Answered step by step

Verified Expert Solution

Question

1 Approved Answer

minicase the capital-budgeting analysis department or are provided with remedial training. The memorandum you received outlining your assignment follows: To: New Financial Analysts From: Mr.

minicase

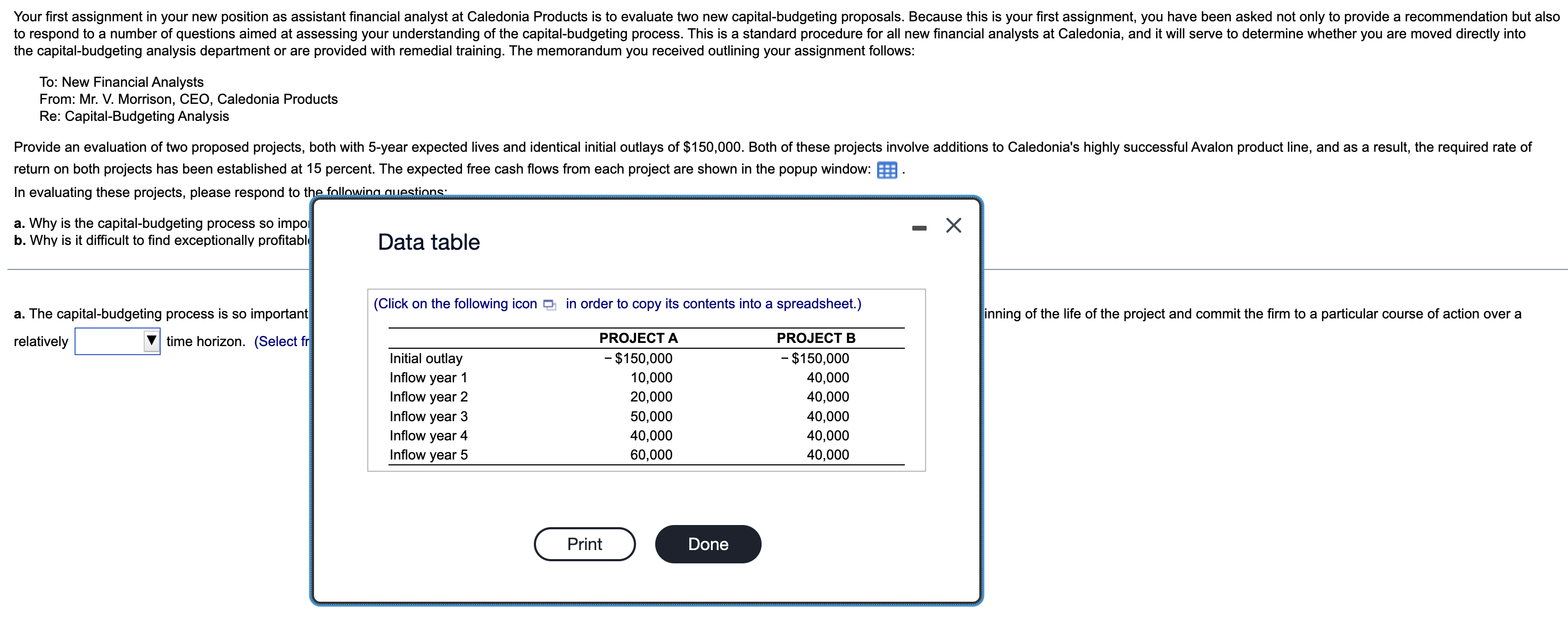

the capital-budgeting analysis department or are provided with remedial training. The memorandum you received outlining your assignment follows: To: New Financial Analysts From: Mr. V. Morrison, CEO, Caledonia Products Re: Capital-Budgeting Analysis return on both projects has been established at 15 percent. The expected free cash flows from each project are shown in the popup window: In evaluating these projects, please respond to the followina auections. a. Why is the capital-budgeting process so impo b. Why is it difficult to find exceptionally profitabl a. The capital-budgeting process is so important relatively time horizon. (Select fr Data table (Click on the following icon in order to copy its contents into a spreadsheet.) (Click on the following icon in order to copy its contents into a spreadsheet.) inning of the life of the project and commit the firm to a particular course of action over a

the capital-budgeting analysis department or are provided with remedial training. The memorandum you received outlining your assignment follows: To: New Financial Analysts From: Mr. V. Morrison, CEO, Caledonia Products Re: Capital-Budgeting Analysis return on both projects has been established at 15 percent. The expected free cash flows from each project are shown in the popup window: In evaluating these projects, please respond to the followina auections. a. Why is the capital-budgeting process so impo b. Why is it difficult to find exceptionally profitabl a. The capital-budgeting process is so important relatively time horizon. (Select fr Data table (Click on the following icon in order to copy its contents into a spreadsheet.) (Click on the following icon in order to copy its contents into a spreadsheet.) inning of the life of the project and commit the firm to a particular course of action over a Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started