Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Miss V is bullish about the stock of Ghana Commercial Bank ( GCB ) . She is very confident in the five - year strategic

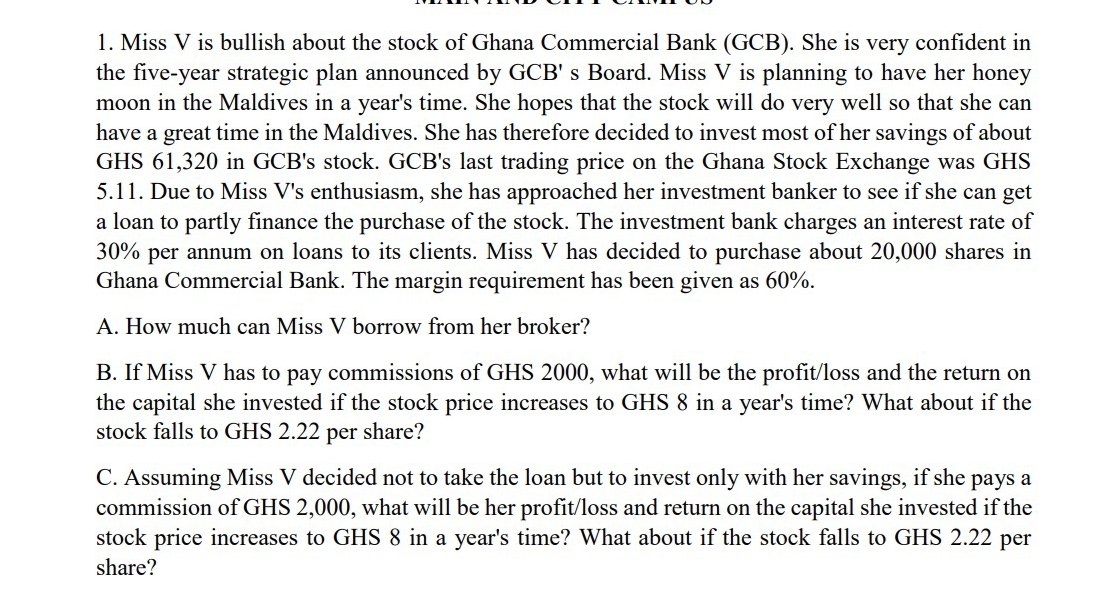

Miss V is bullish about the stock of Ghana Commercial Bank GCB She is very confident in the fiveyear strategic plan announced by GCB s Board. Miss V is planning to have her honey moon in the Maldives in a year's time. She hopes that the stock will do very well so that she can have a great time in the Maldives. She has therefore decided to invest most of her savings of about GHS in GCBs stock. GCBs last trading price on the Ghana Stock Exchange was GHS Due to Miss Vs enthusiasm, she has approached her investment banker to see if she can get a loan to partly finance the purchase of the stock. The investment bank charges an interest rate of per annum on loans to its clients. Miss V has decided to purchase about shares in Ghana Commercial Bank. The margin requirement has been given as

A How much can Miss V borrow from her broker?

B If Miss V has to pay commissions of GHS what will be the profitloss and the return on the capital she invested if the stock price increases to GHS in a year's time? What about if the stock falls to GHS per share?

C Assuming Miss V decided not to take the loan but to invest only with her savings, if she pays a commission of GHS what will be her profitloss and return on the capital she invested if the stock price increases to GHS in a year's time? What about if the stock falls to GHS per share?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started