Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mini Case The following transactions take place in month of September 2018 for Northern Lights Company. Sept 1 Paid the monthly rent with $3,500 cash.

Mini Case

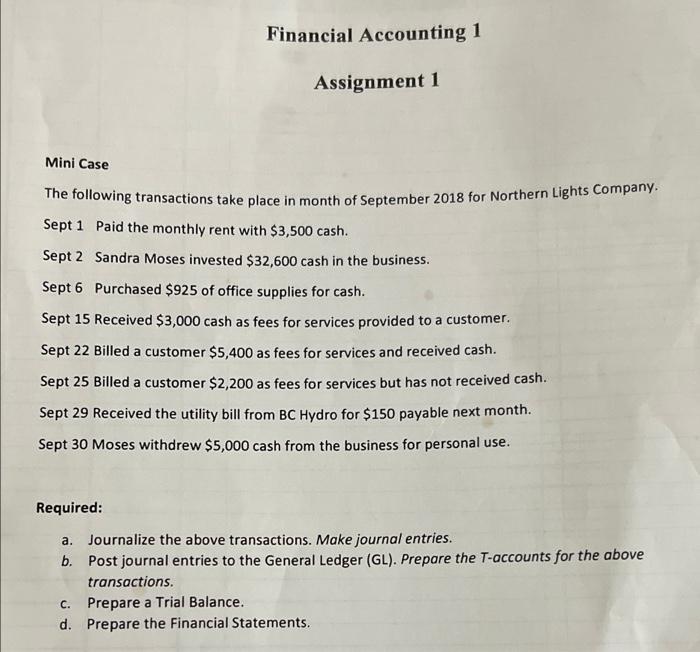

Financial Accounting 1 Assignment 1 Mini Case The following transactions take place in month of September 2018 for Northern Lights Company. Sept 1 Paid the monthly rent with $3,500 cash. Sept 2 Sandra Moses invested $32,600 cash in the business. Sept 6 Purchased $925 of office supplies for cash. Sept 15 Received $3,000 cash as fees for services provided to a customer. Sept 22 Billed a customer $5,400 as fees for services and received cash. Sept 25 Billed a customer $2,200 as fees for services but has not received cash. Sept 29 Received the utility bill from BC Hydro for $150 payable next month. Sept 30 Moses withdrew $5,000 cash from the business for personal use. Required: a. Journalize the above transactions. Make journal entries. b. Post journal entries to the General Ledger (GL). Prepare the T-accounts for the above transactions. C. Prepare a Trial Balance. d. Prepare the Financial Statements. Financial Accounting 1 Assignment 1 Mini Case The following transactions take place in month of September 2018 for Northern Lights Company Sept 1 Paid the monthly rent with $3,500 cash. Sept 2 Sandra Moses invested $32,600 cash in the business. Sept 6 Purchased $925 of office supplies for cash. Sept 15 Received $3,000 cash as fees for services provided to a customer. Sept 22 Billed a customer $5,400 as fees for services and received cash. Sept 25 Billed a customer $2,200 as fees for services but has not received cash. Sept 29 Received the utility bill from BC Hydro for $150 payable next month. Sept 30 Moses withdrew $5,000 cash from the business for personal use. Required: a. Journalize the above transactions. Make journal entries. b. Post journal entries to the General Ledger (GL). Prepare the T-accounts for the above transactions. Prepare a Trial Balance. d. Prepare the Financial Statements. C The following transactions take place in month of September 2018 for Northern Lights Company.

Sept 1 Paid the monthly rent with $3,500 cash.

Sept 2 Sandra Moses invested $32,600 cash in the business.

Sept 6 Purchased $925 of office supplies for cash.

Sept 15 Received $3,000 cash as fees for services provided to a customer.

Sept 22 Billed a customer $5,400 as fees for services and received cash.

Sept 25 Billed a customer $2,200 as fees for services but has not received cash.

Sept 29 Received the utility bill from BC Hydro for $150 payable next month.

Sept 30 Moses withdrew $5,000 cash from the business for personal use.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started