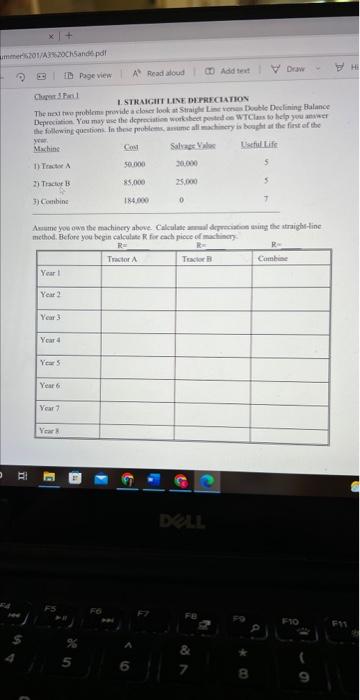

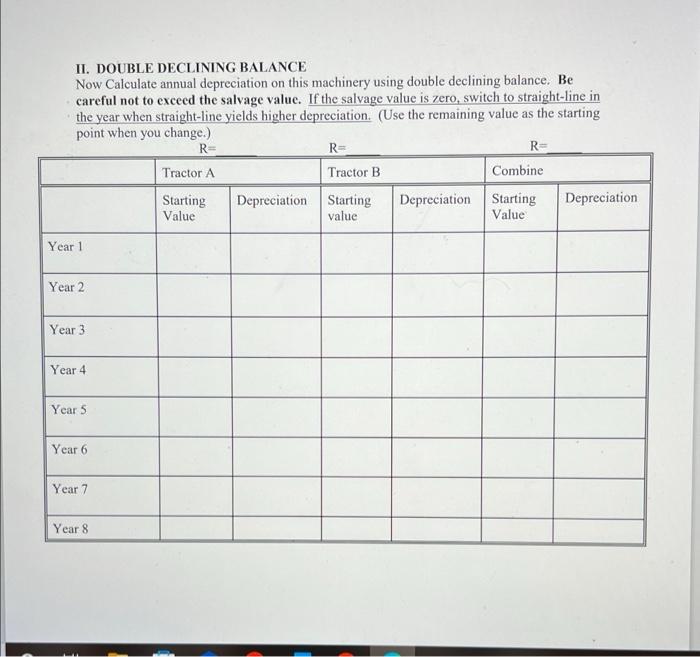

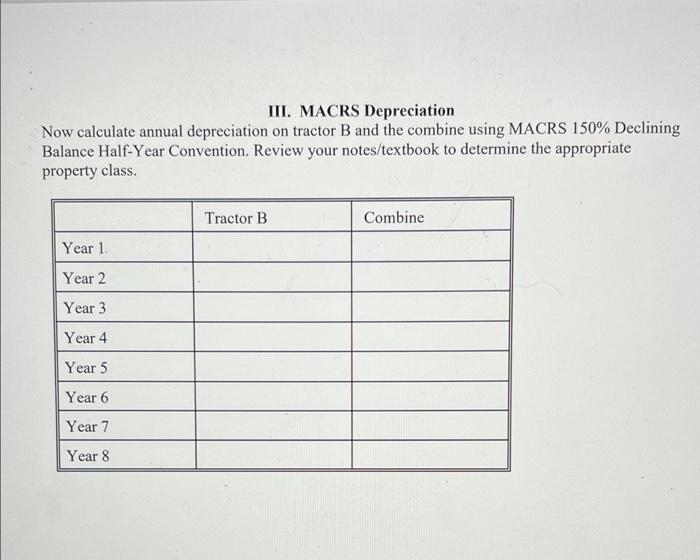

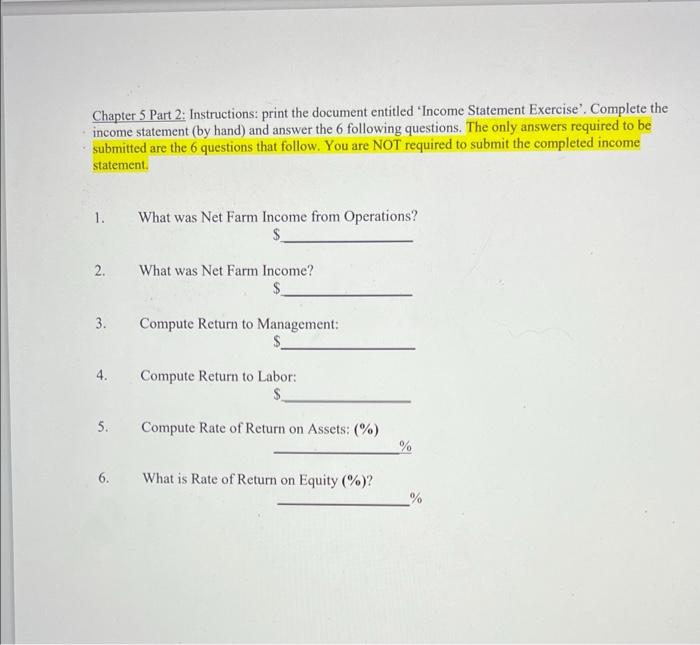

mmer201/A3%20ChSand pdf. A Read aloud Add textDraw Page view Chigen 5. Par 1 STRAIGHT LINE DEPRECIATION The next two problems provide a closer look at Straight Line venas Double Declining Balance Depreciation. You may use the depreciation worksheet posted on WTClass to help you answer the following questions. In these problems, assume all machinery is bought at the first of the year. Machine Cost Salvage Valas Useful Life 1) Tractor A 50.000 20,000 2) Tractor B 85,000 25,000 3) Combine 184,000 0 Assume you own the machinery above. Calculate anual depreciation using the straight-line method. Before you begin calculate R for each piece of machinery R= R Tractor A Tractor B Combine Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 D E DELL 8 F10 F11 HE II. DOUBLE DECLINING BALANCE Now Calculate annual depreciation on this machinery using double declining balance. Be careful not to exceed the salvage value. If the salvage value is zero, switch to straight-line in the year when straight-line yields higher depreciation. (Use the remaining value as the starting point when you change.) R= R= R= Tractor A Tractor B Combine Starting Depreciation Depreciation Starting value Depreciation Starting Value Value Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 III. MACRS Depreciation Now calculate annual depreciation on tractor B and the combine using MACRS 150% Declining Balance Half-Year Convention. Review your notes/textbook to determine the appropriate property class. Tractor B Combine Year 1. Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Chapter 5 Part 2: Instructions: print the document entitled 'Income Statement Exercise'. Complete the income statement (by hand) and answer the 6 following questions. The only answers required to be submitted are the 6 questions that follow. You are NOT required to submit the completed income statement. 1. What was Net Farm Income from Operations? 2. What was Net Farm Income? 3. Compute Return to Management: 4. Compute Return to Labor: 5. Compute Rate of Return on Assets: (%) 6. What is Rate of Return on Equity (%)? % % Chapter 6 Answer the following questions. 1. What is the difference between "net farm income from operations" and "adjusted net farm income from operations"? 2. What 3 general factors determine economic efficiency? 