Answered step by step

Verified Expert Solution

Question

1 Approved Answer

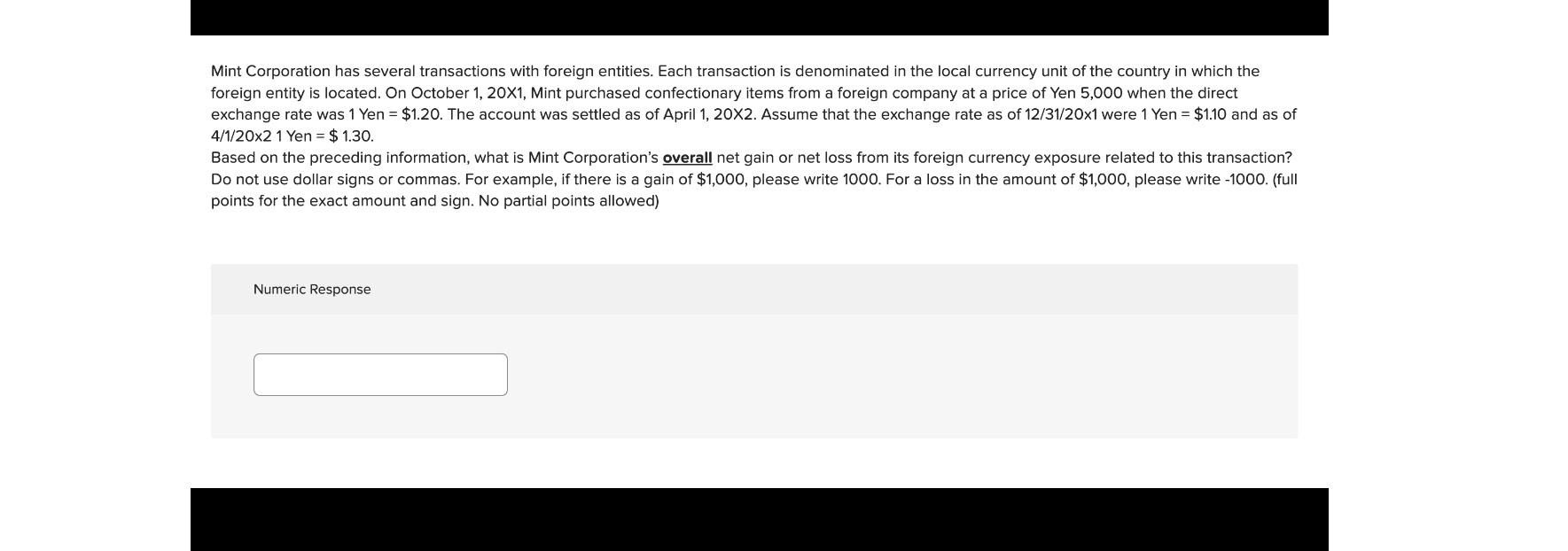

Mint Corporation has several transactions with foreign entities. Each transaction is denominated in the local currency unit of the country in which the foreign entity

Mint Corporation has several transactions with foreign entities. Each transaction is denominated in the local currency unit of the country in which the foreign entity is located. On October X Mint purchased confectionary items from a foreign company at a price of Yen when the direct exchange rate was Yen $ The account was settled as of April X Assume that the exchange rate as of x were Yen $ and as of Yen $

Based on the preceding information, what is Mint Corporation's overall net gain or net loss from its foreign currency exposure related to this transaction? Do not use dollar signs or commas. For example, if there is a gain of $ please write For a loss in the amount of $ please write full points for the exact amount and sign. No partial points allowed

Numeric Response

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started