Question

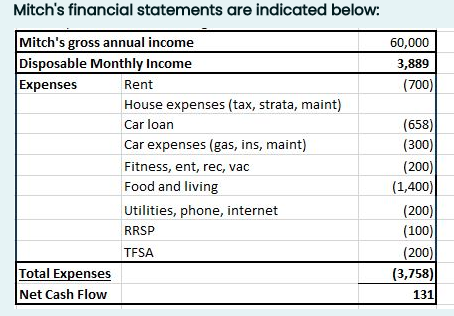

Mitch is 32 years old, single, and has been working for five years at a video game company. His financial statements are shown below. He

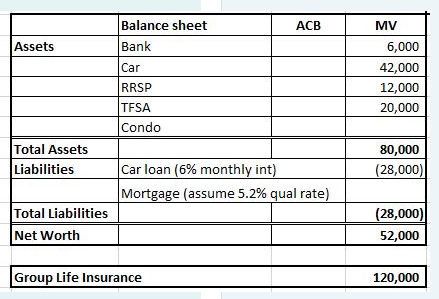

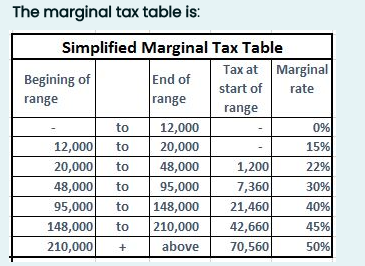

Mitch is 32 years old, single, and has been working for five years at a video game company. His financial statements are shown below. He pays his credit card and all bills monthly so his only debt payment is for his car loan. It is January and Mitch is considering his New Year's resolution, to get financially organized and buy his own place. He is figuring out if he can buy and move into his own studio condo near work before the summer (listed for $236,000). This condo has property taxes, heat and half of strata fees of $270 per month. He would still want to have funds to continue his lifestyle. Longer term he hopes to marry his girlfriend and start a family and also be able to retire at age 65 with a comfortable lifestyle. Assume the qualifying mortgage rate is 5.2% semi-annual interest and 25 year amortization, TDSR requirement is 40% and GDSR is 30%. Assume he has $60,000 RRSP carry forward room and $50,000 TFSA room. Mitch's financial statements are indicated below:

What would most benefit Mitch to help him purchase his condo more quickly (without changing his lifestyle expenses)?

Choose one of below:

- $1230

- $207,405

- 1072

- Sell his car

- No there is no way for him to be able to purchase the condo before summer

- Use the home buyers plan and TFSA funds to buy the condo now

- $180,763

- $1,287

- Transfer his TFSA funds to his RRSP before the end of February

- Transfer his TFSA funds to his RRSP AT least 90 DAYS BEFORE HE USES THE hOME buyers Plan

- Reduce his spending and save 800 a month in his RRSP

L. Start saving $1,000 per month in his TFSA

Please explain how to get the solution. Thanks!

Mitch's financial statements are indicated below: 60,000 3,889 (700) Mitch's gross annual income Disposable Monthly Income Expenses Rent House expenses (tax, strata, maint) Car loan Car expenses (gas, ins, maint) Fitness, ent, rec, vac Food and living Utilities, phone, internet RRSP TFSA Total Expenses Net Cash Flow (658) (300) (200) (1,400) (200) (100) (200) (3,758) 131 ACB MV Balance sheet Bank Assets Car RRSP TFSA Condo 6,000 42,000 12,000 20,000 Total Assets Liabilities 80,000 (28,000) Car loan (6% monthly int) Mortgage (assume 5.2% qual rate) Total Liabilities Net Worth (28,000) 52,000 Group Life Insurance 120,000 The marginal tax table is: Simplified Marginal Tax Table Tax at Marginal Begining of End of start of rate range range range to 12,000 09 12,000 to 20,000 15% 20,000 to 48,000 1,200 22% 48,000 to 95,000 7,360 30% 95,000 to 148,000 21,460 40% 148,000 to 210,000 42,660 45% 210,000 + above 70,560 50% + Mitch's financial statements are indicated below: 60,000 3,889 (700) Mitch's gross annual income Disposable Monthly Income Expenses Rent House expenses (tax, strata, maint) Car loan Car expenses (gas, ins, maint) Fitness, ent, rec, vac Food and living Utilities, phone, internet RRSP TFSA Total Expenses Net Cash Flow (658) (300) (200) (1,400) (200) (100) (200) (3,758) 131 ACB MV Balance sheet Bank Assets Car RRSP TFSA Condo 6,000 42,000 12,000 20,000 Total Assets Liabilities 80,000 (28,000) Car loan (6% monthly int) Mortgage (assume 5.2% qual rate) Total Liabilities Net Worth (28,000) 52,000 Group Life Insurance 120,000 The marginal tax table is: Simplified Marginal Tax Table Tax at Marginal Begining of End of start of rate range range range to 12,000 09 12,000 to 20,000 15% 20,000 to 48,000 1,200 22% 48,000 to 95,000 7,360 30% 95,000 to 148,000 21,460 40% 148,000 to 210,000 42,660 45% 210,000 + above 70,560 50% +Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started