HOMEWORK-SAMPLE as Just an Example

This is Just a SAMPLE for Homework

ACKNOWLEDGEMENT

First thanks to almighty God who granted us health and long life, without which we could not have finished this report. I respect and thank our supervisor Dr. Reshma , for giving us all support and valuable guidance which made us complete the report duly, I am extremely thankful to her for providing such a nice support and guidance. She has always helped us and has always given a very good knowledge and inspiration towards the course.

ABSTRACT

The Bank Account Management System is an application for maintaining a person's account in a bank. In this project I tried to show the working of a banking account system and cover the basic functionality of a Bank Account Management System. To develop a project for solving financial applications of a customer in banking environment in order to nurture the needs of an end banking user by providing various ways to perform banking tasks. Also, to enable the users work space to have additional functionalities which are not provided under a conventional banking project. The Bank Account Management System undertaken as a project is based on relevant technologies. The main aim of this project is to develop software for Bank Account Management System. This project has been developed to carry out the processes easily and quickly, which is not possible with the manuals systems, which are overcome by this software. This project is developed using PHP, HTML language and MYSQL use for database connection. Creating and managing requirements is a challenge of IT, systems and product development projects or indeed for any activity where you have to manage a contractual relationship. Organization need to effectively define and manage requirements to ensure they are meeting needs of the customer, while proving compliance and staying on the schedule and within budget. The impact of a poorly expressed requirement can bring a business out of compliance or even cause injury or death. Requirements definition and management is an activity that can deliver a high, fast return on investment. The project analyses the system requirements and then comes up with the requirements specifications. It studies other related systems and then come up with system specifications

TABLE OF CONTENTS

ii.

ii

iii

iv

5

7

7

8

8

9

9

11

12

13

14

15

16

16

Abstract .........

iii. Table of Contents...

iiii. List of Figures............

1. Introduction

1.1 Introduction ...........................

2. Analysis and Design ..............................

2.1 Functional Requirements.

2.1.1 Use Case Diagrams..................

2.1.2 Use Cases Descriptions.

2.2 Non-functional Requirements ....

2.3 Software Requirements..

2.4 Hardware Requirements

3. System Modeling ........................................

3.1 Software Process ..

3.2 Class Diagram

3.3 Sequence Diagram..

3.4 Activity Diagram

3.5 Deployment diagram

4. Conclusion

References ..

LIST OF FIGURES

Figure 2.1 Use case Diagram ..7

Figure 3.1 Waterfall Model phases .............9

Figure 3.2 Class Diagram ..........11

Figure 3.3 Sequence Diagram ........12

Figure 3.4 Activity Diagram .....14

Figure 3.5 Deployment Diagram ....15

CHAPTER 1: INTRODUCTION

1.1 Introduction

The Bank Account Management System project is a model Internet Banking Site. This site enables the customers to perform the basic banking transactions by sitting at their office or at homes through PC or laptop. The system provides the access to the customer to create an account, deposit/withdraw the cash from his account, also to view reports of all accounts present. The customers can access the banks website for viewing their Account details and perform the transactions on account as per their requirements. With Internet Banking, the brick and mortar structure of the traditional banking gets converted into a click and portal model, thereby giving a concept of virtual banking a real shape. Thus today's banking is no longer confined to branches. E-banking facilitates banking transactions by customers round the clock globally. The primary aim of this Bank Account Management System is to provide an improved design methodology, which envisages the future expansion, and modification, which is necessary for a core sector like banking. This necessitates the design to be expandable and modifiable and so a modular approach is used in developing the application software. Anybody who is an Account holder in this bank can become a member of Bank Account Management System. He has to fill a form with his personal details and Account Number. Bank is the place where customers feel the sense of safety for their property. In the bank, customers deposit and withdraw their money. Transaction of money also is a part where customer takes shelter of the bank. Now to keep the belief and trust of customers, there is the positive need for management of the bank, which can handle all this with comfort and ease. Smooth and efficient management affects the satisfaction of the customers and staff members, indirectly. And of course, it encourages management committee in taking some needed decision for future enhancement of the bank. Now a days, managing a bank is tedious job up to certain limit. So, software that reduces the work is essential. Also, todays world is a genuine computer world and is getting faster and faster day-by-day. Thus, considering above necessities, the software for bank management has become necessary which would be useful in managing the bank more efficiently. All transactions are carried out online by transferring from accounts in the same Bank or international bank. The software is meant to overcome the drawbacks of the manual system.

