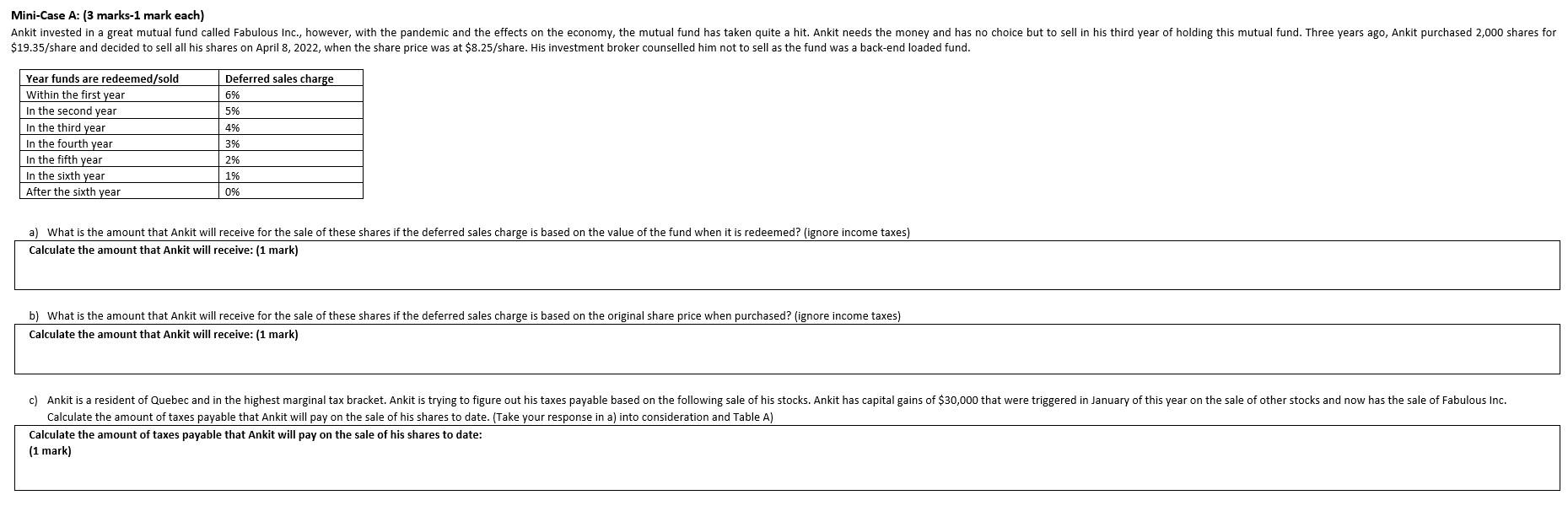

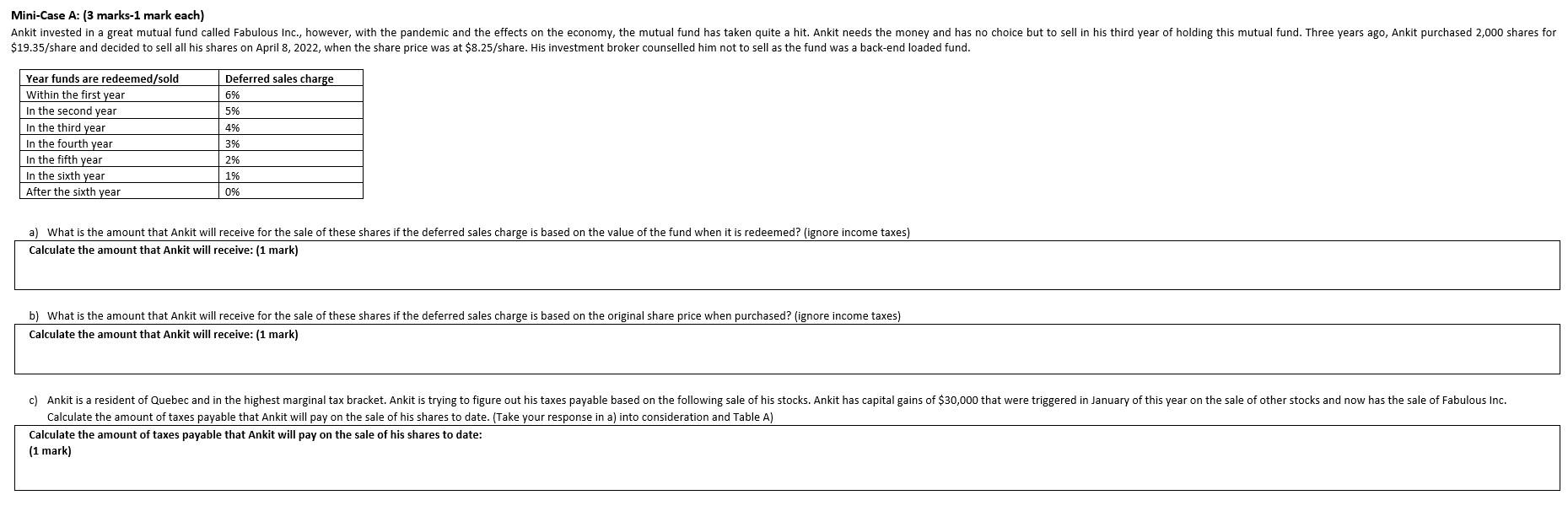

Mini-Case A: (3 marks-1 mark each) Ankit invested in a great mutual fund called Fabulous Inc., however, with the pandemic and the effects on the economy, the mutual fund has taken quite a hit. Ankit needs the money and has no choice but to sell in his third year of holding this mutual fund. Three years ago, Ankit purchased 2,000 shares for $19.35/share and decided to sell all his shares on April 8, 2022, when the share price was at $8.25/share. His investment broker counselled him not to sell as the fund was a back-end loaded fund. Year funds are redeemed/sold Within the first year In the second year In the third year In the fourth year In the fifth year In the sixth year After the sixth year Deferred sales charge 6% 5% 4% 3% 2% 1% 0% a) What is the amount that Ankit will receive for the sale of these shares if the deferred sales charge is based on the value of the fund when it is redeemed? (ignore income taxes) Calculate the amount that Ankit will receive: (1 mark) b) What is the amount that Ankit will receive for the sale of these shares if the deferred sales charge is based on the original share price when purchased? (ignore income taxes) Calculate the amount that Ankit will receive: (1 mark) c) Ankit is a resident of Quebec and in the highest marginal tax bracket. Ankit is trying to figure out his taxes payable based on the following sale of his stocks. Ankit has capital gains of $30,000 that were triggered in January of this year on the sale of other stocks and now has the sale of Fabulous Inc. Calculate the amount of taxes payable that Ankit will pay on the sale of his shares to date. (Take your response in a) into consideration and Table A) Calculate the amount of taxes payable that Ankit will pay