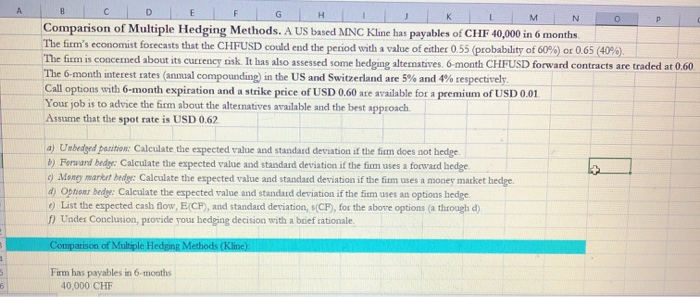

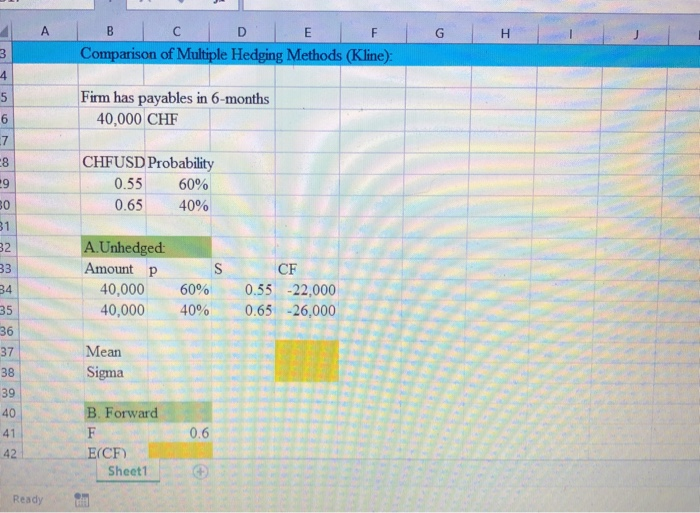

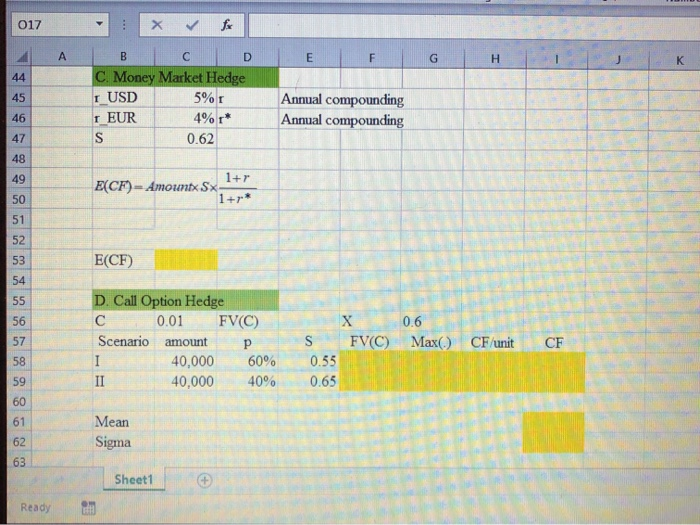

MN Comparison of Multiple Hedging Methods. A US based MNC Kline has payables of CHF 40,000 in 6 months The firm's economist forecasts that the CHFUSD could end the period with a value of either 0.55 (probability of 60%) or 0.65 (40%). The firm is concerned about its currency risk. It has also assessed some hedging alternatives. 6-month CHFUSD forward contracts are traded at 0.60 The 6-month interest rates annual compounding) in the US and Switzerland are 5% and 4% respectively Call options with 6-month expiration and a strike price of USD 0.60 are available for a premium of USD 0.01 Your job is to advice the firm about the alternatives available and the best approach Assume that the spot rate is USD 0.62 a) Unbedged position: Calculate the expected value and standard deviation of the firm does not hedge b) Forward bedyr: Calculate the expected value and standard deviation if the firm uses a forward hedge c) Mong market bed: Calculate the expected value and standard deviation if the times a money market hedge. d) Oposer bedre: Calculate the expected value and standard deviation if the fim ses an options hedge. ) List the expected cash flow, ECF), and standard deviation, (CF), for the above options (a through d) Under Conclusion, provide your hedping decision with a brief rationale Comparison of Multiple Hedging Methods (Kline) Firm has payables in 6 months 40.000 CHF I G H I B C D E F Comparison of Multiple Hedging Methods (Kline): mno. Firm has payables in 6-months 40,000 CHF CHFUSD Probability 0.55 60% 0.65 40% A.Unhedged Amount P 40,000 40,000 60% 40% CF 0.55-22,000 0.65 -26,000 36 Mean Sigma 39 41 0.6 B Forward F E(CF) Sheet1 Ready 017 4 A E F G H I J : for B C D C. Money Market Hedge 1_USD 5% 1 1 EUR 4% r* 0.62 Annual compounding Annual compounding E(CF) -- Amountx Sx + E(CF) D. Call Option Hedge C 0.01 FV(C) Scenario amount P 40,000 60% 40.000 40% FV(C) Max(.) CF/unit CF S 0.55 0.65 Mean Sigma Sheet1 Ready 017 G H I IB II C 40,000 D 40% E 0.65 Mean Sigma (CF) Summary E(CF) Unhedged Forward MM Option Conclusion: Ready MN Comparison of Multiple Hedging Methods. A US based MNC Kline has payables of CHF 40,000 in 6 months The firm's economist forecasts that the CHFUSD could end the period with a value of either 0.55 (probability of 60%) or 0.65 (40%). The firm is concerned about its currency risk. It has also assessed some hedging alternatives. 6-month CHFUSD forward contracts are traded at 0.60 The 6-month interest rates annual compounding) in the US and Switzerland are 5% and 4% respectively Call options with 6-month expiration and a strike price of USD 0.60 are available for a premium of USD 0.01 Your job is to advice the firm about the alternatives available and the best approach Assume that the spot rate is USD 0.62 a) Unbedged position: Calculate the expected value and standard deviation of the firm does not hedge b) Forward bedyr: Calculate the expected value and standard deviation if the firm uses a forward hedge c) Mong market bed: Calculate the expected value and standard deviation if the times a money market hedge. d) Oposer bedre: Calculate the expected value and standard deviation if the fim ses an options hedge. ) List the expected cash flow, ECF), and standard deviation, (CF), for the above options (a through d) Under Conclusion, provide your hedping decision with a brief rationale Comparison of Multiple Hedging Methods (Kline) Firm has payables in 6 months 40.000 CHF I G H I B C D E F Comparison of Multiple Hedging Methods (Kline): mno. Firm has payables in 6-months 40,000 CHF CHFUSD Probability 0.55 60% 0.65 40% A.Unhedged Amount P 40,000 40,000 60% 40% CF 0.55-22,000 0.65 -26,000 36 Mean Sigma 39 41 0.6 B Forward F E(CF) Sheet1 Ready 017 4 A E F G H I J : for B C D C. Money Market Hedge 1_USD 5% 1 1 EUR 4% r* 0.62 Annual compounding Annual compounding E(CF) -- Amountx Sx + E(CF) D. Call Option Hedge C 0.01 FV(C) Scenario amount P 40,000 60% 40.000 40% FV(C) Max(.) CF/unit CF S 0.55 0.65 Mean Sigma Sheet1 Ready 017 G H I IB II C 40,000 D 40% E 0.65 Mean Sigma (CF) Summary E(CF) Unhedged Forward MM Option Conclusion: Ready