Some of the features available through online banking:

1. View balances: Firstly, login your account with your account number and password.

Then checking your balance doesn't require much work. You simply select Account

balances and take a look at your balance and past transactions. If you have more than

one account, you can also do transfers between accounts.

2. Transfer funds: When you select Transfer Funds, you'll be asked where to transfer

the money to and from, when, and the amount.

3. Set up recurring bill payments or transfers: If you make a regular payment every

month, it might be convenient to set up an automatic withdrawal from your account.

4. Monitor CIBC investments: If you have any CIBC investments, you can keep an eye

on those stocks or mutual funds here.

5. Pay bills: To pay your bills online, you just need to add to your account the names of

the companies you wish to pay bills to.

6. View our VISA* accounts: Always a good place to monitor your spending. You can

make your credit card payments online, right from your account.

7. Order Cheques: We don't need them much anymore due to online banking and debit

purchases, but if you still use cheques, you can order them directly from the BAMS

website.

CHAPTER 2: ANALYSIS AND DESIGN

2.1 Functional Requirements.

User basic graphical tools such as shapes,objects,brushes,colour tools,eraser etc

Should allow free hand drawing, object shapes such as circle,ellipse,rectangle,polygon.

Should allow the usage of different colors in the form of brushes,shapes,curves.

Manage the picture with tools such as pencil,airbrush,clear all.

Unified Modelling Language Design

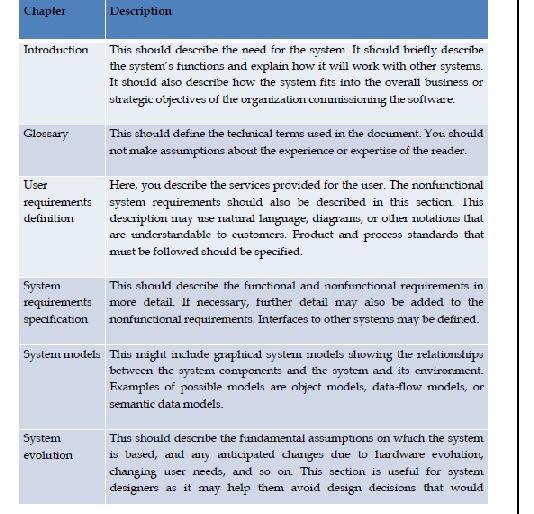

UML diagrams are often used in banking management for documenting a banking system. In particular, the interaction of bank customers with an automated teller machine (ATM) can be represented in a Use Case diagram. Before the software code for an ATM, or any other system design, is written, it is necessary to create a visual representation of any object-oriented processes. This is done most effectively by creating a Unified Modeling Language (UML) diagram, using object-oriented modeling. UML works as a general-purpose modelling language for software engineers or system analysts, offering a number of different diagram styles with which to visually depict all aspects of a software system.

2.1.1 Use Case Diagram.

Figure 2.1: Use case diagram for online shopping website

2.1.2 FUNTIONAL REQUIREMENT

"Banks offer many different channels to access their banking and other services:

(1) Automated Teller Machines.

(2) A branch is a retail location.

(3) Call centre.

(4) Mail: most banks accept cheque deposits via mail and use mail to communicate to their customers, e.g. by sending out statements.

(5) Mobile banking is a method of using one's mobile phone to conduct banking transactions.

(6) Online banking is a term used for performing multiple transactions, payments etc. over the Internet.

(7) Relationship Managers, mostly for private banking or business banking, often visiting customers at their homes or businesses.

(8) Telephone banking is a service which allows its customers to conduct transactions over the telephone with automated attendant or when requested with telephone operator.

(9) Video banking is a term used for performing banking transactions or professional banking consultations via a remote video and audio connection. Video banking can be performed via purpose-built banking transaction machines (similar to an Automated teller machine), or via a video conference enabled bank branch clarification.

(10) DSA is a Direct Selling Agent, who works for the bank based on a contract. Its main job is to increase the customer base for the bank." [Bank. Wikipedia]

The UML use case diagram example "Banking system" was created using the Concept Draw PRO diagramming and vector drawing software extended with the Rapid UML solution from the Software Development area of Concept Draw Solution Park.

