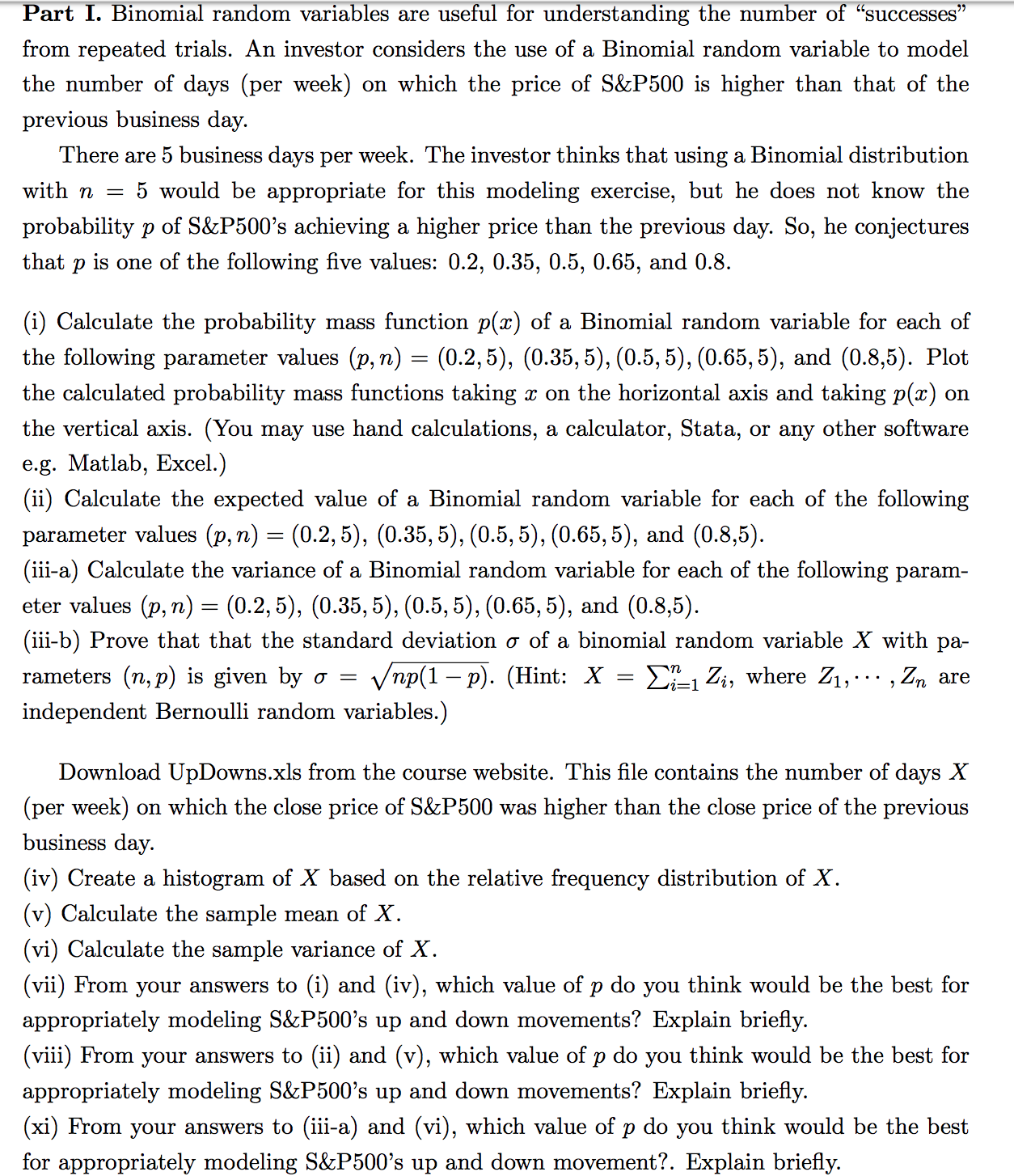

mm from repeated trials. An investor considers the use of a Binomial random variable to model the number of days (per week) on which the price of S&P500 is higher than that of the previous business day. There are 5 business days per week. The investor thinks that using a Binomial distribution with n = 5 would be appropriate for this modeling exercise, but he does not know the probability p of S&P500's achieving a higher price than the previous day. So, he conjectures that p is one of the following ve values: 0.2, 0.35, 0.5, 0.65, and 0.8. (i) Calculate the probability mass function p(:c) of a Binomial random variable for each of the following parameter values (p, n) = (02,5), (035,5), (05,5), (065,5), and (08,5). Plot the calculated probability mass functions taking :2: on the horizontal axis and taking p(m) on the vertical axis. (You may use hand calculations, a calculator, Stata, or any other software e.g. Matlab, Excel.) (ii) Calculate the expected value of a Binomial random variable for each of the following parameter values (pm) = (02,5), (035,5), (05,5), (065,5), and (08,5). (iii-a) Calculate the variance of a Binomial random variable for each of the following param- eter values (pm) = (02,5), (035,5), (05,5), (065,5), and (08,5). (iii-b) Prove that that the standard deviation 0 of a binomial random variable X with pa- rameters (mp) is given by or = xp(1 p). (Hint: X = 2:21:12,\" where Z1,--- ,2\" are independent Bernoulli random variables.) Download UpDowns.xls from the course website. This le contains the number of days X (per week) on which the close price of S&P500 was higher than the close price of the previous business day. (iv) Create a histogram of X based on the relative frequency distribution of X. (v) Calculate the sample mean of X. (vi) Calculate the sample variance of X. (vii) From your answers to (i) and (iv), which value of 3) do you think would be the best for appropriately modeling S&P500's up and down movements? Explain briey. (viii) From your answers to (ii) and (v), which value of 3) do you think would be the best for appropriately modeling S&P500's up and down movements? Explain briey. (xi) From your answers to (iii-a) and (vi), which value of 3) do you think would be the best for appropriately modeling S&P500's up and down movement?. Explain briey. Sheet1 Week PosDays 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 2 1 3 0 0 3 2 0 3 2 2 1 2 4 2 2 2 3 3 1 3 1 3 1 3 2 2 1 2 0 3 2 2 1 3 1 3 2 2 2 2 2 1 2 1 1 1 Page 1 Sheet1 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 3 2 2 2 0 2 0 1 2 2 2 3 0 2 1 2 2 1 0 0 2 2 1 0 1 1 3 4 3 2 1 1 2 2 0 0 1 0 1 2 3 3 1 2 1 3 0 0 Page 2 Sheet1 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 2 2 2 3 1 1 1 2 1 1 2 2 1 2 4 3 2 1 2 4 1 4 3 3 2 3 1 0 2 0 1 1 3 4 2 2 3 2 1 3 2 1 1 1 3 2 1 2 Page 3 Sheet1 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 2 2 2 1 0 4 3 0 0 2 2 1 0 1 2 1 2 3 1 0 1 3 1 3 2 1 2 0 1 1 2 0 0 1 1 1 2 3 3 3 3 3 3 3 3 1 2 1 Page 4 Sheet1 192 193 194 195 196 197 198 199 200 1 4 1 1 4 3 1 2 2 Page 5