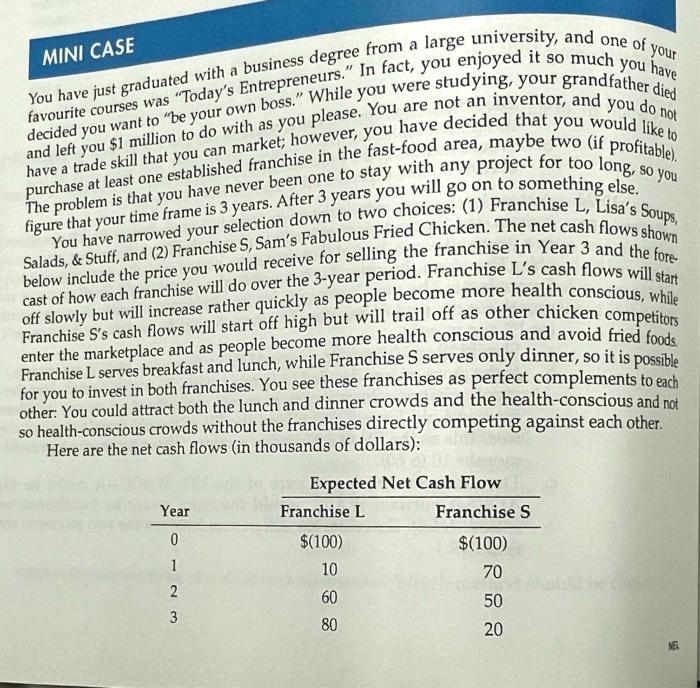

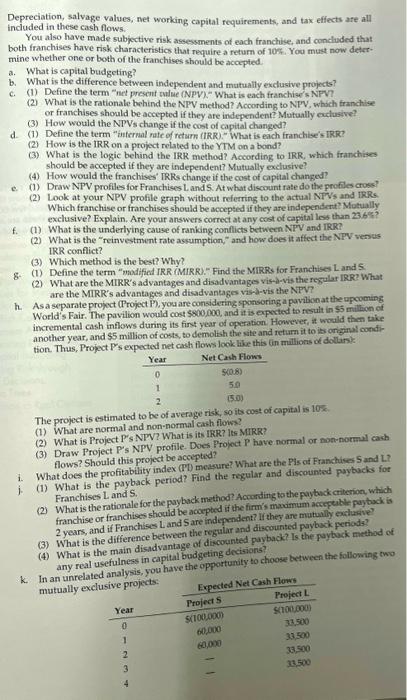

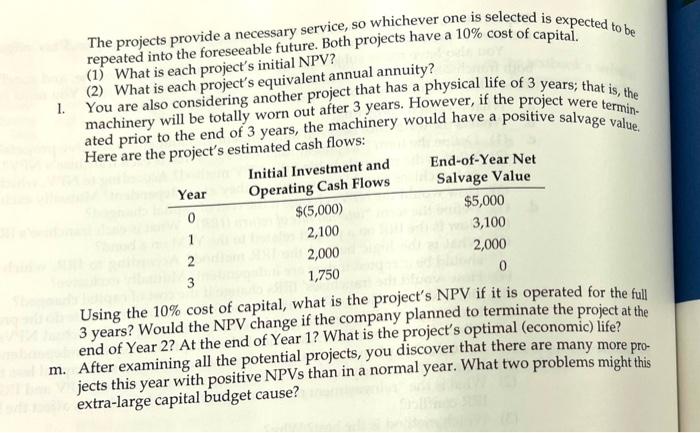

MINI CASE You have just graduated with a business degree from a large university, and one of your favourite courses was "Today's Entrepreneurs." In fact, you enjoyed it so much you have decided you want to "be your own boss." While you were studying, your grandfather died and left you $1 million to do with as you please. You are not an inventor, and you do not have a trade skill that you can market; however, you have decided that yo fred maybe two (if profitable). purchase at least one established franchise in the stay with any project for too long, so you The problem is that you have never been 3 years you will go on to something else. figure that your time frame is 3 years. Aftion down to two choices: (1) Franchise L, Lisa's Soups, You have narrowed your selection's Fabulous Fried Chicken. The net cash flows shown Salads, \& Stuff, and (2) Franchise S, Samise for selling the franchise in Year 3 and the forebelow include the price you would rer the 3-year period. Franchise L's cash flows will start cast of how each franchise will do mere huickly as people become more health conscious, while off slowly but will increase rather quill high but will trail off as other chicken competitors Franchise S's cash flows will start of become more health conscious and avoid fried foods, Franchise L serves breakfast and lunch, while Franchise S serves only dinner, so it is possible for you to invest in both franchises. You see these franchises as perfect complements to each other: You could attract both the lunch and dinner crowds and the health-conscious and not so health-conscious crowds without the franchises directly competing against each other. Here are the net cash flows (in thousands of dollars): Depreciation, salvage values, net working capital requirements, and tax effects afe all included in these cash flows. You also have made subjective risk assessments of each franchise, and concluded that both franchises have risk characteristics that require a return of 10%, You must now determine whether one or both of the franchises should be accepted. a. What is capital budgeting? b. What is the difference between independent and mutually exdusive projects? c. (1) Define the term "net prosent malue (NPV)" What is each franchise' s NFV? (2) What is the rationale behind the NPV method? According to NPV, which franchise or franchises should be accepted if they are independent? Mutually eaclusive? (3) How would the NPVs change if the cost of capital changed? d. (1) Define the term "infernal rate of return (IRR)," What is each franchise's IRR? (2) How is the IRR on a project related to the YTM on a bond? (3) What is the logic behind the IRR method? According to IRR, which franchises shouid be accepted if they are independent? Mutually exclusive? (4) How would the franchises' IRRs change if the cost of captal changed? e. (1) Draw NPV profiles for Franchises L and S. At what discount rate do the profiles cross? (2) Look at your NPV profile graph without referring to the actual NTVs and IRRs. Which franchise or franchises should be accepted if they are independent? Mutually exclusive? Explain. Are your answers correct at any cost of capital los than 23.6 ? f. (1) What is the underlying cause of raniking conflicts between NPV and IRR? (2) What is the "reinvestrment rate assumption," and how does it affect the NPV versus IRR conflict? (3) Which method is the best? Why? g. (1) Define the term "modified IRR (MIRR)." Find the MIRRs for Franchises L and 5. (2) What are the MIRR's advantages and disadvantages vis-i-vis the regular IRR? What are the MIRR's advantages and disadvantages vis-a-vis the NPV? h. As a separate project (Project P), you are considering sponsoring a pavibonat the upcoming World's Fair. The pavilion would cost $800,000, and it is expected to result in $5 million of incremental cash inflows during its first year of operation. However, at wocld then take another year, and $5 million of costs, to demoltsh the site and return it to is original condtion. Thus, Project