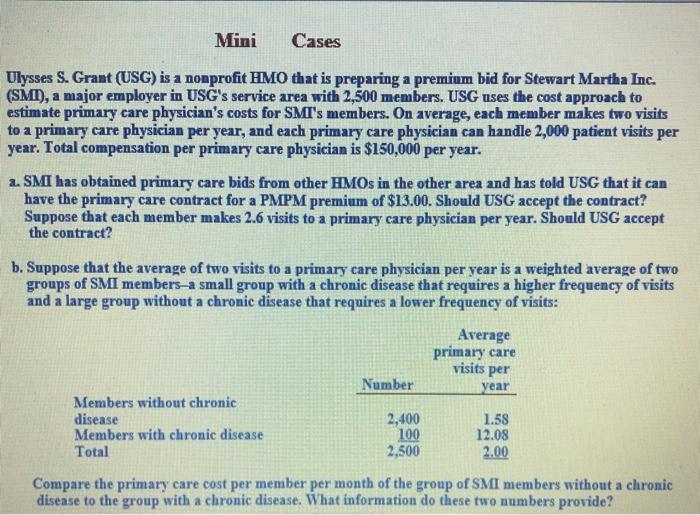

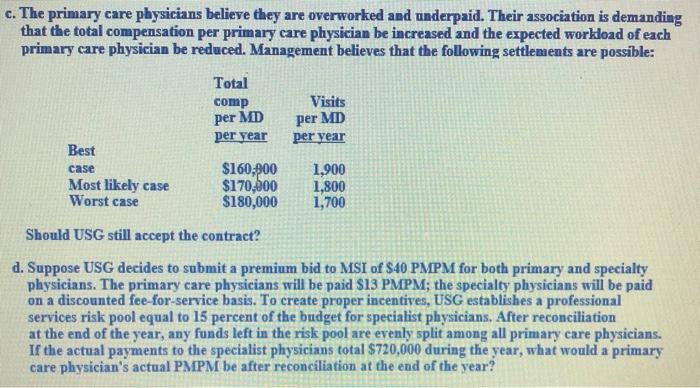

Mini Cases Ulysses S. Grant (USG) is a nonprofit HMO that is preparing a premium bid for Stewart Martha Inc. (SMI), a major employer in USG's service area with 2,500 members. USG uses the cost approach to estimate primary care physician's costs for SMI's members. On average, each member makes two visits to a primary care physician per year, and each primary care physician can handle 2,000 patient visits per year. Total compensation per primary care physician is $150,000 per year. a. SMI has obtained primary care bids from other HMOs in the other area and has told USG that it can have the primary care contract for a PMPM premium of $13.00. Should USG accept the contract? Sappose that each member makes 2.6 visits to a primary care physician per year. Should USG accept the contract? b. Suppose that the average of two visits to a primary care physician per year is a weighted average of two groups of SMI members a small group with a chronic disease that requires a higher frequency of visits and a large group without a chronic disease that requires a lower frequency of visits: Average primary care visits per Number year Members without chronic disease Members with chronic disease Total 2,400 100 2,500 1.58 12.08 2.00 Compare the primary care cost per member per month of the group of SMI members without a chronic disease to the group with a chronic disease. What information do these two numbers provide? c. The primary care physicians believe they are overworked and underpaid. Their association is demanding that the total compensation per primary care physician be increased and the expected workload of each primary care physician be reduced. Management believes that the following settlements are possible: Total comp Visits per MD per MD per year per year Best case Most likely case Worst case $160,000 $170,000 $180,000 1,900 1,800 1,700 Should USG still accept the contract? d. Suppose USG decides to submit a premium bid to MSI of S40 PMPM for both primary and specialty physicians. The primary care physicians will be paid S13 PMPM; the specialty physicians will be paid on a discounted fee-for-service basis. To create proper incentives, USG establishes a professional services risk pool equal to 15 percent of the budget for specialist physicians. After reconciliation at the end of the year, any funds left in the risk pool are evenly split among all primary care physicians. If the actual payments to the specialist physicians total $720,000 during the year, what would a primary care physician's actual PMPM be after reconciliation at the end of the year