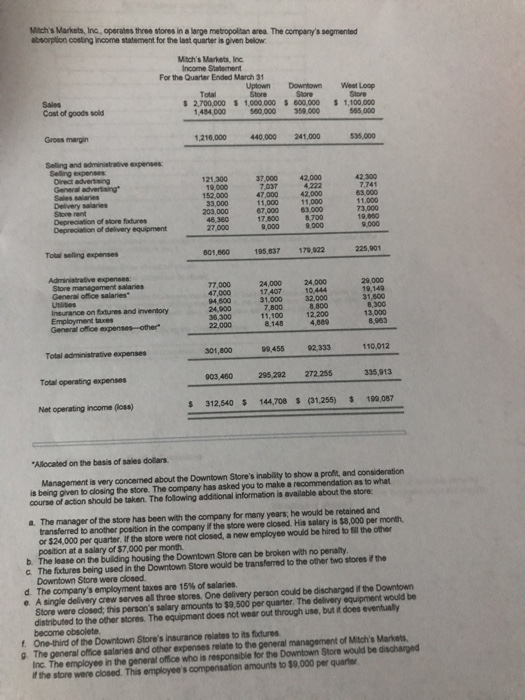

Mitchs markets Inc. operates three stores in a large metropolitan area the company segmented absorption costing income statement for the last quarter is given below $2,700,00

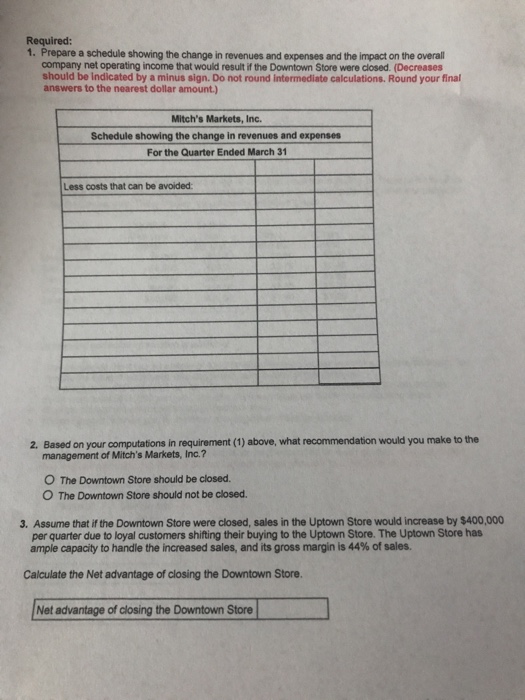

Mitch's Markets, Inc, operates three stores in a large metropoltan area. The company's segmented absorption costing Income statement for the last quarter is given below Mtch's Markets, Inc Income Statement For the Quarter Ended March 31 Uptown Downtown West Loop Total 484,000 1,216,000 Store Store Sales 2,700,000 1,000.000 600,000 1,100.000 555,000 Cost of goods sold Gross margin Selling and administralive expenses 50000 350 000 440,000 241,000 35,000 Selling expenses 121,300 19,000 152,000 7,000 42,000 42.300 General advertising Sales salaries Delivery salaries Store rent Depreciation of store fotures 47,000 42,000 203,000 46,360 27,000 63,000 8,700 9,000 11,000 73,000 19,860 9.000 67,000 17,800 9,000 Total seling expenses 601,800 195,837 179,922 225,901 Administrative expenses: General office salaries Insurance on fxtures and inventory General office expenses-other 77,000 47,000 94,800 24,900 36,300 22,000 29,000 19,149 31,800 24,000 24,000 17 31,00032,000 8,800 12,200 4,889 7,800 13,000 8,963 8,148 99,455 92.333 Total administrative expenses 301,800 110,012 Total operating expensers 903,460295,292 272,255 335,913 Net operating income (loss) 312,540 144,708 (31,255) $ 199,087 Alocated on the basis of sales dolars Management is very concemed about the Downtown Store's inability to show a proft, and consideration is being given to dlosing the store. The company has asked you to make a recommendation as to what course of action should be taken. The following additional information is available about the store a. The manager of the store has been with the company for many years; he would be retained and transferred to another position in the company if the store were closed. His salary is $8,000 per month, or $24,000 per quarter. If the store were not closed, a new employee would be hired to fill the other position at a salary of $7,000 per month b. The lease on the building housing the Downtown Store can be broken with no penalty The futures being used in the Downtown Store would be transferred to the other two stores if the Downtown Store were closed d. The company's employment taxes are 15% of salaries. e. A single delivery crew serves all three stores. One delivery person could be discharged if the Downtown Store were closed, this person's salary amounts to $9,500 per quarter. The delivery equipment would be distributed to the other stores. The equipment does not wear out through use, but it does eventualy become obsolete t One-third of the Downtown Store's insurance relates to its futures g The general office salaries and other expenses relate to the general management of Mitch's Markets, Inc. The employee in the general office who is responsible for the Downtown Store would be dischanged If the store were closed. This employee's compensation amounts to $9,000 per quarter