P's expected net cash flows lock like this (in mallions of dollans: The project is estimated to be of average risk, so its cost of capital is 10x: (1) What are normal and non-normal cash flows? (2) What is Project P's NPV? What is its IRR? lts MIRR? (3) Draw Project P's NPV profile. Dves Project P have normal or non-normal cash flows? Should this project be accepted? flows? Should this project be accephd? What does the profitabtity index (PD) mease? What are the Pis of Franchises S and L.? 1. What does the protitabtaty index (P) measure? What are the is of Franchuses 5 and L. (1) What is the payback period? Find the regular and discounted paybacks fot Franchises L and S. (2) What is the rationale for the pay back method? Acrording to the payback criterion, which 2 years, and if Franchises Land S are independent? If they are mutually exchasive? (3) Wears, and if Franchises Land S are independent disterence difference between the regular and discounted paybock periods? (4) What is the main disadvantage of discounted payback? Is the paybock method of Why real usefulness in capital budgeting dectsions? k. In an unrelater The projects provide a necessary service, so whichever one is selected is expected to be repeated into the foreseeable future. Both projects have a 10% cost of capital. (1) What is each project's initial NPV? (2) What is each project's equivalent annual annuity? 1. You are also considering another project that has a physical life of 3 years; that is, the machinery will be totally worn out after 3 years. However, if the project were terminated prior to the end of 3 years, the machinery would have a positive salvage value, Here are th Using the 10% cost of capital, what is the project's INV in it is uperated for the full 3 years? Would the NPV change if the company planned to terminate the project at the end of Year 2? At the end of Year 1? What is the project's optimal (economic) life? a. After examining all the potential projects, you discover that there are many more projects this year with positive NPVs than in a normal year. What two problems might this extra-large capital budget cause? MINI CASE You have just graduated with a business degree from a large university, and one of your favourite courses was "Today's Entrepreneurs." In fact, you enjoyed it so much you have decided you want to "be your own boss." While you were studying, your grandfather died and left you $1 million to do with as you please. You are not an inventor, and you do not have a trade skill that you can market; however, you have decided that yo fred maybe two (if profitable). purchase at least one established franchise in the stay with any project for too long, so you The problem is that you have never been 3 years you will go on to something else. figure that your time frame is 3 years. Aftion down to two choices: (1) Franchise L, Lisa's Soups, You have narrowed your selection's Fabulous Fried Chicken. The net cash flows shown Salads, \& Stuff, and (2) Franchise S, Samise for selling the franchise in Year 3 and the forebelow include the price you would rer the 3-year period. Franchise L's cash flows will start cast of how each franchise will do mere huickly as people become more health conscious, while off slowly but will increase rather quill high but will trail off as other chicken competitors Franchise S's cash flows will start of become more health conscious and avoid fried foods, Franchise L serves breakfast and lunch, while Franchise S serves only dinner, so it is possible for you to invest in both franchises. You see these franchises as perfect complements to each other: You could attract both the lunch and dinner crowds and the health-conscious and not so health-conscious crowds without the franchises directly competing against each other. Here are the net cash flows (in thousands of dollars): Depreciation, salvage values, net working capital requirements, and tax effects afe all included in these cash flows. You also have made subjective risk assessments of each franchise, and concluded that both franchises have risk characteristics that require a return of 10%, You must now determine