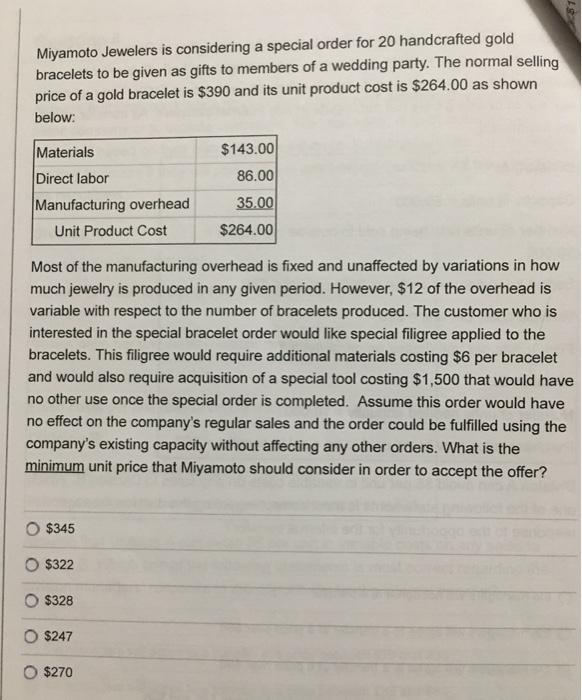

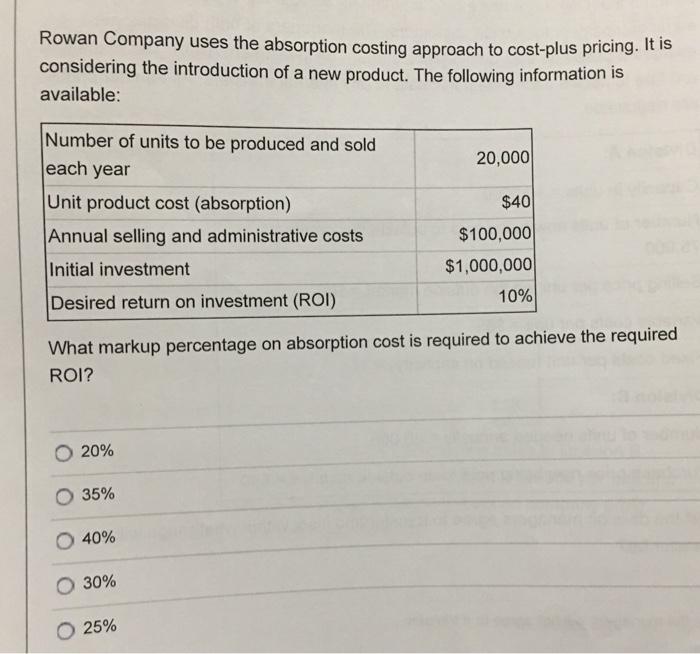

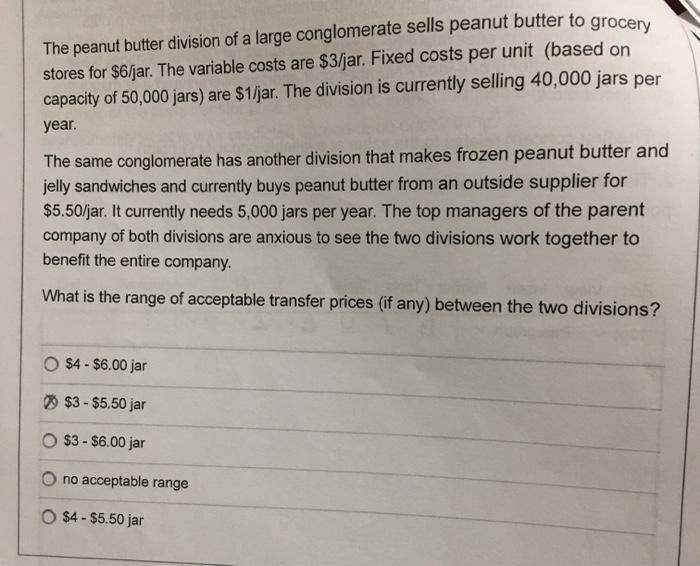

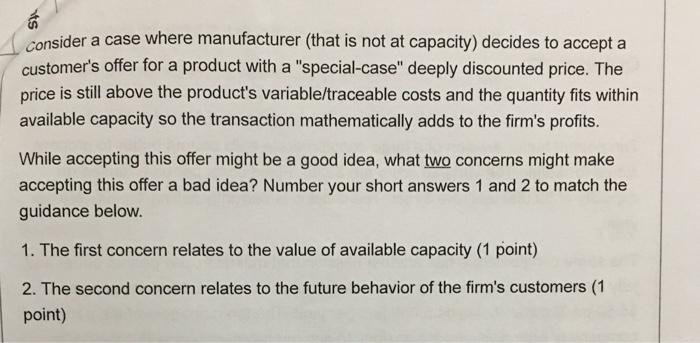

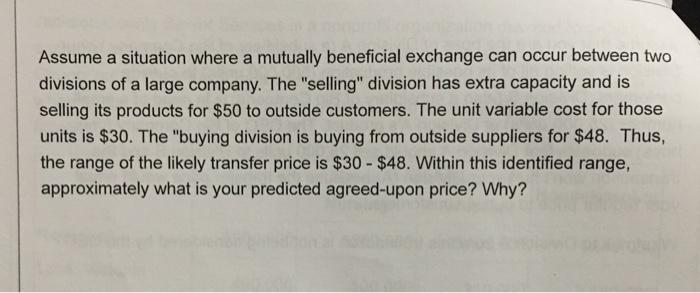

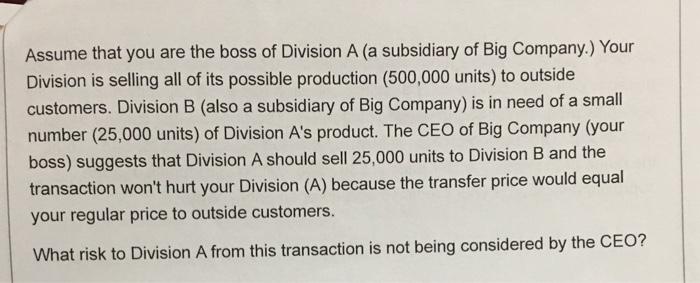

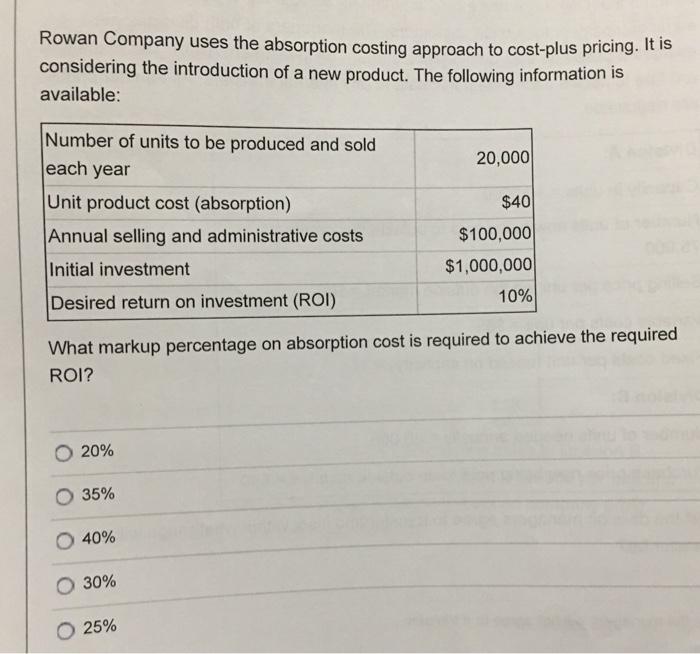

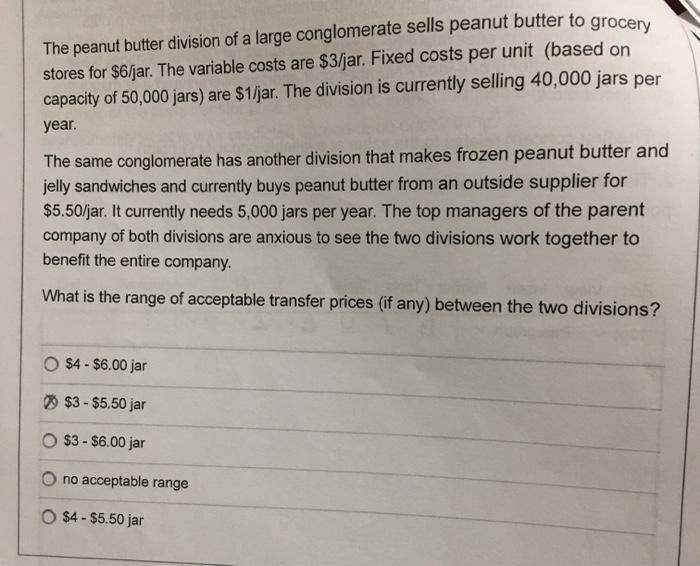

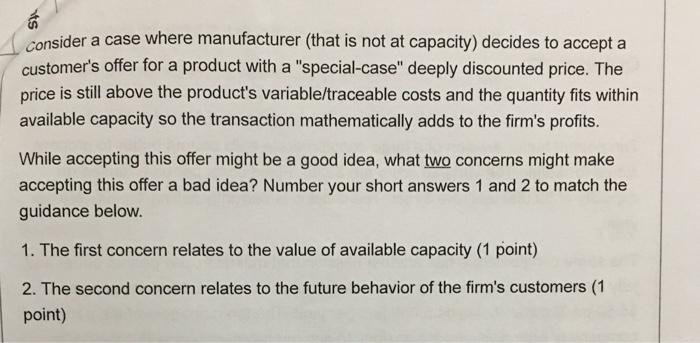

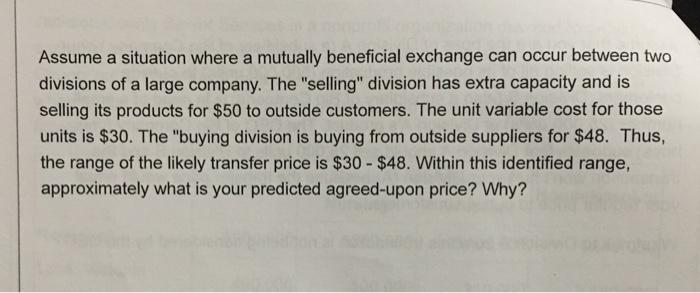

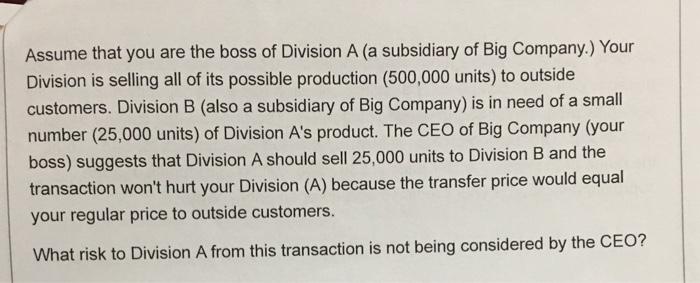

Miyamoto Jewelers is considering a special order for 20 handcrafted gold bracelets to be given as gifts to members of a wedding party. The normal selling price of a gold bracelet is $390 and its unit product cost is $264.00 as shown below: $143.00 86.00 Materials Direct labor Manufacturing overhead Unit Product Cost 35.00 $264.00 Most of the manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $12 of the overhead is variable with respect to the number of bracelets produced. The customer who is interested in the special bracelet order would like special filigree applied to the bracelets. This filigree would require additional materials costing $6 per bracelet and would also require acquisition of a special tool costing $1,500 that would have no other use once the special order is completed. Assume this order would have no effect on the company's regular sales and the order could be fulfilled using the company's existing capacity without affecting any other orders. What is the minimum unit price that Miyamoto should consider in order