allow East Coast Yachts to better integrate its supply chain and get more control over esgine features. After investigating several porable companies, Larina feels that the purchase of Regan Eapises, Inc. is a posibility. She has asked Dan Ervis to analyze Ragan's value. Ragan Eazines, Inc., was founded nine years ago by a brother and sister-Carrington and Geneviere Ragan-and has remained a privately owned company. The company manufactures marine engines for a variety of applications. Ragan has experiesced rapid growth because of a proprietary techa loys that increases the fuel eciecy of its eagines with very little sacrifice in performance. The company is equally owned by Carrington and Genevieve. The original agreement between the siblings as each 150,000 shares of stock. Larina has asked Dan to determine a value per share of Ragan stock. To accomplish this, Dan has gathered the following information about some od Ragan's competitors that are publicly traded: EPS DPS Stock Price BOE R Blae Ribband Motors Corp. $1.19 0.19 $16.32 10.00% 12.00% Bon Voyage Marice, Inc. 1.26 .55 13.94 12.00 17.00 Nautilus Marine Engines -:27 57 23.97 NA 16.00 Ladustry average 3.73 3.44 $15.08 11.00% 15.00% Nautilus Mariae Esgier's negative earnings per share (EPS) were the result of an accounting write-cat last year. Without the write-o, EPS for the company would have been $2.07. Last yezz, Ragan had an EPS of $5.35 and paid a dividend to Carringtoo and Genevieve of $320,000 each. The company ho had a setara on equity of 21 percent. Lacina tel: Das that a required retara for Ragan of 15 percent is appropriate 1. Asraming the company coatinues its current growth rate, what is the value per share of the company's stock? 2. Dan has examined both the company's Anancial statements and those of its competitors. Although Ragan currently has a technological advantage. Dan's research indicates that Ragan's competitors are investigating other methods to improve elcieco: Givea this, Dan believes that Ragan's technological advantage will last caly for the sex ave year. After that period, the company's zoonth will likely low to the industry average. Additionally, Dan believes that the required return the company wies is too high. He believes the industry average required return is noce appropriate Under Dan's arramptions, what is the estimated stock price? 3. What is the industry zerage price-earnings ratio? What is Ragan's price-earnings ratio? Comment on any differences and explain why they may excist. 4. Asrame the company's growth rate declines to the industry average after five years. What percentage of the Page 298 stock's value is attributable to growth opportunities? 5. Asrame the company's growth rate clows to the industry average in se years. What future setara on equity does this imply 6. Cacciatoa and Deseriere are not rare if they should sell the company. If they do not sell the company outright to East Court Yachts, they would like to try and increase the value of the company's stock. In this case, they want to retain control of the company and do not want to sell stock to outside insectors. They also feel that the company's debt is at a manageable level and do not want to borrow more money: What steps can they take to try to increase the price of the stock? Are there any conditions ander which this atrategy would so increase the stock price