Question

Mini-Case 1: Personal Financial Statement Analysis Hasan Fareed, a 24-year-old college graduate, never took a personal finance class. He pays his bills on time, has

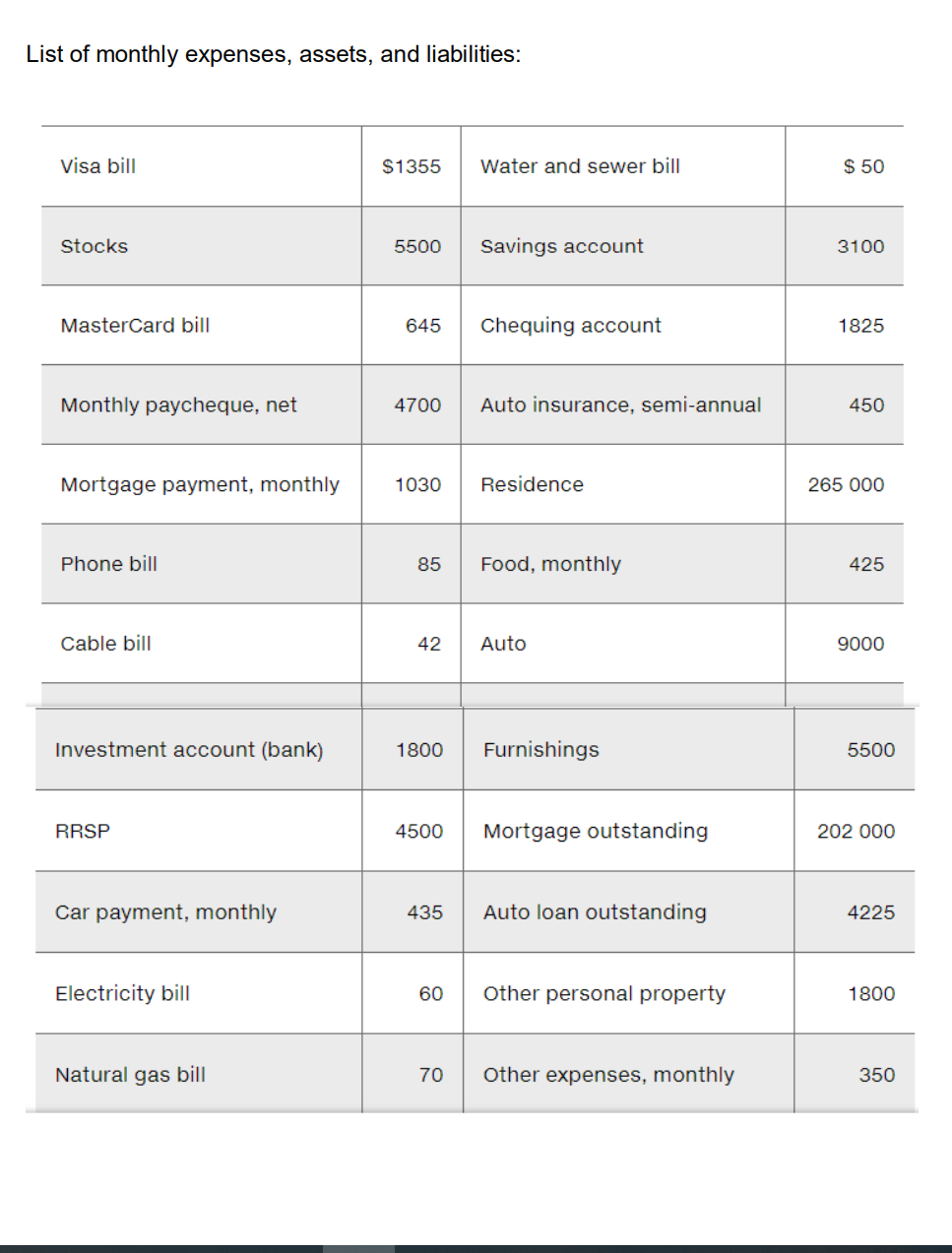

Mini-Case 1: Personal Financial Statement Analysis Hasan Fareed, a 24-year-old college graduate, never took a personal finance class. He pays his bills on time, has managed to save a little in an investment account, and with the help of an inheritance managed to buy a condominium. Hasan worries about his financial situation. Given the following information, prepare a personal cash flow statement and personal balance sheet for Hasan. Also, calculate the current ratio, liquidity ratio, debt-to-assets ratio, and savings ratio associated with Hasans personal financial statements. Interpret these financial statements and ratios for Hasan. In addition to the list of monthly expenses, assets, and liabilities below, Hasan offers this information:

All utility bills for the month are unpaid, and therefore appear as a current liability (phone, cable, electricity, natural gas, water/sewer).

Auto and mortgage payments have been paid for the month; note that he lists mortgage outstanding and auto loan outstanding to indicate the outstanding amount remaining to pay off each loan.

Other expenses, monthly represents cash spent without a record to verify where.

Hasan charges everything on his credit cards and pays the balances off monthly. Credit card bills represent his average monthly balance.

Semi-annual auto insurance premium payment is due this month.

Please show steps, Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started