2.3 Non-functional Requirements

Those requirements which are not the functionalities of a system but are the characteristics of a system are called the non-functionalities. Every software system has some on-functionalities. Just fulfilling the requirements of the user is not a good task, keeping the system accurate, easy to maintain, reliable and secure is also a basic part of software engineering. Online Banking System must have the following non-functional requirements so that I could be said as a complete system.

a) Conformance to specific standards') Performance constraints:

This system must be fit according to the performance wise. It should use less memory and will be easily accessible by the user. Memory management should be done wisely so that none of the memory part goes wasted.

c) Hardware limitations:

It should be designed in such a way that cheap hardware must be installed to access and use it effectively. It should be platform independent. There should be no hardware limitations. In should be designed to work with the low specification hardware so that it could easily work with the high specification hardware.

d) Maintainable:

Each of the modules should be designed in such a way that a new module can easily be integrated with it.

e) Reliable

f) Testable

2.4 Software Requirements

Front End/Language: PHP

Back End/Database: MYSQL

Additional Tools: XAPM Server

Operating System: Windows 7, 8, 9, 10, XP

2.5 Hardware Requirements

Processor: Intel Pentium III or later

Main Memory (RAM): 256 MB

Cache Memory: 512 KB Monitor: 14-inch Color Monitor

Keyboard: 108 Keys

Mouse: Optical Mouse

Hard Disk: 160 GB

CHAPTER 3: SYSTEM MODELING

3.1 Software Process

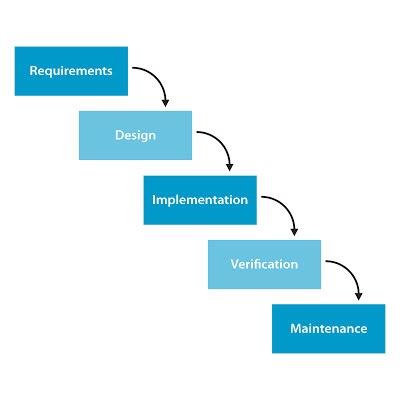

Waterfall Model:

Waterfall approach was first Process Model to be introduced and followed widely in Software Engineering to ensure success of the project. In "The Waterfall" approach, the whole process of software development is divided into separate process phases. The phases in Waterfall model are: Requirement Specifications phase, Software Design, Implementation and Testing & Maintenance. All these phases are cascaded to each other so that second phase is started as and when defined set of goals are achieved for first phase and it is signed off, so the name "Waterfall Model". All the methods and processes undertaken in Waterfall Model are more visible

Figure 3.1 Waterfall Model phases

The stages of "The Waterfall Model" are:

Requirement Analysis & Definition:

All possible requirements of the system to be developed are captured in this phase. Requirements are set of functionalities and constraints that the end-user (who will be using the system) expects from the system. The requirements are gathered from the end-user by consultation, these requirements are analysed for their validity and the possibility of incorporating the requirements in the system to be development is also studied. Finally, a Requirement Specification document is created which serves the purpose of guideline for the next phase of the model.

System & Software Design:

Before a starting for actual coding, it is highly important to understand what we are going to create and what it should look like? The requirement specifications from first phase are studied in this phase and system design is prepared. System Design helps in specifying hardware and system requirements and also helps in defining overall system architecture. The system design specifications serve as input for the next phase of the model.

Implementation & Unit Testing:

On receiving system design documents, the work is divided in modules/units and actual coding is started. The system is first developed in small programs called units, which are integrated in the next phase. Each unit is developed and tested for its functionality; this is referred to as Unit Testing. Unit testing mainly verifies if the modules/units meet their specifications.

Integration & System Testing:

As specified above, the system is first divided in units which are developed and tested for their functionalities. These units are integrated into a complete system during Integration phase and tested to check if all modules/units coordinate between each other and the system as a whole behaves as per the specifications. After successfully testing the software, it is delivered to the customer.

Operations & Maintenance:

This phase of "The Waterfall Model" is virtually never-ending phase (Very long). Generally, problems with the system developed (which are not found during the development life cycle) come up after its practical use starts, so the issues related to the system are solved after deployment of the system. Not all the problems come in picture directly but they arise time to time and needs to be solved; hence this process is referred as Maintenance.

