Answered step by step

Verified Expert Solution

Question

1 Approved Answer

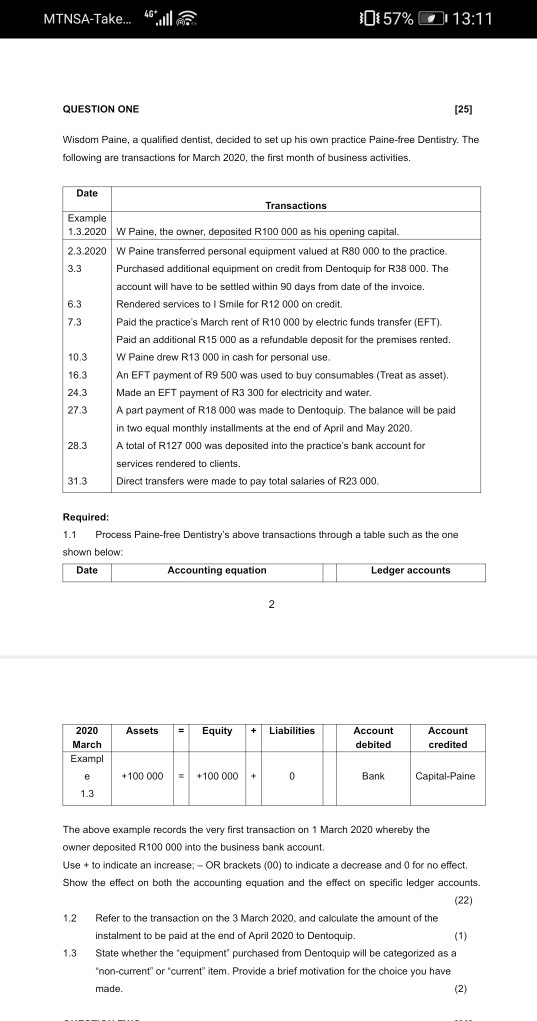

MINSA-Take... ll. 0157% 13:11 QUESTION ONE [25] Wisdom Paine, a qualified dentist, decided to set up his own practice Paine-free Dentistry. The following are transactions

MINSA-Take... ll. 0157% 13:11 QUESTION ONE [25] Wisdom Paine, a qualified dentist, decided to set up his own practice Paine-free Dentistry. The following are transactions for March 2020, the first month of business activities. Date Transactions Example 1.3.2020 W Paine, the owner, deposited R100 000 as his opening capital. 2.3.2020 W Paine transferred personal equipment valued at R80 000 to the practice. 3.3 Purchased additional equipment on credit from Dentoquip for R38 000. The account will have to be settled within 90 days from date of the invoice. 6.3 Rendered services to Smile for R12 000 on credit 7.3 Paid the practice's March rent of R10 000 by electric funds transfer (EFT) Paid an additional R15 000 as a refundable deposit for the premises rented. 10.3 W Paine drew R13 000 in cash for personal use. 16.3 An EFT payment of R9 500 was used to buy consumables (Treat as asset). 24.3 Made an EFT payment of R3 300 for electricity and water. 27.3 A part payment of R18 000 was made to Dentoquip. The balance will be paid in two equal monthly installments at the end of April and May 2020 28.3 A total of R127 000 was deposited into the practice's bank account for services rendered to clients. 31.3 Direct transfers were made to pay total salaries of R23 000 Required: 1.1 Process Paine-free Dentistry's above transactions through a table such as the one shown below: Date Accounting equation Ledger accounts 2 Assets Equity + Liabilities 2020 March Exampl Account debited Account credited e +100 000 +100 000 + 0 Bank Capital-Paine 1.3 The above example records the very first transaction on 1 March 2020 whereby the owner deposited R100 000 into the business bank account. Use + to indicate an increase:- OR brackets (00) to indicate a decrease and 0 for no effect Show the effect on both the accounting equation and the effect on specific ledger accounts. (22) 1.2 Refer to the transaction on the 3 March 2020, and calculate the amount fthe instalment to be paid at the end of April 2020 to Dentoquip. 1.3 State whether the equipment" purchased from Dentoquip will be categorized as a "non-current" or "current" item. Provide a brief motivation for the choice you have made. (2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started