to accept the offer? $345 $322 $328 $247 $270 Rowan Company uses the absorption costing approach to cost-plus pricing. It is considering the introduction of a new product. The following information is available: 20,000 $40 Number of units to be produced and sold each year Unit product cost (absorption) Annual selling and administrative costs Initial investment Desired return on investment (ROI) $100,000 $1,000,000 10% What markup percentage on absorption cost is required to achieve the required ROI? 20% 35% 40% 30% 25% The peanut butter division of a large conglomerate sells peanut butter to grocery stores for $6/jar. The variable costs are $3/jar. Fixed costs per unit (based on capacity of 50,000 jars) are $1/jar. The division is currently selling 40,000 jars per year. The same conglomerate has another division that makes frozen peanut butter and jelly sandwiches and currently buys peanut butter from an outside supplier for $5.50/jar. It currently needs 5,000 jars per year. The top managers of the parent company of both divisions are anxious to see the two divisions work together to benefit the entire company. What is the range of acceptable transfer prices (if any) between the two divisions? $4 - $6.00 jar $3 - $5.50 jar $3 - $6.00 jar no acceptable range O $4 - $5.50 jar consider a case where manufacturer (that is not at capacity) decides to accept a customer's offer for a product with a "special-case" deeply discounted price. The price is still above the product's variable/traceable costs and the quantity fits within available capacity so the transaction mathematically adds to the firm's profits. While accepting this offer might be a good idea, what two concerns might make accepting this offer a bad idea? Number your short answers 1 and 2 to match the guidance below. 1. The first concern relates to the value of available capacity (1 point) 2. The second concern relates to the future behavior of the firm's customers (1 point) Assume a situation where a mutually beneficial exchange can occur between two divisions of a large company. The "selling" division has extra capacity and is selling its products for $50 to outside customers. The unit variable cost for those units is $30. The "buying division is buying from outside suppliers for $48. Thus, the range of the likely transfer price is $30 - $48. Within this identified range, approximately what is your predicted agreed-upon price? Why? Assume that you are the boss of Division A (a subsidiary of Big Company.) Your Division is selling all of its possible production (500,000 units) to outside customers. Division B (also a subsidiary of Big Company) is in need of a small number (25,000 units) of Division A's product. The CEO of Big Company (your boss) suggests that Division A should sell 25,000 units to Division B and the transaction won't hurt your Division (A) because the transfer price would equal your regular price to outside customers. What risk to Division A from this transaction is not being considered by the CEO