whether one or both of the franchises should be accepted. a. What is capital budgeting? b. What is the difference between independent and mutually exdusive projects? c. (1) Define the term "net prosent malue (NPV)" What is each franchise' s NFV? (2) What is the rationale behind the NPV method? According to NPV, which franchise or franchises should be accepted if they are independent? Mutually eaclusive? (3) How would the NPVs change if the cost of capital changed? d. (1) Define the term "infernal rate of return (IRR)," What is each franchise's IRR? (2) How is the IRR on a project related to the YTM on a bond? (3) What is the logic behind the IRR method? According to IRR, which franchises shouid be accepted if they are independent? Mutually exclusive? (4) How would the franchises' IRRs change if the cost of captal changed? e. (1) Draw NPV profiles for Franchises L and S. At what discount rate do the profiles cross? (2) Look at your NPV profile graph without referring to the actual NTVs and IRRs. Which franchise or franchises should be accepted if they are independent? Mutually exclusive? Explain. Are your answers correct at any cost of capital los than 23.6 ? f. (1) What is the underlying cause of raniking conflicts between NPV and IRR? (2) What is the "reinvestrment rate assumption," and how does it affect the NPV versus IRR conflict? (3) Which method is the best? Why? g. (1) Define the term "modified IRR (MIRR)." Find the MIRRs for Franchises L and 5. (2) What are the MIRR's advantages and disadvantages vis-i-vis the regular IRR? What are the MIRR's advantages and disadvantages vis-a-vis the NPV? h. As a separate project (Project P), you are considering sponsoring a pavibonat the upcoming World's Fair. The pavilion would cost $800,000, and it is expected to result in $5 million of incremental cash inflows during its first year of operation. However, at wocld then take another year, and $5 million of costs, to demoltsh the site and return it to is original condtion. Thus, Project P's expected net cash flows lock like this (in mallions of dollans: The project is estimated to be of average risk, so its cost of capital is 10x: (1) What are normal and non-normal cash flows? (2) What is Project P's NPV? What is its IRR? lts MIRR? (3) Draw Project P's NPV profile. Dves Project P have normal or non-normal cash flows? Should this project be accepted? flows? Should this project be accephd? What does the profitabtity index (PD) mease? What are the Pis of Franchises S and L.? 1. What does the protitabtaty index (P) measure? What are the is of Franchuses 5 and L. (1) What is the payback period? Find the regular and discounted paybacks fot Franchises L and S. (2) What is the rationale for the pay back method? Acrording to the payback criterion, which 2 years, and if Franchises Land S are independent? If they are mutually exchasive? (3) Wears, and if Franchises Land S are independent disterence difference between the regular and discounted paybock periods? (4) What is the main disadvantage of discounted payback? Is the paybock method of Why real usefulness in capital budgeting dectsions? k. In an unrelater The projects provide a necessary service, so whichever one is selected is expected to be repeated into the foreseeable future. Both projects have a 10% cost of capital. (1) What is each project's initial NPV? (2) What is each project's equivalent annual annuity? 1. You are also considering another project that has a physical life of 3 years; that is, the machinery will be totally worn out after 3 years. However, if the project were terminated prior to the end of 3 years, the machinery would have a positive salvage value, Here are th Using the 10% cost of capital, what is the project's INV in it is uperated for the full 3 years? Would the NPV change if the company planned to terminate the project at the end of Year 2? At the end of Year 1? What is the project's optimal (economic) life? a. After examining all the potential projects, you discover that there are many more projects this year with positive NPVs than in a normal year. What two problems might this extra-large capital budget cause