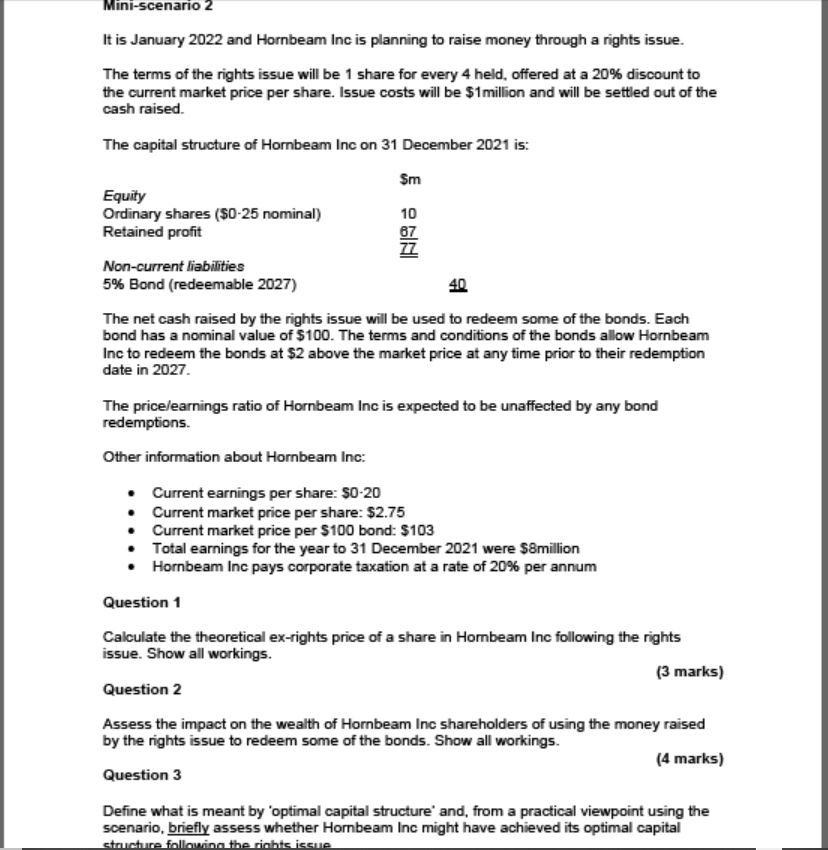

Mini-scenario 2 It is January 2022 and Hornbeam Inc is planning to raise money through a rights issue. The terms of the rights issue will be 1 share for every 4 held, offered at a 20% discount to the current market price per share. Issue costs will be $1million and will be settled out of the cash raised The capital structure of Hornbeam Inc on 31 December 2021 is: Sm Equity Ordinary shares ($0-25 nominal) 10 Retained profit 67 Non-current liabilities 5% Bond (redeemable 2027) 40 The net cash raised by the rights issue will be used to redeem some of the bonds. Each bond has a nominal value of $100. The terms and conditions of the bonds allow Hornbeam Inc to redeem the bonds at $2 above the market price at any time prior to their redemption date in 2027. The price/earnings ratio of Hornbeam Inc is expected to be unaffected by any bond redemptions. Other information about Hornbeam Inc: Current earnings per share: $0-20 Current market price per share: $2.75 Current market price per $100 bond: $103 Total earnings for the year to 31 December 2021 were $8million Hornbeam Inc pays corporate taxation at a rate of 20% per annum Question 1 Calculate the theoretical ex-rights price of a share in Hornbeam Inc following the rights issue. Show all workings. (3 marks) Question 2 Assess the impact on the wealth of Hornbeam Inc shareholders of using the money raised by the rights issue to redeem some of the bonds. Show all workings. (4 marks) Question 3 Define what is meant by 'optimal capital structure and, from a practical viewpoint using the scenario, briefly assess whether Hornbeam Inc might have achieved its optimal capital structure following the right issue Mini-scenario 2 It is January 2022 and Hornbeam Inc is planning to raise money through a rights issue. The terms of the rights issue will be 1 share for every 4 held, offered at a 20% discount to the current market price per share. Issue costs will be $1million and will be settled out of the cash raised The capital structure of Hornbeam Inc on 31 December 2021 is: Sm Equity Ordinary shares ($0-25 nominal) 10 Retained profit 67 Non-current liabilities 5% Bond (redeemable 2027) 40 The net cash raised by the rights issue will be used to redeem some of the bonds. Each bond has a nominal value of $100. The terms and conditions of the bonds allow Hornbeam Inc to redeem the bonds at $2 above the market price at any time prior to their redemption date in 2027. The price/earnings ratio of Hornbeam Inc is expected to be unaffected by any bond redemptions. Other information about Hornbeam Inc: Current earnings per share: $0-20 Current market price per share: $2.75 Current market price per $100 bond: $103 Total earnings for the year to 31 December 2021 were $8million Hornbeam Inc pays corporate taxation at a rate of 20% per annum Question 1 Calculate the theoretical ex-rights price of a share in Hornbeam Inc following the rights issue. Show all workings. (3 marks) Question 2 Assess the impact on the wealth of Hornbeam Inc shareholders of using the money raised by the rights issue to redeem some of the bonds. Show all workings. (4 marks) Question 3 Define what is meant by 'optimal capital structure and, from a practical viewpoint using the scenario, briefly assess whether Hornbeam Inc might have achieved its optimal capital structure following the right issue