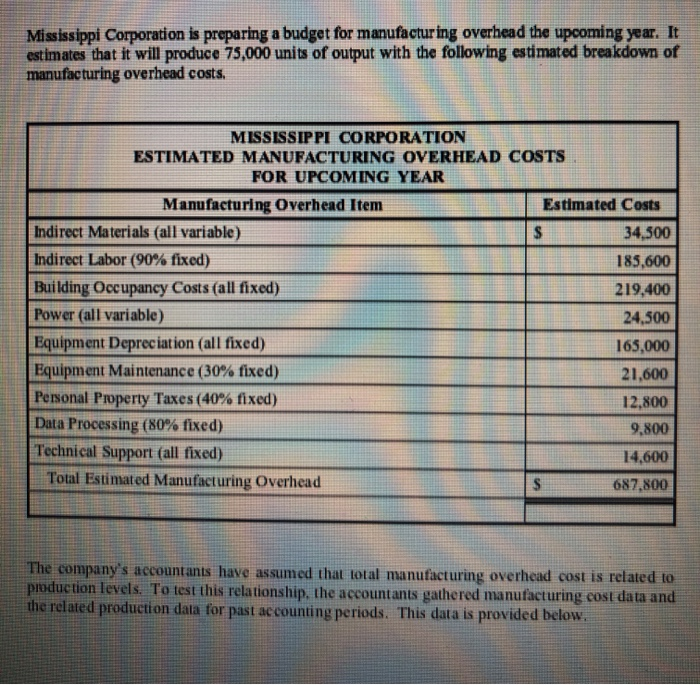

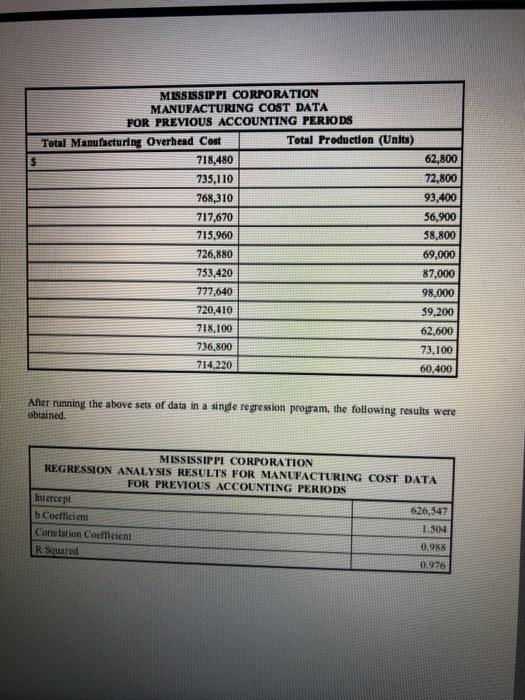

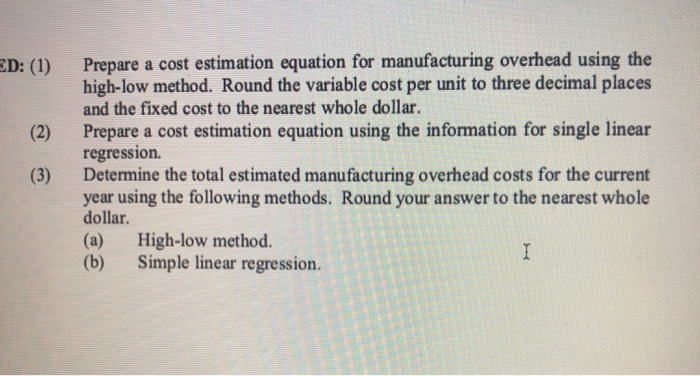

Mississippi Corporation is preparing a budget for manufacturing overhead the upcoming year. It estimates that it will produce 75,000 units of output with the following estimated breakdown of manufacturing overhead costs. MISSISSIPPI CORPORATION ESTIMATED MANUFACTURING OVERHEAD COSTS FOR UPCOMING YEAR Manufacturing Overhead Item Estimated Costs ndirect Materials (all variable) $ 34,500 Indirect Labor (90% fixed) 185,600 Building Occupancy Costs (all fixed) 219,400 Power (all variable) 24,500 Equipment Depreciation (all fixed) 165,000 Equipment Maintenance (30% fixed) 21,600 Personal Property Taxes (40% fixed) 12.800 Data Processing (80% fixed) 9,800 Technical Support (all fixed) 14,600 Total Estimated Manufacturing Overhead S 687,800 The company's accountants have assumed that total manufacturing overhead cost is related to production levels. To test this relationship, the accountants gathered manufacturing cost data and the related production data for past accounting periods. This data is provided below. MISSISSIPPI CORPORATION MANUFACTURING COST DATA FOR PREVIOUS ACCOUNTING PERIODS Total Manufacturing Overhead Cost Total Production (Units) $ 718,480 735,110 768,310 717,670 715,960 726,880 753,420 777,640 720,410 718,100 736.800 714,220 62,800 72,800 93,400 56,900 58,800 69,000 87,000 98.000 59.200 62,600 73.100 60.400 After running the above sets of data in a single regression program, the following results were obtained. MISSISSIPPI CORPORATION REGRESSION ANALYSIS RESULTS FOR MANUFACTURING COST DATA FOR PREVIOUS ACCOUNTING PERIODS Intercept 626,547 b Coefficient 1.304 Correlation Coefficient 0,988 R Squared 0.976 ED: (1) (2) Prepare a cost estimation equation for manufacturing overhead using the high-low method. Round the variable cost per unit to three decimal places and the fixed cost to the nearest whole dollar. Prepare a cost estimation equation using the information for single linear regression. Determine the total estimated manufacturing overhead costs for the current year using the following methods. Round your answer to the nearest whole