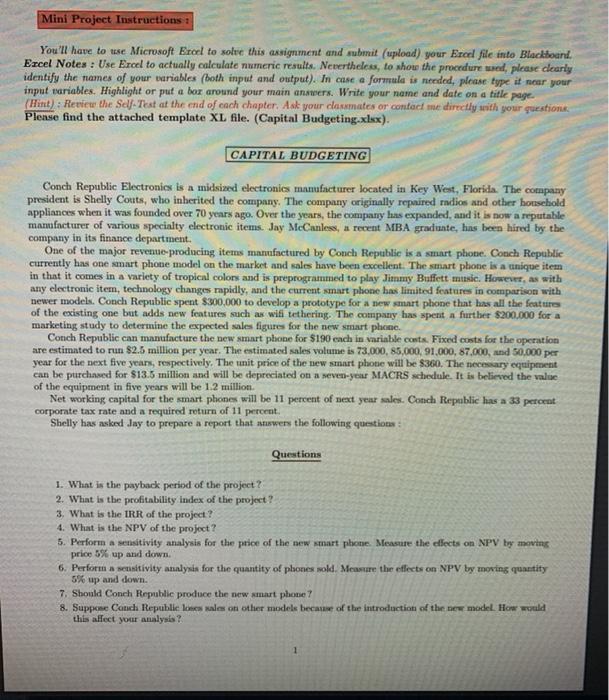

Mini Project Instructions You'll have to use Microsoft Erol to solre this assignment and submit (upload) your Ercel file into Blackboard. Excel Notes : Use Ercel to actually calculate numeric results. Nevertheless, to show the procedure wed, please clearly identify the names of your variables (both input and output). In case a formula is needed, please type it near your input variables. Highlight or put a bor around your main answers. Write your name and date on a title page (Hitit) : Review the Self-Test at the end of each chapter. Ask your classmates or contact me directly with your questions Please find the attached template XL file. (Capital Budgeting.xlsx). CAPITAL BUDGETING Conch Republic Electronics is a midsized electronics manufacturer located in Key West, Florida. The company president is Shelly Couts, who inherited the company. The company originally repaired radios and other household appliances when it was founded over 10 years ago. Over the years, the company has expanded, and it is now a reputable manufacturer of various specialty electronic items. Jay McCanless, a recent MBA graduate, has been hired by the company in its finance department. One of the major revenue-producing items manufactured by Conch Republic is a smart phone. Conch Republic currently has one smart phone model on the market and sales have been excellent. The smart phone is a unique item in that it comes in a variety of tropical colors and is preprogrammed to play Jimmy Buffett music. However, as with any electronic item, technology changes rapidly, and the current smart phone has limited features in comparison with newer models. Conch Republic spent $300,000 to develop a prototype for a new smart phone that has all the feature of the existing one but adds new features such as will tethering. The company has spent a further $200,000 for a marketing study to determine the expected sales figures for the new smart phone. Conch Republic can manufacture the new smart phone for $190 each in variable costs. Fixed costs for the operation are estimated to run $2.5 million per year. The estimated sales volume is 73.000, 85,000, 91,000, 87.000, and 50.000 per year for the next five years, respectively. The unit price of the new smart phone will be $360. The necessary equipment can be purchased for $13.5 million and will be depreciated on a seven-year MACRS schedule. It is believed the value of the equipment in five years will be 1.2 million Net working capital for the smart phones will be 11 percent of next year sales. Conch Republic has a 33 percent corporate tax rate and a required return of 11 percent. Shelly has asked Jay to prepare a report that awers the following questions Questions 1. What is the payback period of the project? 2. What is the profitability index of the project? 3. What is the IRR of the project? 4. What is the NPV of the project? 5. Perform a sensitivity analysis for the price of the new smart phone. Measure the elects on NPV by moving price 5% up and down 6. Perform a sensitivity analysis for the quantity of phones sold. Measure the eflects on NPV by moving quantity 5% up and down 7. Should Conch Republic produce the new smart phone? 8. Suppone Catch Republic locales on other models because of the introduction of the new model. How would this affect your analysis