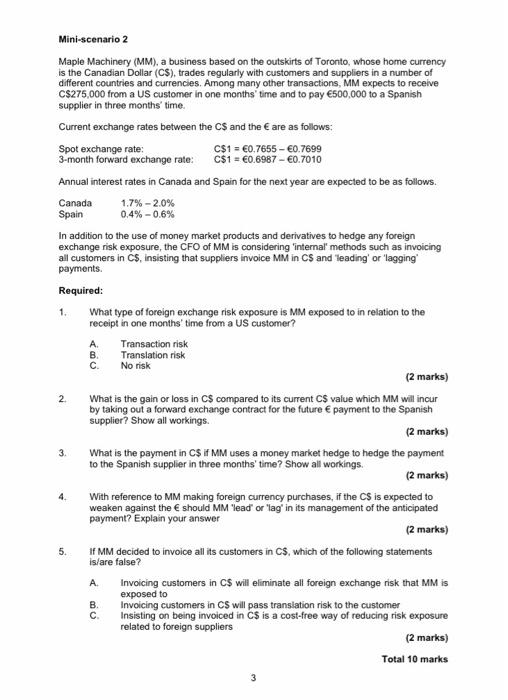

Mini-scenario 2 Maple Machinery (MM), a business based on the outskirts of Toronto, whose home currency is the Canadian Dollar (CS), trades regularly with customers and suppliers in a number of different countries and currencies. Among many other transactions, MM expects to receive C$275,000 from a US customer in one months' time and to pay 500,000 to a Spanish supplier in three months' time. Current exchange rates between the CS and the are as follows: Spot exchange rate C$1 = 0.7655 - 0.7699 3-month forward exchange rate: C$1 = 0.6987 - 0.7010 Annual interest rates in Canada and Spain for the next year are expected to be as follows. Canada Spain 1.7% -2.0% 0.4% -0,6% In addition to the use of money market products and derivatives to hedge any foreign exchange risk exposure, the CFO of MM is considering 'internal methods such as invoicing all customers in CS, insisting that suppliers invoice MM in CS and leading' or 'lagging payments. Required: 1. What type of foreign exchange risk exposure is MM exposed to in relation to the receipt in one months' time from a US customer? A. B. C. Transaction risk Translation risk No risk (2 marks) 2 What is the gain or loss in C$ compared to its current C$ value which MM will incur by taking out a forward exchange contract for the future payment to the Spanish supplier Show all workings. (2 marks) 3. What is the payment in CS ir MM uses a money market hedge to hedge the payment to the Spanish supplier in three months' time? Show all workings (2 marks) 4. With reference to MM making foreign currency purchases, if the CS is expected to weaken against the should MM lead' or 'lag' in its management of the anticipated payment? Explain your answer (2 marks) 5. if MM decided to invoice all its customers in Cs, which of the following statements is/are false? A B C Invoicing customers in CS will eliminate all foreign exchange risk that MM is exposed to Invoicing customers in Cs will pass translation risk to the customer Insisting on being invoiced in Cs is a cost-free way of reducing risk exposure related to foreign suppliers (2 marks) Total 10 marks 3