Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mini-Case B: (3 marks-.5 marks each) Nelson is your best friend; he is very careless with his money. He is 25 years old and over

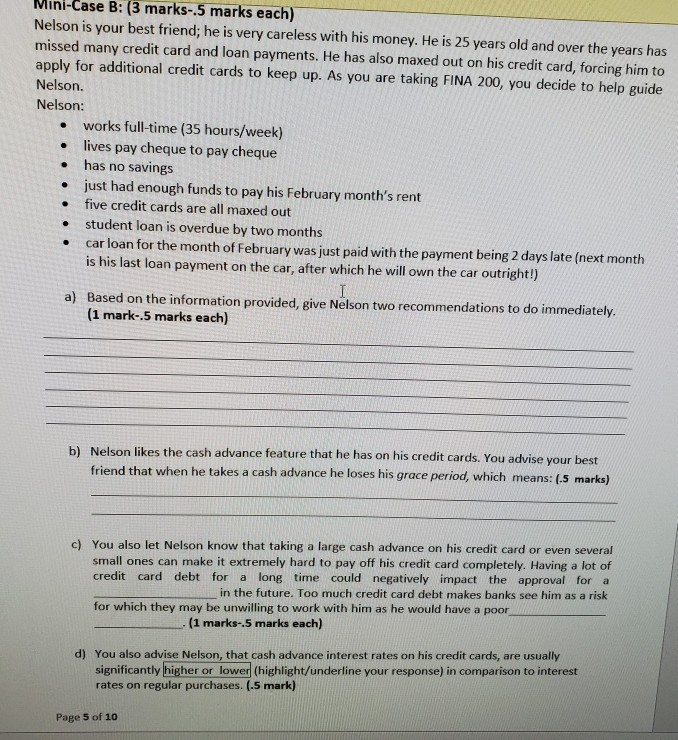

Mini-Case B: (3 marks-.5 marks each) Nelson is your best friend; he is very careless with his money. He is 25 years old and over the years has missed many credit card and loan payments. He has also maxed out on his credit card, forcing him to apply for additional credit cards to keep up. As you are taking FINA 200, you decide to help guide Nelson. Nelson: works full-time (35 hours/week) lives pay cheque to pay cheque has no savings just had enough funds to pay his February month's rent five credit cards are all maxed out student loan is overdue by two months car loan for the month of February was just paid with the payment being 2 days late (next month is his last loan payment on the car, after which he will own the car outright!) a) Based on the information provided, give Nelson two recommendations to do immediately. (1 mark-.5 marks each) b) Nelson likes the cash advance feature that he has on his credit cards. You advise your best friend that when he takes a cash advance he loses his grace period, which means: (.5 marks) c) You also let Nelson know that taking a large cash advance on his credit card or even several small ones can make it extremely hard to pay off his credit card completely. Having a lot of credit card debt for a long time could negatively impact the approval for a in the future. Too much credit card debt makes banks see him as a risk for which they may be unwilling to work with him as he would have a poor - (1 marks-5 marks each) d) You also advise Nelson, that cash advance interest rates on his credit cards, are usually significantly higher or lower (highlight/underline your response) in comparison to interest rates on regular purchases. (.5 mark) Page 5 of 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started