Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MISSISSIPPI CORPORATION manufactures ONE PRODUCT. The company prepared a master budget for 2019 which included the following pro-forma income statement, which is based on an

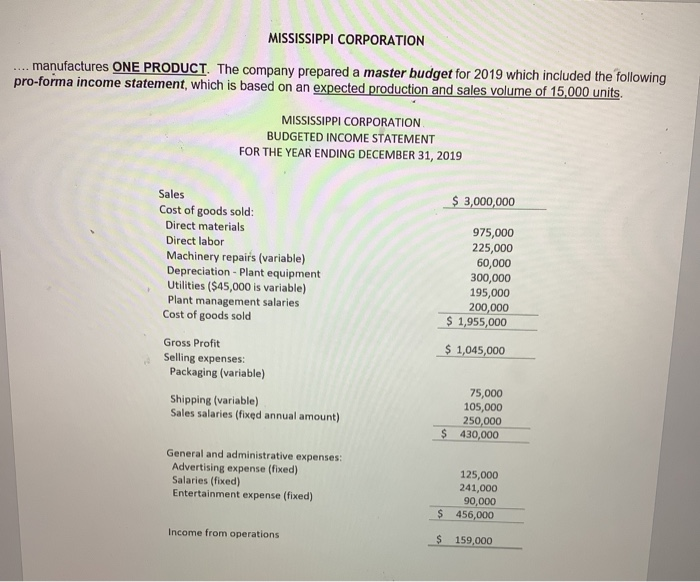

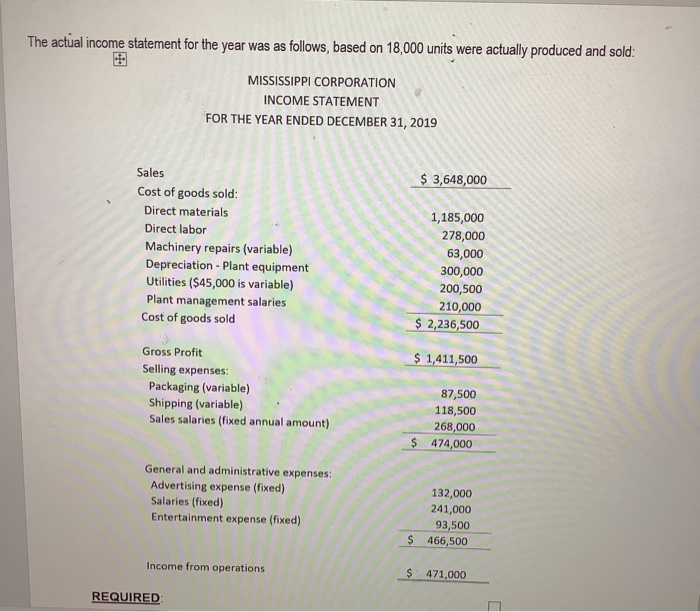

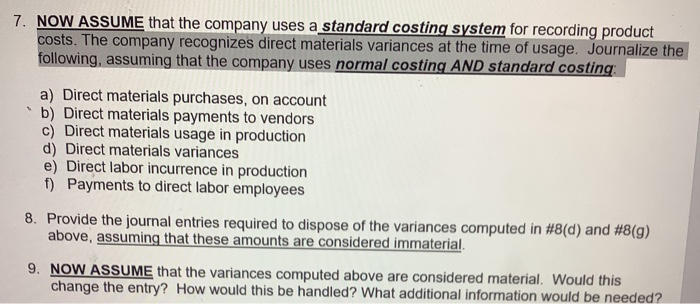

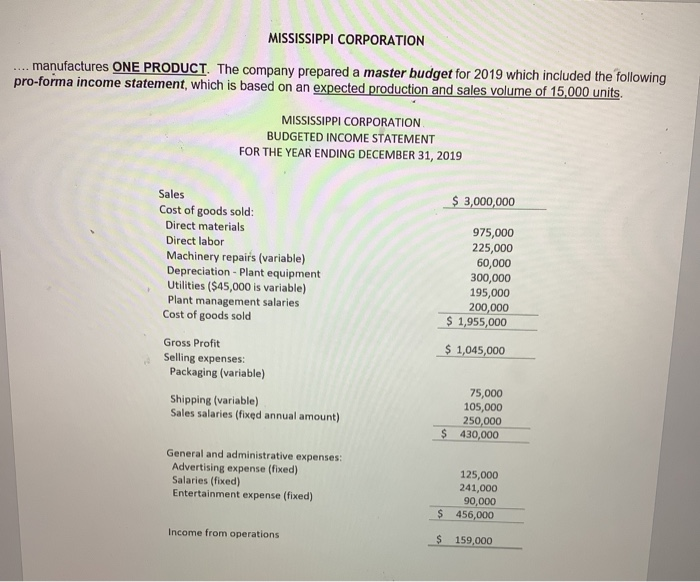

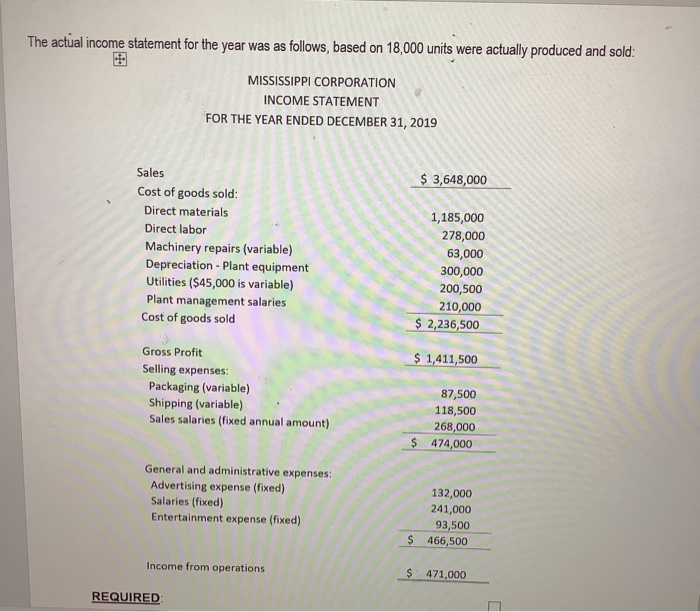

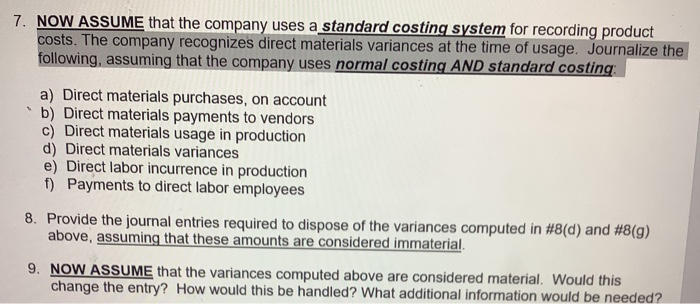

MISSISSIPPI CORPORATION manufactures ONE PRODUCT. The company prepared a master budget for 2019 which included the following pro-forma income statement, which is based on an expected production and sales volume of 15,000 units. MISSISSIPPI CORPORATION BUDGETED INCOME STATEMENT FOR THE YEAR ENDING DECEMBER 31, 2019 $ 3,000,000 Sales Cost of goods sold: Direct materials Direct labor Machinery repairs (variable) Depreciation - Plant equipment Utilities ($45,000 is variable) Plant management salaries Cost of goods sold 975,000 225,000 60,000 300,000 195,000 200,000 $ 1,955,000 $ 1,045,000 Gross Profit Selling expenses Packaging (variable) Shipping (variable) Sales salaries (fixed annual amount) 75,000 105,000 250,000 $ 430,000 General and administrative expenses: Advertising expense (fixed) Salaries (fixed) Entertainment expense (fixed) 125,000 241,000 90,000 $ 456,000 Income from operations $ 159,000 The actual income statement for the year was as follows, based on 18,000 units were actually produced and sold: MISSISSIPPI CORPORATION INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2019 $ 3,648,000 Sales Cost of goods sold: Direct materials Direct labor Machinery repairs (variable) Depreciation - Plant equipment Utilities ($45,000 is variable) Plant management salaries Cost of goods sold 1,185,000 278,000 63,000 300,000 200,500 210,000 $ 2,236,500 $ 1,411,500 Gross Profit Selling expenses: Packaging (variable) Shipping (variable) Sales salaries (fixed annual amount) 87,500 118,500 268,000 $ 474,000 General and administrative expenses: Advertising expense (fixed) Salaries (fixed) Entertainment expense (fixed) 132,000 241,000 93,500 $ 466,500 Income from operations $ 471,000 REQUIRED 7. NOW ASSUME that the company uses a standard costing system for recording product costs. The company recognizes direct materials variances at the time of usage. Journalize the following, assuming that the company uses normal costing AND standard costing: a) Direct materials purchases, on account b) Direct materials payments to vendors c) Direct materials usage in production d) Direct materials variances e) Direct labor incurrence in production f) Payments to direct labor employees 8. Provide the journal entries required to dispose of the variances computed in #8(d) and #8(g) above, assuming that these amounts are considered immaterial. 9. NOW ASSUME that the variances computed above are considered material. Would this change the entry? How would this be handled? What additional information would be needed? MISSISSIPPI CORPORATION manufactures ONE PRODUCT. The company prepared a master budget for 2019 which included the following pro-forma income statement, which is based on an expected production and sales volume of 15,000 units. MISSISSIPPI CORPORATION BUDGETED INCOME STATEMENT FOR THE YEAR ENDING DECEMBER 31, 2019 $ 3,000,000 Sales Cost of goods sold: Direct materials Direct labor Machinery repairs (variable) Depreciation - Plant equipment Utilities ($45,000 is variable) Plant management salaries Cost of goods sold 975,000 225,000 60,000 300,000 195,000 200,000 $ 1,955,000 $ 1,045,000 Gross Profit Selling expenses Packaging (variable) Shipping (variable) Sales salaries (fixed