Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mini Case This Mini Case is available in MyFinanceLab. Superior Europe, is a medium-sized company, located in the Netherlands, and has suc- cessfully been doing

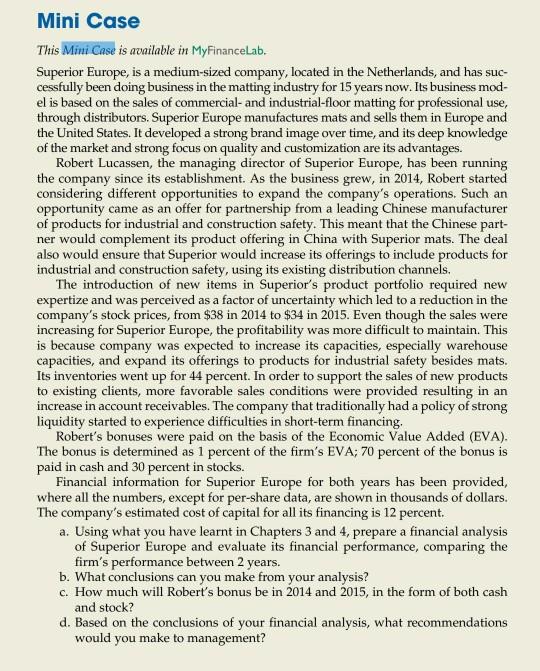

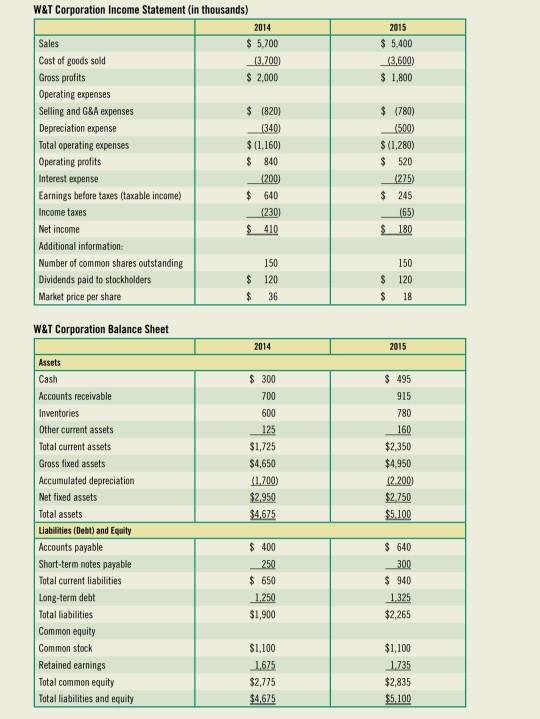

Mini Case This Mini Case is available in MyFinanceLab. Superior Europe, is a medium-sized company, located in the Netherlands, and has suc- cessfully been doing business in the matting industry for 15 years now. Its business mod- el is based on the sales of commercial- and industrial-floor matting for professional use, through distributors. Superior Europe manufactures mats and sells them in Europe and the United States. It developed a strong brand image over time, and its deep knowledge of the market and strong focus on quality and customization are its advantages. Robert Lucassen, the managing director of Superior Europe, has been running the company since its establishment. As the business grew, in 2014, Robert started considering different opportunities to expand the company's operations. Such an opportunity came as an offer for partnership from a leading Chinese manufacturer of products for industrial and construction safety. This meant that the Chinese part- ner would complement its product offering in China with Superior mats. The deal also would ensure that Superior would increase its offerings to include products for industrial and construction safety, using its existing distribution channels. The introduction of new items in Superior's product portfolio required new expertize and was perceived as a factor of uncertainty which led to a reduction in the company's stock prices, from $38 in 2014 to $34 in 2015. Even though the sales were increasing for Superior Europe, the profitability was more difficult to maintain. This is because company was expected to increase its capacities, especially warehouse capacities, and expand its offerings to products for industrial safety besides mats. Its inventories went up for 44 percent. In order to support the sales of new products to existing clients, more favorable sales conditions were provided resulting in an increase in account receivables. The company that traditionally had a policy of strong liquidity started to experience difficulties in short-term financing, Robert's bonuses were paid on the basis of the Economic Value Added (EVA). The bonus is determined as 1 percent of the firm's EVA; 70 percent of the bonus is paid in cash and 30 percent in stocks. Financial information for Superior Europe for both years has been provided, where all the numbers, except for per-share data, are shown in thousands of dollars. The company's estimated cost of capital for all its financing is 12 percent. a. Using what you have learnt in Chapters 3 and 4, prepare a financial analysis of Superior Europe and evaluate its financial performance, comparing the firm's performance between 2 years. b. What conclusions can you make from your analysis? c. How much will Robert's bonus be in 2014 and 2015, in the form of both cash and stock? d. Based on the conclusions of your financial analysis, what recommendations would you make to management? 2015 $ 5.400 (3.600) $ 1,800 W&T Corporation Income Statement (in thousands) 2014 Sales $ 5.700 Cost of goods sold 13.700 Gross profits $ 2,000 Operating expenses Selling and G&A expenses $ (820) Depreciation expense (340) Total operating expenses $ (1,160) Operating profits $ 840 Interest expense (200) Earnings before taxes (taxable income) $ 640 Income taxes (230) Net income $410 Additional information: Number of common shares outstanding 150 Dividends paid to stockholders $ 120 Market price per share $ 36 $ 1780) (500) $(1,280) $ 520 (275) $ 245 (65) $ 180 150 $ 120 $ 18 W&T Corporation Balance Sheet 2014 2015 $ 300 700 600 125 $1,725 $4,650 1.700) $2.950 $4.675 $ 495 915 780 160 $2,350 $4,950 12.200) $2.750 $5.100 Assets Cash Accounts receivable Inventories Other current assets Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities (Debt) and Equity Accounts payable Short-term notes payable Total current liabilities Long-term debt Total liabilities Common equity Common stock Retained earnings Total common equity Total liabilities and