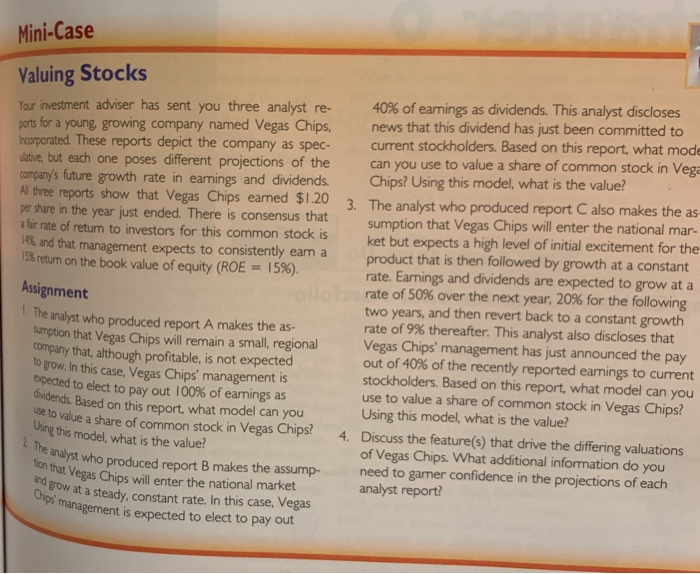

Mini-Case Valuing Stocks dividends. Based on this report, what model can you 2 The analyst who produced report B makes the assump- ion that Vegas Chips will enter the national market w grow at a steady, constant rate. In this case, Vegas management is expected to elect to pay out Your investment adviser has sent you three analyst re 40% of earnings as dividends. This analyst discloses ports for a young growing company named Vegas Chips, news that this dividend has just been committed to Incorporated. These reports depict the company as spec current stockholders. Based on this report, what mode dative, but each one poses different projections of the can you use to value a share of common stock in Vega company's future growth rate in earnings and dividends. Chips? Using this model, what is the value? Al three reports show that Vegas Chips eamed $1.20 3. The analyst who produced report C also makes the as- per share in the year just ended. There is consensus that sumption that Vegas Chips will enter the national mar- a far rate of return to investors for this common stock is ket but expects a high level of initial excitement for the 14% and that management expects to consistently eam a 15% retum on the book value of equity (ROE = 15%). product that is then followed by growth at a constant rate. Earnings and dividends are expected to grow at a rate of 50% over the next year, 20% for the following two years, and then revert back to a constant growth The analyst who produced report A makes the as rate of 9% thereafter. This analyst also discloses that sumption that Vegas Chips will remain a small, regional Vegas Chips' management has just announced the pay company that, although profitable, is not expected out of 40% of the recently reported earnings to current to grow. In this case, Vegas Chips' management is stockholders. Based on this report, what model can you opected to elect to pay out 100% of earnings as use to value a share of common stock in Vegas Chips? Using this model, what is the value? le to value a share of common stock in Vegas Chips? 4. Discuss the feature(s) that drive the differing valuations of Vegas Chips. What additional information do you need to gamer confidence in the projections of each analyst report? Assignment Using this model, what is the value? Chips