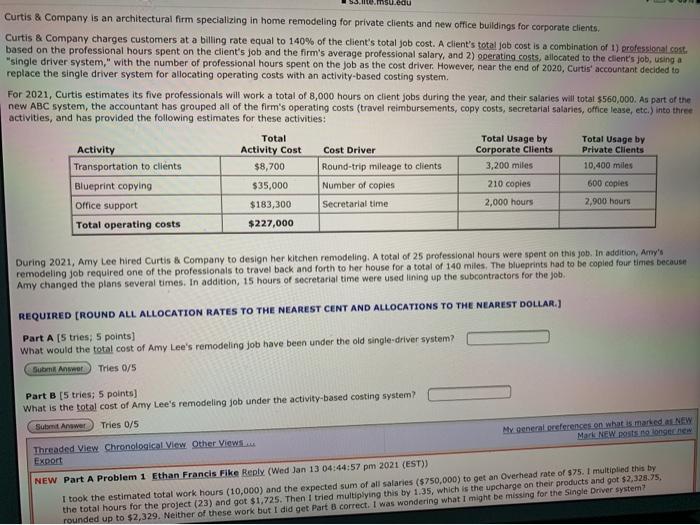

misu.edu Curtis & Company is an architectural firm specializing in home remodeling for private clients and new office buildings for corporate clients. Curtis & Company charges customers at a billing rate equal to 140% of the client's total job cost. A client's total job cost is a combination of 1) professional cost. based on the professional hours spent on the client's job and the firm's average professional salary, and 2) operating costs, allocated to the client's job, using a "single driver system, with the number of professional hours spent on the job as the cost driver. However, near the end of 2020, Curtis accountant decided to replace the single driver system for allocating operating costs with an activity-based costing system. For 2021, Curtis estimates its five professionals will work a total of 8,000 hours on client jobs during the year, and their salaries will total $560,000. As part of the new ABC system, the accountant has grouped all of the firm's operating costs (travel reimbursements, copy costs, secretarial salaries, office lease, etc.) into three activities, and has provided the following estimates for these activities: Total Total Usage by Total Usage by Activity Activity Cost Cost Driver Corporate Clients Private Clients Transportation to clients $8,700 Round-trip mileage to clients 3,200 miles 10,400 miles Blueprint copying $35,000 Number of copies 210 copies 600 copies Office support $183,300 Secretarial time 2,000 hours 2,900 hours Total operating costs $227,000 During 2021, Amy Lee hired Curtis & Company to design her kitchen remodeling. A total of 25 professional hours were spent on this job. In addition, Amy's remodeling job required one of the professionals to travel back and forth to her house for a total of 140 miles. The blueprints had to be copied four times because Amy changed the plans several times. In addition, 15 hours of secretarial time were used lining up the subcontractors for the job. REQUIRED (ROUND ALL ALLOCATION RATES TO THE NEAREST CENT AND ALLOCATIONS TO THE NEAREST DOLLAR.) Part A [Stries; 5 points) What would the total cost of Amy Lee's remodeling Job have been under the old single-driver system? Subm Answer Tries 0/5 Part B (5 tries; 5 points) What is the total cost of Amy Lee's remodeling Job under the activity-based costing system? Submit Answer Tries 0/5 Threaded View Chronological View Other View My general references on what is marked NEW Export Mark NEW posts no longer new NEW Part A Problem 1 Ethan Francis Fike Reply (Wed Jan 13 04:44:57 pm 2021 (EST) I took the estimated total work hours (10,000) and the expected sum of all salaries ($750,000) to get an Overhead rate of $75.1 multiplied this by the total hours for the project (23) and got $1,725. Then I tried multiplying this by 1.35, which is the upcharge on their products and got $2,328.75, rounded up to $2,329. Neither of these work but I did get Part 8 correct. I was wondering what I might be missing for the Single Driver system