equity $ 400 250 $ 650 1.250 $1,900 $ 640 300 $ 940 1.325 $2,265 $1,100 1,675 $2,775 $4,675 $1,100 1.735 $2,835 $5.100 Mini Case This Mini Case is available in MyFinanceLab. Superior Europe, is a medium-sized company, located in the Netherlands, and has suc- cessfully been doing business in the matting industry for 15 years now. Its business mod- el is based on the sales of commercial- and industrial-floor matting for professional use, through distributors. Superior Europe manufactures mats and sells them in Europe and the United States. It developed a strong brand image over time, and its deep knowledge of the market and strong focus on quality and customization are its advantages. Robert Lucassen, the managing director of Superior Europe, has been running the company since its establishment. As the business grew, in 2014, Robert started considering different opportunities to expand the company's operations. Such an opportunity came as an offer for partnership from a leading Chinese manufacturer of products for industrial and construction safety. This meant that the Chinese part- ner would complement its product offering in China with Superior mats. The deal also would ensure that Superior would increase its offerings to include products for industrial and construction safety, using its existing distribution channels. The introduction of new items in Superior's product portfolio required new expertize and was perceived as a factor of uncertainty which led to a reduction in the company's stock prices, from $38 in 2014 to $34 in 2015. Even though the sales were increasing for Superior Europe, the profitability was more difficult to maintain. This is because company was expected to increase its capacities, especially warehouse capacities, and expand its offerings to products for industrial safety besides mats. Its inventories went up for 44 percent. In order to support the sales of new products to existing clients, more favorable sales conditions were provided resulting in an increase in account receivables. The company that traditionally had a policy of strong liquidity started to experience difficulties in short-term financing, Robert's bonuses were paid on the basis of the Economic Value Added (EVA). The bonus is determined as 1 percent of the firm's EVA; 70 percent of the bonus is paid in cash and 30 percent in stocks. Financial information for Superior Europe for both years has been provided, where all the numbers, except for per-share data, are shown in thousands of dollars. The company's estimated cost of capital for all its financing is 12 percent. a. Using what you have learnt in Chapters 3 and 4, prepare a financial analysis of Superior Europe and evaluate its financial performance, comparing the firm's performance between 2 years. b. What conclusions can you make from your analysis? c. How much will Robert's bonus be in 2014 and 2015, in the form of both cash and stock? d. Based on the conclusions of your financial analysis, what recommendations would you make to management? 2015 $ 5.400 (3.600) $ 1,800 W&T Corporation Income Statement (in thousands) 2014 Sales $ 5.700 Cost of goods sold 13.700 Gross profits $ 2,000 Operating expenses Selling and G&A expenses $ (820) Depreciation expense (340) Total operating expenses $ (1,160) Operating profits $ 840 Interest expense (200) Earnings before taxes (taxable income) $ 640 Income taxes (230) Net income $410 Additional information: Number of common shares outstanding 150 Dividends paid to stockholders $ 120 Market price per share $ 36 $ 1780) (500) $(1,280) $ 520 (275) $ 245 (65) $ 180 150 $ 120 $ 18 W&T Corporation Balance Sheet 2014 2015 $ 300 700 600 125 $1,725 $4,650 1.700) $2.950 $4.675 $ 495 915 780 160 $2,350 $4,950 12.200) $2.750 $5.100 Assets Cash Accounts receivable Inventories Other current assets Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities (Debt) and Equity Accounts payable Short-term notes payable Total current liabilities Long-term debt Total liabilities Common equity Common stock Retained earnings Total common equity Total liabilities and equity $ 400 250 $ 650 1.250 $1,900 $ 640 300 $ 940 1.325 $2,265 $1,100 1,675 $2,775 $4,675 $1,100 1.735 $2,835 $5.100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started