Why using Waterfall Model in Bank System:

The system incorporates enhanced security features since it uses security techniques and standards in every tier of the architecture. The system was developed using object-oriented analysis and modelling techniques based on the waterfall model. Concerning the modelling of data flows, two diagram categories have been used throughout the various phases of the design: the workflow diagrams and the UML diagrams. The resulting web banking system is an online transaction system addressing individual bank clients as well as Small and Medium Enterprises (SME). This transactional system offers multiple capabilities such as funds transfer, electronic payments, remittances, information for user accounts and transactions, account customization and management of users credentials. In addition to the transactional system, two intranet systems have been developed for supporting the systems functions while providing an authorization framework. The users who access the web system experience different views of the bank site, depending on the roles and permissions they have. Every system is user-friendly and provides business intelligence capabilities such as reporting and management. Advantages of waterfall model:

It allows for departmentalization and managerial control.

Simple and easy to understand and use.

Easy to manage due to the rigidity of the model each phase has specific deliverables and a review process.

Phases are processed and completed one at a time.

Works well for smaller projects where requirements are very well understood.

A schedule can be set with deadlines for each stage of development and a product can proceed through the development process like a car in a car-wash, and theoretically, be delivered on time.

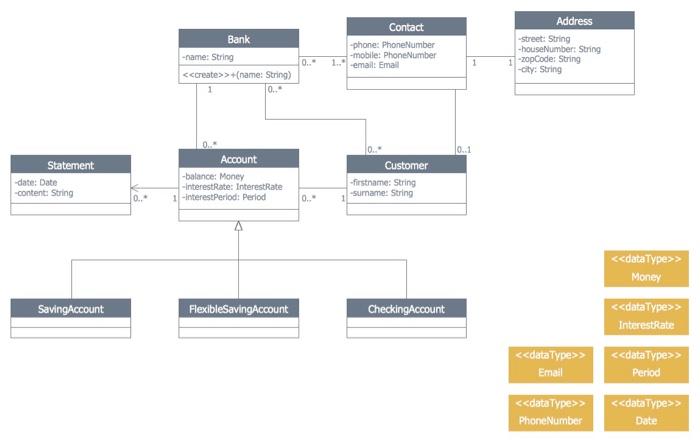

3.2 Class Diagram

UML for Bank - This sample was created in Concept Draw DIAGRAM diagramming and vector drawing software using the UML Class Diagram library of the Rapid UML Solution from the Software Development area of Concept Draw Solution Park.

Figure 3.2: Class Diagram

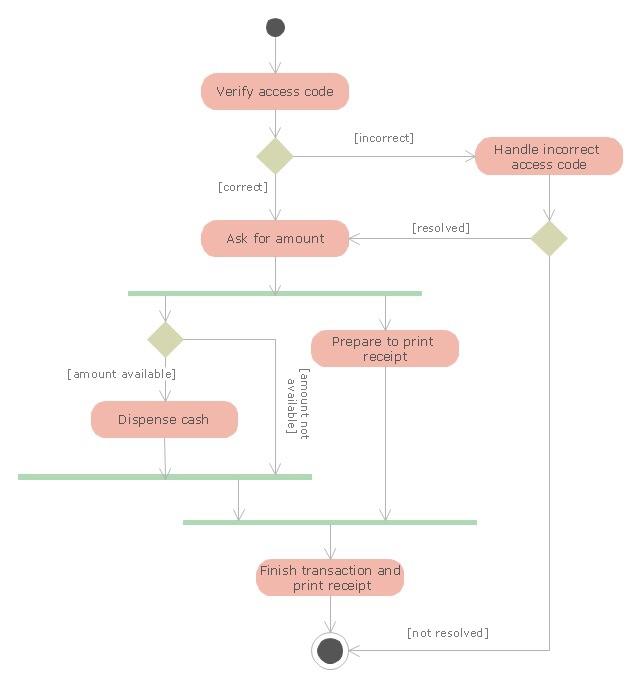

3.3 Sequence Diagram

UML Sequence Diagram can be created using Concept Draw DIAGRAM diagramming software contains rich examples and template. Concept Draw is perfect for software designers and software developers who need to draw UML Sequence Diagrams.

