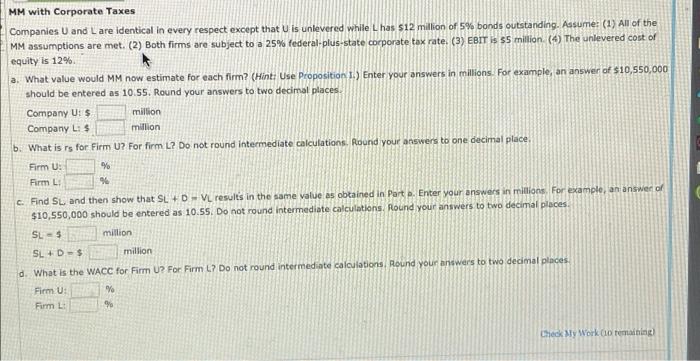

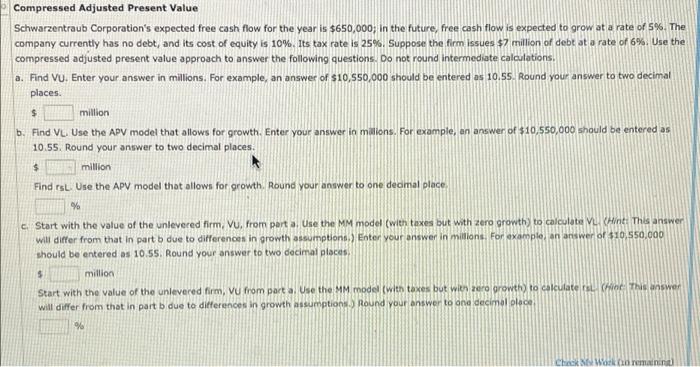

MM with Corporate Taxes Companies U and L are identical in every respect except that U is unlevered while L has $12 million of 5% bonds outstanding. Assume: (1) All of the MM assumptions are met. (2) Both firms are subject to a 25% federal-plus-state corporate tax rate (3) EBIT is 55 million (4) The unlevered cost of equity is 12% a. What value would MM now estimate for each firm? (Hint: Use Proposition 1.) Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answers to two decimal places. Company U: $ million Company L: $ million b. What is rs for Firm U? For firm L? Do not found intermediate calculations. Round your answers to one decimal place, Firm U: % Firm L: c. Find SL and then show that SL+D - VL results in the same value as obtained in Part. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answers to two decimal places SL-5 million SLD-$ million d. What is the WACC for Firm Up For Firm L? Do not round intermediate calculations, Round your answers to two decimal places Firm U: % Firm 9 Check My Work 10 remaining Compressed Adjusted Present Value Schwarzentraub Corporation's expected free cash flow for the year is $650,000 in the future, free cash flow is expected to grow at a rate of 5%. The company currently has no debt, and its cost of equity is 10%. Its tax rate is 25%. Suppose the firm issues $2 million of debt at a rate of 6%. Use the compressed adjusted present value approach to answer the following questions. Do not round Intermediate calculations. a. Find Vu. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. million b. Find VL. Use the APV model that allows for growth. Enter your answer in millons. For example, an answer of $10.550,000 should be entered as 10.55. Round your answer to two decimal places, million Find rs Use the APV model that allows for growth Round your answer to one dedmal place $ $ % c. Start with the value of the unlevered firm, vu, from part a. Use the MM model (with taxes but with zero growth) to calculate Vint: This answer will differ from that in part b due to differences in growth assumptions.) Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places $ million Start with the value of the unlevered firm, VU from parta. Use the MM model with taxes but with zero growtly to calculate to Win This answer will differ from that in part b due to differences in growth assumption Round your answer to ona decimal place 96 CNN and