Question

- MM is currently being sued by Tech Outerwear (TO) for patent infringement regarding the design of a new glove. The lawsuit was filed on

- MM is currently being sued by Tech Outerwear (TO) for patent infringement regarding the design of a new glove. The lawsuit was filed on December 15, 2020. MMs lawyers have not had enough time to properly assess the lawsuit and therefore cannot determine the likelihood of losing the suit. Similar, past lawsuits have settled for anywhere between $200,000 and $700,000.

- Included in the $510,000 of capital stock is $50,000 of preferred shares. The preferred shares are retractable by the holders if there is a change in the ownership of the business.

- During the year, MMs management was issued employee stock options. The options can be exercised anytime during the next three years, which is the expected period of benefit. No options were exercised during the year. As such, the options are not reflected in the financial statements.

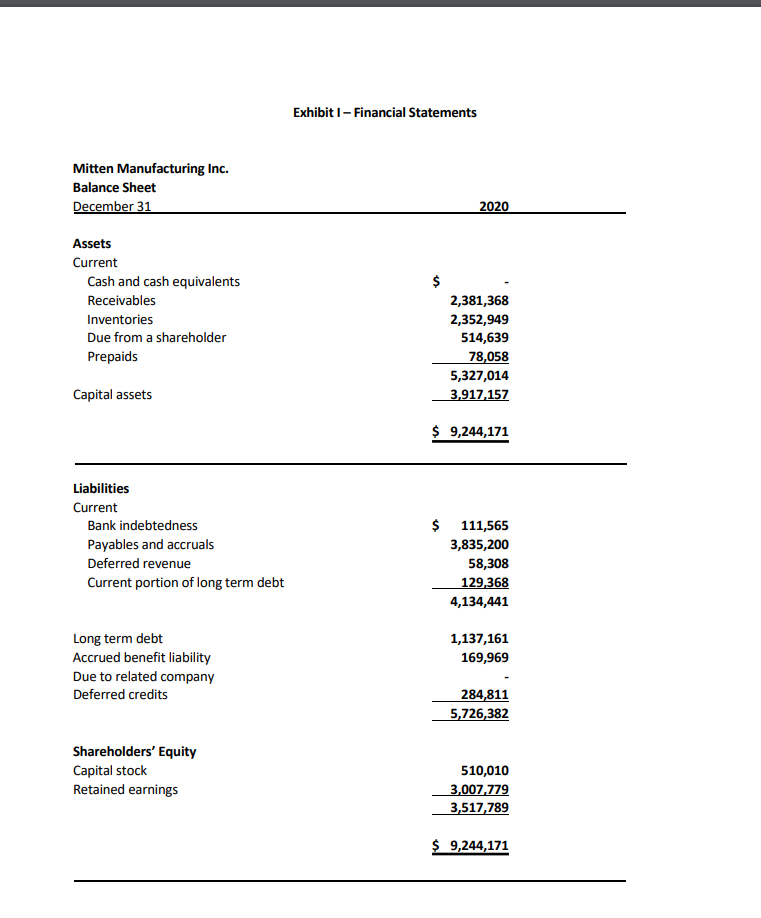

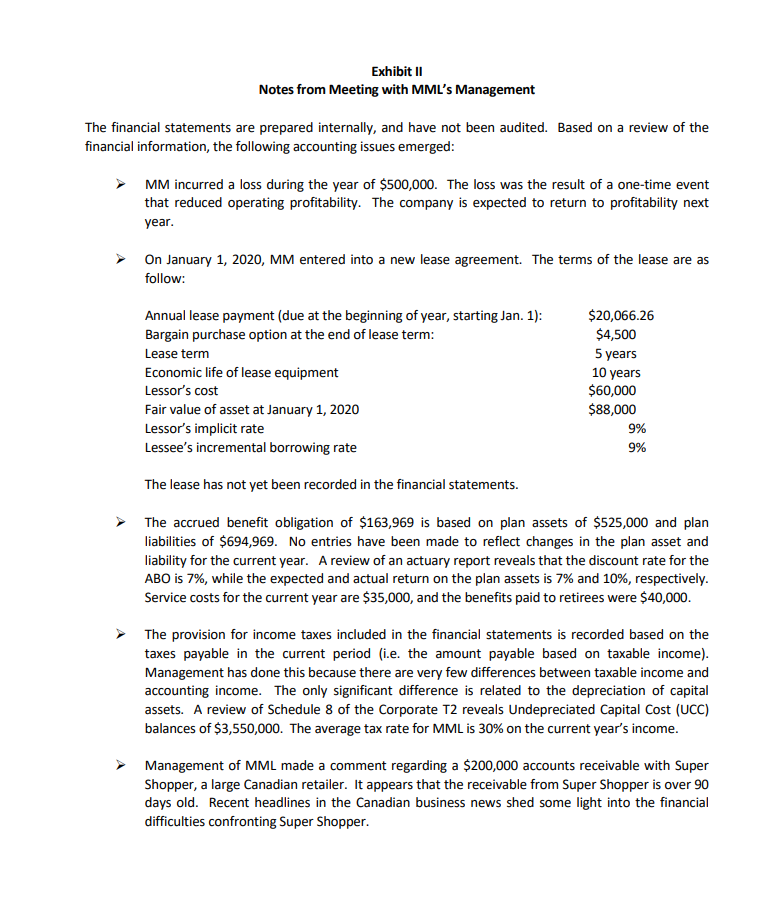

Mitten Manufacturing Ltd. Mitten Manufacturing Ltd. (MML) produces children's mittens and scarves, and sells their products to various large retailers in Canada. The Company's sole shareholder and owner, Angela Mitten, is planning to pursue retirement in the near future and has decided to sell her ownership interest in the business. John Doughman, a successful businessperson, has been in negotiations to purchase MML. John currently owns a company that manufactures winter jackets. He feels that an acquisition of MML would result in some synergies and economies of scale. Angela has offered to sell the business to John for the book value of equity, calculated based on the December 31, 2020 balance sheet prepared in accordance with IFRS. John has approach the public accounting firm of Lento and Lento LLP (L&L) requesting assistance in determining an estimate of the purchase price. The partner has assigned you, a recently qualified professional accountant, to this engagement. During an initial meeting with John, the following discussion took place: John: "I am not sure how much the business is going to cost me!" You: "Okay, well, I can help you with that." John: "When I look at the balance sheet, I see net equity of $3,517,789; however, I know that there are some accounting issues that need to be considered. In order to get started, I can give you MML's balance sheet (Exhibit 1) and some notes that I took from my discussion with Angela, MML's management (Exhibit 11)." You: "Okay, well, this should give me enough to get started on a report." John: "Sounds good. I look forward to your report. Please keep in mind that MML's financial statements were prepared for internal purposes and have not been audited." After you meeting with John, you head back to your office and think about how to approach the engagement Required It is now January 10th, 2021. The partner has asked you to prepare a memo addressing John's concerns. The partner reminds you that the memo should provide adequate discussions of any alternative accounting treatments within ASPE. In addition, the partner has asked to provide as many journal entries as possible. The journal entries may be provided to Angela in order to update the financial statements. Exhibit I - Financial Statements Mitten Manufacturing Inc. Balance Sheet December 31 2020 Assets Current Cash and cash equivalents Receivables Inventories Due from a shareholder Prepaids $ 2,381,368 2,352,949 514,639 78,058 5,327,014 3,917,157 Capital assets $ 9,244,171 Liabilities Current Bank indebtedness Payables and accruals Deferred revenue Current portion of long term debt $ 111,565 3,835,200 58,308 129,368 4,134,441 1,137,161 169,969 Long term debt Accrued