Figure 3.3: Sequence Diagram

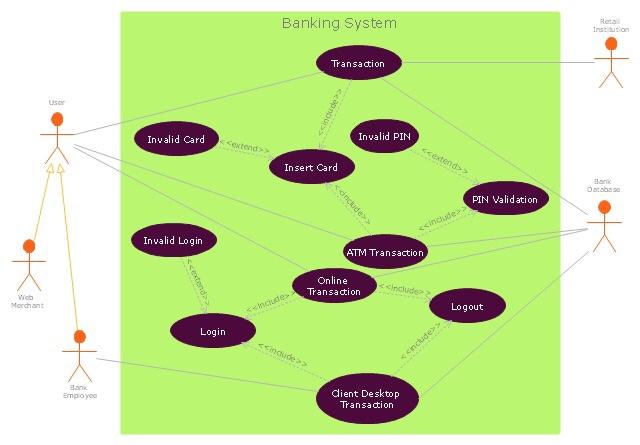

3.4 Activity Diagram

An automated teller machine or automatic teller machine" (ATM) (American, Australian, Singaporean, Indian, and Hiberno-English), also known as an automated banking machine (ABM) (Canadian English), cash machine, cashpoint, cash line or hole in the wall (British, South African, and Sri Lankan English), is an electronic telecommunications device that enables the clients of a financial institution to perform financial transactions without the need for a cashier, human clerk or bank teller.

On most modern ATMs, the customer is identified by inserting a plastic ATM card with a magnetic stripe or a plastic smart card with a chip that contains a unique card number and some security information such as an expiration date or CVVC (CVV). Authentication is provided by the customer entering a personal identification number (PIN). The newest ATM at Royal Bank of Scotland allows customers to withdraw cash up to 100 without a card by inputting a six-digit code requested through their smartphones.

Using an ATM, customers can access their bank accounts in order to make cash withdrawals, get debit card cash advances, and check their account balances as well as purchase pre-paid mobile phone credit. If the currency being withdrawn from the ATM is different from that which the bank account is denominated in (e.g.: Withdrawing Japanese yen from a bank account containing US dollars), the money will be converted at an official wholesale exchange rate. Thus, ATMs often provide one of the best possible official exchange rates for foreign travelers, and are also widely used for this purpose."

The UML activity diagram example "Cash withdrawal from ATM" was created using the Concept Draw PRO diagramming and vector drawing software extended with the Rapid UML solution from the Software Development area of Concept Draw Solution Park. Figure 3.4: Activity Diagram

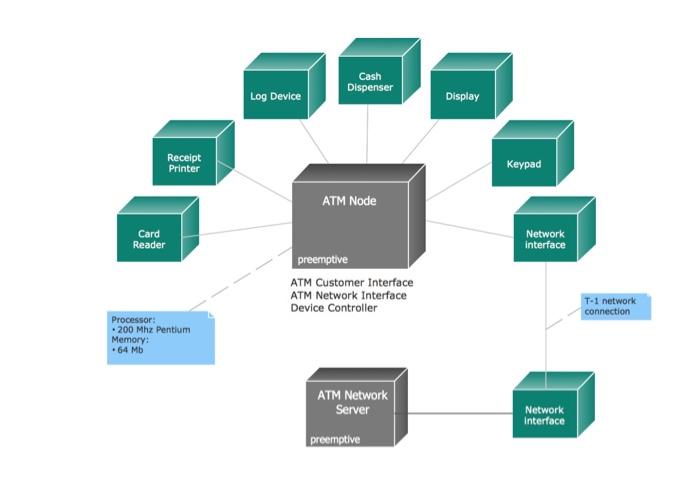

3.5 Deployment Diagram

This sample was created in Concept Draw DIAGRAM diagramming and vector drawing software using the UML Deployment Diagram library of the Rapid UML Solution from the Software Development area of Concept Draw Solution Park.

This sample shows the work of the ATM (Automated Teller Machine) banking system that is used for service and performing of the banking transactions using ATMs. System engineers can use comprehensive UML diagrams solution.

Figure 3.5: Deployment Diagram

CHAPTER 4: CONCLUSION

UML diagrams are useful when modeling business data. By accurately modeling attributes and associations of class entities, we can easily map these diagram specifications to entity beans with CMP. Class attributes map to abstract access methods for persistent fields, and association roles map to abstract access methods for relationship fields. Navigability determines whether relationship access methods appear in both related entity beans or multiplicity notation determines the correct type for relationship fields, life cycle issues, and cascading delete characteristics.

