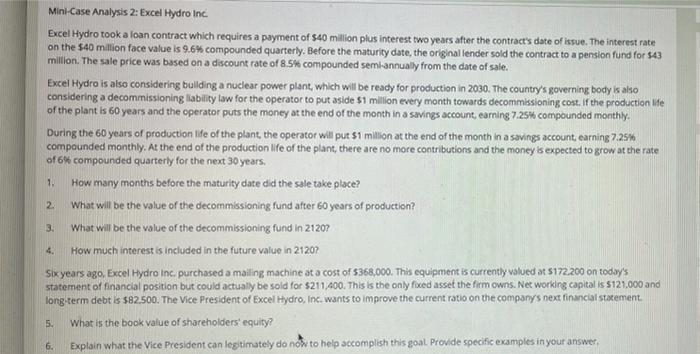

Mini-Case Analysis 2: Excel Hydro Inc Excel Hydro took a loan contract which requires a payment of $40 million plus interest two years after the contract's date of issue. The interest rate on the 540 million face value is 9.6% compounded quarterly. Before the maturity date, the original lender sold the contract to a pension fund for 543 million. The sale price was based on a discount rate of 8.5% compounded semi-annually from the date of sale. Excel Hydro is also considering bullding a nuclear power plant, which will be ready for production in 2030. The country's governing body is also considering a decommissioning liability law for the operator to put aside $1 million every month towards decommissioning cost. If the production life of the plant is 60 years and the operator puts the money at the end of the month in a savings account, earning 7.25% compounded monthly During the 60 years of production life of the plant, the operator will put $1 milion at the end of the month in a savings account, earning 7.25% compounded monthly. At the end of the production life of the plant, there are no more contributions and the money is expected to grow at the rate of 6% compounded quarterly for the next 30 years. How many months before the maturity date did the sale take place? What will be the value of the decommissioning fund after 60 years of production? What will be the value of the decommissioning fund in 2120? How much interest is included in the future value in 21207 Six years ago, Excel Hydro Inc. purchased a mailing machine at a cost of 5368,000. This equipment is currently valued at $172.200 on today's statement of financial position but could actually be sold for $211,400. This is the only fixed asset the firm owns. Net working capital is 5121.000 and long-term debt is $82.500. The Vice President of Excel Hydro, Inc. wants to improve the current ratio on the company's next financial statement What is the book value of shareholders' equity? 6. Explain what the Vice President can legitimately do now to help accomplish this goal. Provide specific examples in your answer 1. 2 3. 4. 5