3. Define Solvency and Liquidity. Explain the difference between solvency and liquidity. List two tests that can be used to diagnose liquidity problems. mmer201/A3%20ChSand pdf. A Read aloud Add textDraw Page view Chigen 5. Par 1 STRAIGHT LINE DEPRECIATION The next two problems provide a closer look at Straight Line venas Double Declining Balance Depreciation. You may use the depreciation worksheet posted on WTClass to help you answer the following questions. In these problems, assume all machinery is bought at the first of the year. Machine Cost Salvage Valas Useful Life 1) Tractor A 50.000 20,000 2) Tractor B 85,000 25,000 3) Combine 184,000 0 Assume you own the machinery above. Calculate anual depreciation using the straight-line method. Before you begin calculate R for each piece of machinery R= R Tractor A Tractor B Combine Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 D E DELL 8 F10 F11 HE II. DOUBLE DECLINING BALANCE Now Calculate annual depreciation on this machinery using double declining balance. Be careful not to exceed the salvage value. If the salvage value is zero, switch to straight-line in the year when straight-line yields higher depreciation. (Use the remaining value as the starting point when you change.) R= R= R= Tractor A Tractor B Combine Starting Depreciation Depreciation Starting value Depreciation Starting Value Value Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 III. MACRS Depreciation Now calculate annual depreciation on tractor B and the combine using MACRS 150% Declining Balance Half-Year Convention. Review your notes/textbook to determine the appropriate property class. Tractor B Combine Year 1. Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Chapter 5 Part 2: Instructions: print the document entitled 'Income Statement Exercise'. Complete the income statement (by hand) and answer the 6 following questions. The only answers required to be submitted are the 6 questions that follow. You are NOT required to submit the completed income statement. 1. What was Net Farm Income from Operations? 2. What was Net Farm Income? 3. Compute Return to Management: 4. Compute Return to Labor: 5. Compute Rate of Return on Assets: (%) 6. What is Rate of Return on Equity (%)? % % Chapter 6 Answer the following questions. 1. What is the difference between "net farm income from operations" and "adjusted net farm income from operations"? 2. What 3 general factors determine economic efficiency? 3. Define Solvency and Liquidity. Explain the difference between solvency and liquidity. List two tests that can be used to diagnose liquidity problems