annual amount) 75,000 105,000 250,000 $ 430,000 General and administrative expenses: Advertising expense (fixed) Salaries (fixed) Entertainment expense (fixed) 125,000 241,000 90,000 $ 456,000 Income from operations $ 159,000 The actual income statement for the year was as follows, based on 18,000 units were actually produced and sold: MISSISSIPPI CORPORATION INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2019 $ 3,648,000 Sales Cost of goods sold: Direct materials Direct labor Machinery repairs (variable) Depreciation - Plant equipment Utilities ($45,000 is variable) Plant management salaries Cost of goods sold 1,185,000 278,000 63,000 300,000 200,500 210,000 $ 2,236,500 $ 1,411,500 Gross Profit Selling expenses: Packaging (variable) Shipping (variable) Sales salaries (fixed annual amount) 87,500 118,500 268,000 $ 474,000 General and administrative expenses: Advertising expense (fixed) Salaries (fixed) Entertainment expense (fixed) 132,000 241,000 93,500 $ 466,500 Income from operations $ 471,000 REQUIRED 7. NOW ASSUME that the company uses a standard costing system for recording product costs. The company recognizes direct materials variances at the time of usage. Journalize the following, assuming that the company uses normal costing AND standard costing: a) Direct materials purchases, on account b) Direct materials payments to vendors c) Direct materials usage in production d) Direct materials variances e) Direct labor incurrence in production f) Payments to direct labor employees 8. Provide the journal entries required to dispose of the variances computed in #8(d) and #8(g) above, assuming that these amounts are considered immaterial. 9. NOW ASSUME that the variances computed above are considered material. Would this change the entry? How would this be handled? What additional information would be needed