on the sale of his shares to date: (1 mark) Mini-Case A: (3 marks-1 mark each) Ankit invested in a great mutual fund called Fabulous Inc., however, with the pandemic and the effects on the economy, the mutual fund has taken quite a hit. Ankit needs the money and has no choice but to sell in his third year of holding this mutual fund. Three years ago, Ankit purchased 2,000 shares for $19.35/share and decided to sell all his shares on April 8, 2022, when the share price was at $8.25/share. His investment broker counselled him not to sell as the fund was a back-end loaded fund. Year funds are redeemed/sold Within the first year In the second year In the third year In the fourth year In the fifth year In the sixth year After the sixth year Deferred sales charge 6% 5% 4% 3% 2% 1% 0% a) What is the amount that Ankit will receive for the sale of these shares if the deferred sales charge is based on the value of the fund when it is redeemed? (ignore income taxes) Calculate the amount that Ankit will receive: (1 mark) b) What is the amount that Ankit will receive for the sale of these shares if the deferred sales charge is based on the original share price when purchased? (ignore income taxes) Calculate the amount that Ankit will receive: (1 mark) c) Ankit is a resident of Quebec and in the highest marginal tax bracket. Ankit is trying to figure out his taxes payable based on the following sale of his stocks. Ankit has capital gains of $30,000 that were triggered in January of this year on the sale of other stocks and now has the sale of Fabulous Inc. Calculate the amount of taxes payable that Ankit will pay on the sale of his shares to date. (Take your response in a) into consideration and Table A) Calculate the amount of taxes payable that Ankit will pay on the sale of his shares to date: (1 mark)