dollar. (a) High-low method. (b) I Simple linear regression. (3) Mississippi Corporation is preparing a budget for manufacturing overhead the upcoming year. It estimates that it will produce 75,000 units of output with the following estimated breakdown of manufacturing overhead costs. MISSISSIPPI CORPORATION ESTIMATED MANUFACTURING OVERHEAD COSTS FOR UPCOMING YEAR Manufacturing Overhead Item Estimated Costs ndirect Materials (all variable) $ 34,500 Indirect Labor (90% fixed) 185,600 Building Occupancy Costs (all fixed) 219,400 Power (all variable) 24,500 Equipment Depreciation (all fixed) 165,000 Equipment Maintenance (30% fixed) 21,600 Personal Property Taxes (40% fixed) 12.800 Data Processing (80% fixed) 9,800 Technical Support (all fixed) 14,600 Total Estimated Manufacturing Overhead S 687,800 The company's accountants have assumed that total manufacturing overhead cost is related to production levels. To test this relationship, the accountants gathered manufacturing cost data and the related production data for past accounting periods. This data is provided below. MISSISSIPPI CORPORATION MANUFACTURING COST DATA FOR PREVIOUS ACCOUNTING PERIODS Total Manufacturing Overhead Cost Total Production (Units) $ 718,480 735,110 768,310 717,670 715,960 726,880 753,420 777,640 720,410 718,100 736.800 714,220 62,800 72,800 93,400 56,900 58,800 69,000 87,000 98.000 59.200 62,600 73.100 60.400 After running the above sets of data in a single regression program, the following results were obtained. MISSISSIPPI CORPORATION REGRESSION ANALYSIS RESULTS FOR MANUFACTURING COST DATA FOR PREVIOUS ACCOUNTING PERIODS Intercept 626,547 b Coefficient 1.304 Correlation Coefficient 0,988 R Squared 0.976 ED: (1) (2) Prepare a cost estimation equation for manufacturing overhead using the high-low method. Round the variable cost per unit to three decimal places and the fixed cost to the nearest whole dollar. Prepare a cost estimation equation using the information for single linear regression. Determine the total estimated manufacturing overhead costs for the current year using the following methods. Round your answer to the nearest whole dollar. (a) High-low method. (b) I Simple linear regression. (3)