benefit liability Due to related company Deferred credits 284,811 5,726,382 Shareholders' Equity Capital stock Retained earnings 510,010 3,007,779 3,517,789 $ 9,244,171 Exhibit 11 Notes from Meeting with MML's Management The financial statements are prepared internally, and have not been audited. Based on a review of the financial information, the following accounting issues emerged: MM incurred a loss during the year of $500,000. The loss was the result of a one-time event that reduced operating profitability. The company is expected to return to profitability next year. On January 1, 2020, MM entered into a new lease agreement. The terms of the lease are as follow: Annual lease payment (due at the beginning of year, starting Jan. 1): $20,066.26 Bargain purchase option at the end of lease term: $4,500 Lease term 5 years Economic life of lease equipment 10 years Lessor's cost $60,000 Fair value of asset at January 1, 2020 $88,000 Lessor's implicit rate 9% Lessee's incremental borrowing rate 9% The lease has not yet been recorded in the financial statements. The accrued benefit obligation of $163,969 is based on plan assets of $525,000 and plan liabilities of $694,969. No entries have been made to reflect changes in the plan asset and liability for the current year. A review of an actuary report reveals that the discount rate for the ABO is 7%, while the expected and actual return on the plan assets is 7% and 10%, respectively. Service costs for the current year are $35,000, and the benefits paid to retirees were $40,000. The provision for income taxes included in the financial statements is recorded based on the taxes payable in the current period (i.e. the amount payable based on taxable income). Management has done this because there are very few differences between taxable income and accounting income. The only significant difference is related to the depreciation of capital assets. A review of Schedule 8 of the Corporate T2 reveals Undepreciated Capital Cost (UCC) balances of $3,550,000. The average tax rate for MML is 30% on the current year's income. Management of MML made a comment regarding a $200,000 accounts receivable with Super Shopper, a large Canadian retailer. It appears that the receivable from Super Shopper is over 90 days old. Recent headlines in the Canadian business news shed some light into the financial difficulties confronting Super Shopper. Mitten Manufacturing Ltd. Mitten Manufacturing Ltd. (MML) produces children's mittens and scarves, and sells their products to various large retailers in Canada. The Company's sole shareholder and owner, Angela Mitten, is planning to pursue retirement in the near future and has decided to sell her ownership interest in the business. John Doughman, a successful businessperson, has been in negotiations to purchase MML. John currently owns a company that manufactures winter jackets. He feels that an acquisition of MML would result in some synergies and economies of scale. Angela has offered to sell the business to John for the book value of equity, calculated based on the December 31, 2020 balance sheet prepared in accordance with IFRS. John has approach the public accounting firm of Lento and Lento LLP (L&L) requesting assistance in determining an estimate of the purchase price. The partner has assigned you, a recently qualified professional accountant, to this engagement. During an initial meeting with John, the following discussion took place: John: "I am not sure how much the business is going to cost me!" You: "Okay, well, I can help you with that." John: "When I look at the balance sheet, I see net equity of $3,517,789; however, I know that there are some accounting issues that need to be considered. In order to get started, I can give you MML's balance sheet (Exhibit 1) and some notes that I took from my discussion with Angela, MML's management (Exhibit 11)." You: "Okay, well, this should give me enough to get started on a report." John: "Sounds good. I look forward to your report. Please keep in mind that MML's financial statements were prepared for internal purposes and have not been audited." After you meeting with John, you head back to your office and think about how to approach the engagement Required It is now January 10th, 2021. The partner has asked you to prepare a memo addressing John's concerns. The partner reminds you that the memo should provide adequate discussions of any alternative accounting treatments within ASPE. In addition, the partner has asked to provide as many journal entries as possible. The journal entries may be provided to Angela in order to update the financial statements. Exhibit I - Financial Statements Mitten Manufacturing Inc. Balance Sheet December 31 2020 Assets Current Cash and cash equivalents Receivables Inventories Due from a shareholder Prepaids $ 2,381,368 2,352,949 514,639 78,058 5,327,014 3,917,157 Capital assets $ 9,244,171 Liabilities Current Bank indebtedness Payables and accruals Deferred revenue Current portion of long term debt $ 111,565 3,835,200 58,308 129,368 4,134,441 1,137,161 169,969 Long term debt Accrued benefit liability Due to related company Deferred credits 284,811 5,726,382 Shareholders' Equity Capital stock Retained earnings 510,010 3,007,779 3,517,789 $ 9,244,171 Exhibit 11 Notes from Meeting with MML's Management The financial statements are prepared internally, and have not been audited. Based on a review of the financial information, the following accounting issues emerged: MM incurred a loss during the year of $500,000. The loss was the result of a one-time event that reduced operating profitability. The company is expected to return to profitability next year. On January 1, 2020, MM entered into a new lease agreement. The terms of the lease are as follow: Annual lease payment (due at the beginning of year, starting Jan. 1): $20,066.26 Bargain purchase option at the end of lease term: $4,500 Lease term 5 years Economic life of lease equipment 10 years Lessor's cost $60,000 Fair value of asset at January 1, 2020 $88,000 Lessor's implicit rate 9% Lessee's incremental borrowing rate 9% The lease has not yet been recorded in the financial statements. The accrued benefit obligation of $163,969 is based on plan assets of $525,000 and plan liabilities of $694,969. No entries have been made to reflect changes in the plan asset and liability for the current year. A review of an actuary report reveals that the discount rate for the ABO is 7%, while the expected and actual return on the plan assets is 7% and 10%, respectively. Service costs for the current year are $35,000, and the benefits paid to retirees were $40,000. The provision for income taxes included in the financial statements is recorded based on the taxes payable in the current period (i.e. the amount payable based on taxable income). Management has done this because there are very few differences between taxable income and accounting income. The only significant difference is related to the depreciation of capital assets. A review of Schedule 8 of the Corporate T2 reveals Undepreciated Capital Cost (UCC) balances of $3,550,000. The average tax rate for MML is 30% on the current year's income. Management of MML made a comment regarding a $200,000 accounts receivable with Super Shopper, a large Canadian retailer. It appears that the receivable from Super Shopper is over 90 days old. Recent headlines in the Canadian business news shed some light into the financial difficulties confronting Super ShopperStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started