MISSISSIPPI CORPORATION manufactures ONE PRODUCT. The company prepared a master budget for 2019 which included the following pro-forma income statement, which is based on an expected production and sales volume of 15,000 units. MISSISSIPPI CORPORATION BUDGETED INCOME STATEMENT FOR THE YEAR ENDING DECEMBER 31, 2019 $ 3,000,000 Sales Cost of goods sold: Direct materials Direct labor Machinery repairs (variable) Depreciation - Plant equipment Utilities ($45,000 is variable) Plant management salaries Cost of goods sold 975,000 225,000 60,000 300,000 195,000 200,000 $ 1,955,000 $ 1,045,000 Gross Profit Selling expenses Packaging (variable) Shipping (variable) Sales salaries (fixed annual amount) 75,000 105,000 250,000 $ 430,000 General and administrative expenses: Advertising expense (fixed) Salaries (fixed) Entertainment expense (fixed) 125,000 241,000 90,000 $ 456,000 Income from operations $ 159,000 The actual income statement for the year was as follows, based on 18,000 units were actually produced and sold: MISSISSIPPI CORPORATION INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2019 $ 3,648,000 Sales Cost of goods sold: Direct materials Direct labor Machinery repairs (variable) Depreciation - Plant equipment Utilities ($45,000 is variable) Plant management salaries Cost of goods sold 1,185,000 278,000 63,000 300,000 200,500 210,000 $ 2,236,500 $ 1,411,500 Gross Profit Selling expenses: Packaging (variable) Shipping (variable) Sales salaries (fixed annual amount) 87,500 118,500 268,000 $ 474,000 General and administrative expenses: Advertising expense (fixed) Salaries (fixed) Entertainment expense (fixed) 132,000 241,000 93,500 $ 466,500 Income from operations $ 471,000 REQUIRED 7. NOW ASSUME that the company uses a standard costing system for recording product costs. The company recognizes direct materials variances at the time of usage. Journalize the following, assuming that the company uses normal costing AND standard costing: a) Direct materials purchases, on account b) Direct materials payments to vendors c) Direct materials usage in production d) Direct materials variances e) Direct labor incurrence in production f) Payments to direct labor employees 8. Provide the journal entries required to dispose of the variances computed in #8(d) and #8(g) above, assuming that these amounts are considered immaterial. 9. NOW ASSUME that the variances computed above are considered material. Would this change the entry? How would this be handled? What additional information would be needed? MISSISSIPPI CORPORATION manufactures ONE PRODUCT. The company prepared a master budget for 2019 which included the following pro-forma income statement, which is based on an expected production and sales volume of 15,000 units. MISSISSIPPI CORPORATION BUDGETED INCOME STATEMENT FOR THE YEAR ENDING DECEMBER 31, 2019 $ 3,000,000 Sales Cost of goods sold: Direct materials Direct labor Machinery repairs (variable) Depreciation - Plant equipment Utilities ($45,000 is variable) Plant management salaries Cost of goods sold 975,000 225,000 60,000 300,000 195,000 200,000 $ 1,955,000 $ 1,045,000 Gross Profit Selling expenses Packaging (variable) Shipping (variable) Sales salaries (fixed annual amount) 75,000 105,000 250,000 $ 430,000 General and administrative expenses: Advertising expense (fixed) Salaries (fixed) Entertainment expense (fixed) 125,000 241,000 90,000 $ 456,000 Income from operations $ 159,000 The actual income statement for the year was as follows, based on 18,000 units were actually produced and sold: MISSISSIPPI CORPORATION INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2019 $ 3,648,000 Sales Cost of goods sold: Direct materials Direct labor Machinery repairs (variable) Depreciation - Plant equipment Utilities ($45,000 is variable) Plant management salaries Cost of goods sold 1,185,000 278,000 63,000 300,000 200,500 210,000 $ 2,236,500 $ 1,411,500 Gross Profit Selling expenses: Packaging (variable) Shipping (variable) Sales salaries (fixed annual amount) 87,500 118,500 268,000 $ 474,000 General and administrative expenses: Advertising expense (fixed) Salaries (fixed) Entertainment expense (fixed) 132,000 241,000 93,500 $ 466,500 Income from operations $ 471,000 REQUIRED 7. NOW ASSUME that the company uses a standard costing system for recording product costs. The company recognizes direct materials variances at the time of usage. Journalize the following, assuming that the company uses normal costing AND standard costing: a) Direct materials purchases, on account b) Direct materials payments to vendors c) Direct materials usage in production d) Direct materials variances e) Direct labor incurrence in production f) Payments to direct labor employees 8. Provide the journal entries required to dispose of the variances computed in #8(d) and #8(g) above, assuming that these amounts are considered immaterial. 9. NOW ASSUME that the variances computed above are considered material. Would this change the entry? How would this be handled? What additional information would be needed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started