References

https://www.conceptdraw.com/examples/activity-diagram-for-banking-system

https://www.researchgate.net/publication/301293322_Bank_Account_Management_System

https://www.slideshare.net/vinothrethnam/bank-management-system

http://tryqa.com/what-is-waterfall-model-advantages-disadvantages-and-when-to-use-it/

https://en.wikipedia.org/wiki/Unified_Modeling_Language

https://www.researchgate.net/publication/262393567_An_effective_and_secure_web_banking_system_Development_and_evaluation

http://jobsandnewstoday.blogspot.com/2013/04/what-is-waterfall-model.html

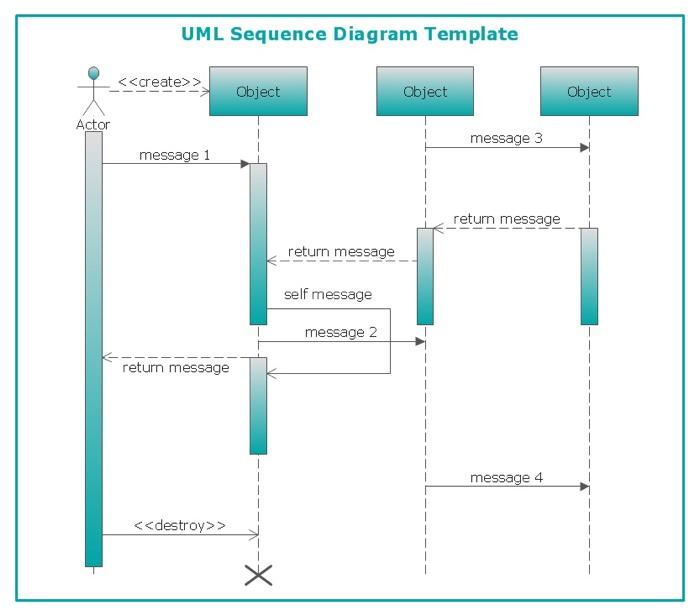

Chapter Description Introduction This should describe the need for the system It should briefly describe the system's functiors and explain how it will wolk with other systems. It should also describe how the system fits into the overall business or Staleyic objectives of Ure vrgauzaliun.concussiang de suflwae. Gloccary User requirements deliciou This should define the technical tems used in the document. You should not make assumptions about the experience or expertise of the seader. Here, you describe the services provided for the user. The nonfitutional system requirements should also be described in this section. This dexxiplin may use ialural language, diagrams, ur olu ulalivis al arc understandable to customers. Frochuct and process standards that must be followed should be specified. System requirements specification This should describe the functional and nonfunctional requirements in more detail. If necessary, further detail may also be added to the nonfunctional requurements Interfaces to other systems may be defined. System uwiels Tlus riglul aulude graphical systemu uwiels slowing de relativstups between the system components and the system and its cnv.sorment. Examples of possible models are oljart models, data-flow models, or semantic data models. System Evolution Thus should describe the fundamental assumptions on which the system is based, au aty alicipaled cuges due w lardware evululivly changing user needs, and so on. This section is useful for system designers as it may help them avoid design decisions that would > ince Banking System Reta Institution Transaction Sinode Invalid card Invalid PIN sextends AA Insert Card Bank Database PIN Validation inchide Invalid Login ATM Transaction Sextend Online Transaction Web Merchant Bank Employee dient Desktop Transaction Verify access code [incorrect] Handle incorrect access code [correct] [resolved] Ask for amount Prepare to print receipt [ amount available] available] [amount not Dispense cash Finish transaction and print receipt [not resolved] UML Sequence Diagram Template > Object Object Object Actor message 3 message 1 return message return message self message message 2 return message message 4 > Bank -name: String >+(name: String) 0.. Contact -phone: PhoneNumber -mobile: Phone Number 1.. email: Email Address Street: String -houseNumber: String 1-zopCode: String -city: String 0.. 1 0..1 Statement date: Date -content: String Account -balance: Money -InterestRate: InterestRate 1 -interest Period: Period Customer -firstname: String Surname: String 0.. > Money SavingAccount FlexibleSavingAccount CheckingAccount > InterestRate > Email > Period > > Phone Number Date Requirements Design Implementation Verification Maintenance Cash Dispenser Log Device Display Receipt Printer Keypad ATM Node Card Reader Network interface preemptive ATM Customer Interface ATM Network Interface Device Controller T-1 network connection Processor: 200 Mhz Pentium Memory: .64 Mb ATM Network Server Network Interface preemptive