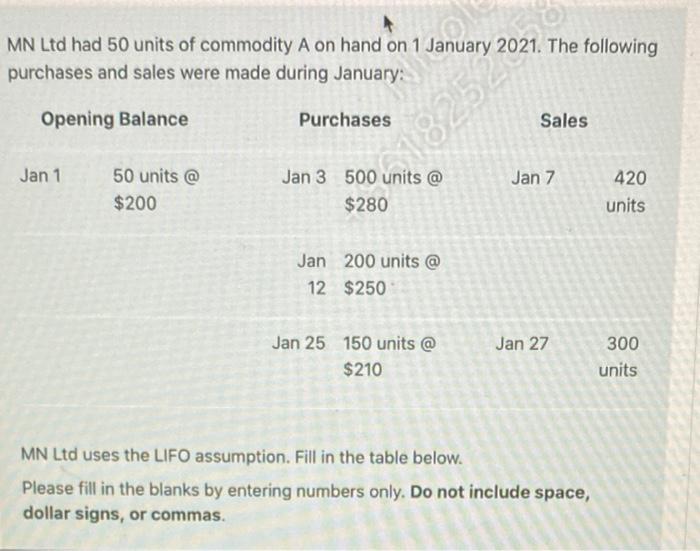

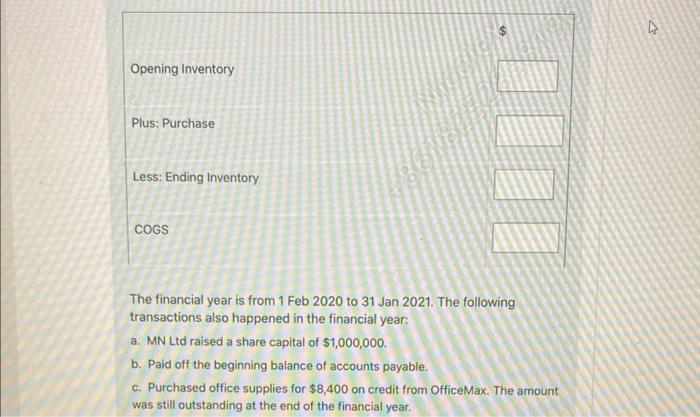

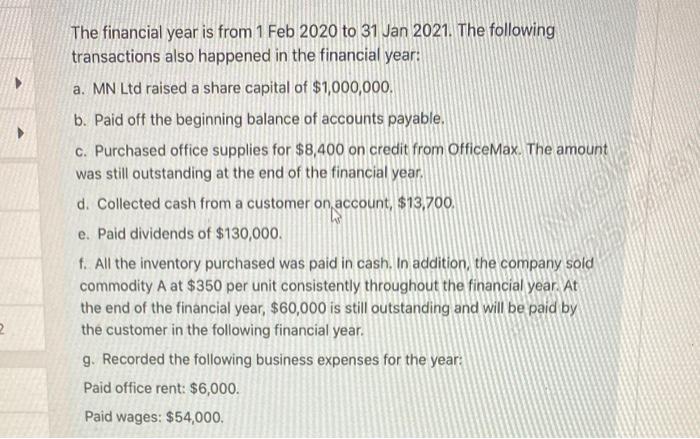

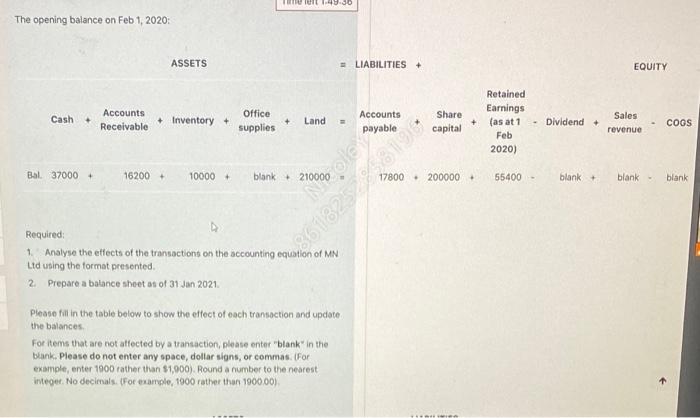

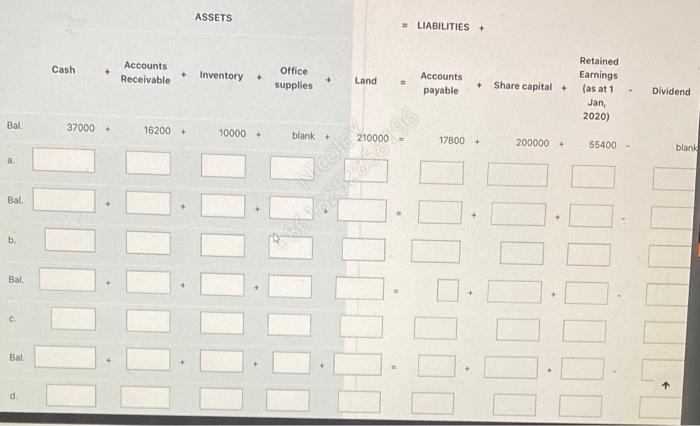

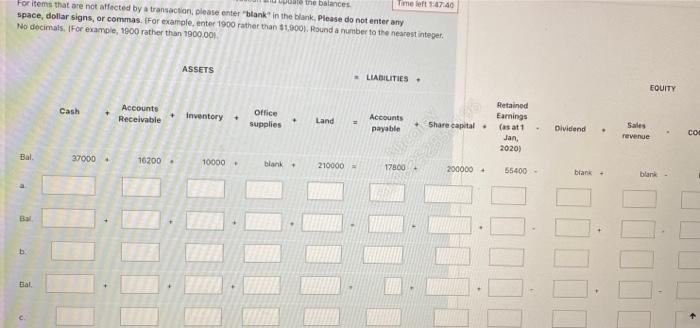

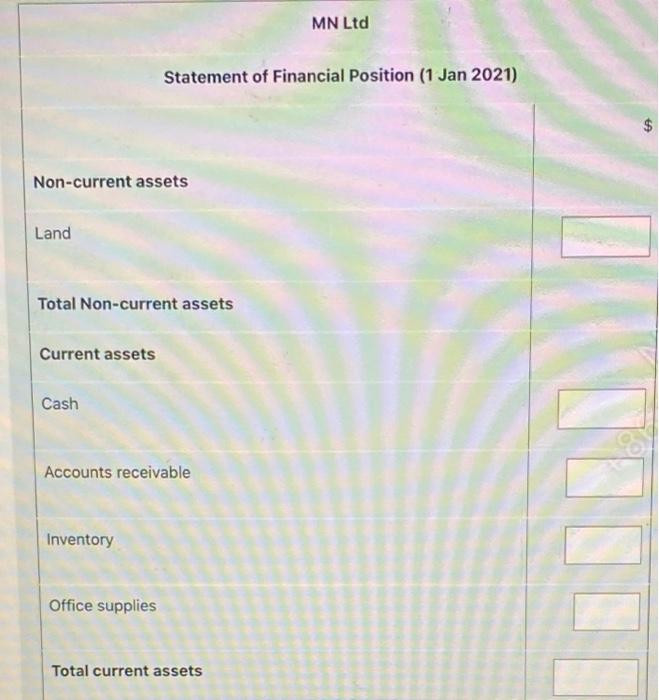

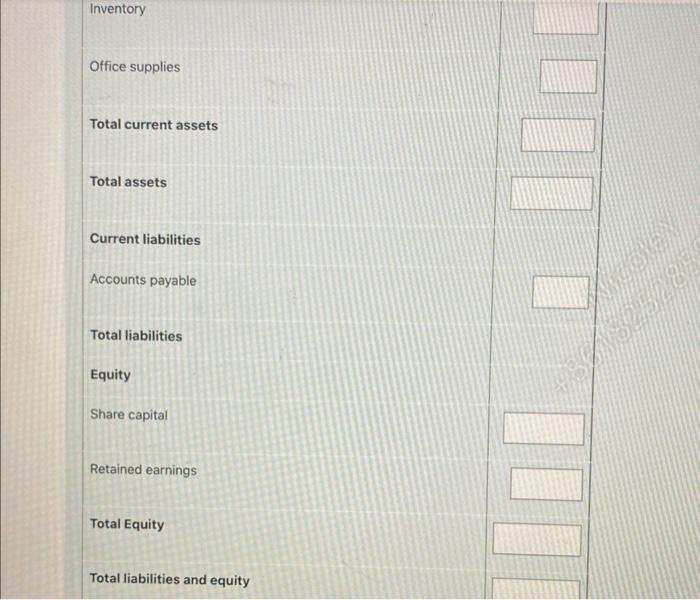

MN Ltd had 50 units of commodity A on hand on 1 January 2021. The following purchases and sales were made during January: MN Ltd uses the LIFO assumption. Fill in the table below. Please fill in the blanks by entering numbers only. Do not include space, dollar signs, or commas. The financial year is from 1 Feb 2020 to 31 Jan 2021. The following transactions also happened in the financial year: a. MN Ltd raised a share capital of $1,000,000. b. Paid off the beginning balance of accounts payable. c. Purchased office supplies for $8,400 on credit from OfficeMax. The amount was still outstanding at the end of the financial year. The financial year is from 1 Feb 2020 to 31 Jan 2021. The following transactions also happened in the financial year: a. MN Ltd raised a share capital of $1,000,000. b. Paid off the beginning balance of accounts payable. c. Purchased office supplies for $8,400 on credit from OfficeMax. The amount was still outstanding at the end of the financial year. d. Collected cash from a customer on, account, $13,700. e. Paid dividends of $130,000. f. All the inventory purchased was paid in cash. In addition, the company sold commodity A at $350 per unit consistently throughout the financial year. At the end of the financial year, $60,000 is still outstanding and will be paid by the customer in the following financial year. g. Recorded the following business expenses for the year: Paid office rent: $6,000. Paid wages: $54,000. Required: 1. Analyse the effects of the transactions on the accounting equation of MN Ltd using the format presented. 2. Prepare a balance sheet as of 31 Jan 2021. Please fili in the table below to show the effect of each transaction and update the balances. For items that are not atfected by a transaction, please enter "blank" in the blank. Please do not enter any space, dollar signs, or commas. (For example, enter 1900 rather than $1,000. Round a number to the nearest integet. No decimals. (For example, 1900 rather than 1900.00 ). Foltemis that are not affected by a trensaction, please enter "blank" in the blank. Please do not enter any space, dollar signs, or commas. (For example, enter 1900 rather than 1,0001 . Round a number to the nearest integer. No docimals. IFor example, 1900 rather than 190000 MN Ltd Statement of Financial Position (1 Jan 2021) Non-current assets Land Total Non-current assets Current assets Cash Accounts receivable Inventory Office supplies Total current assets Inventory Office supplies Total current assets Total assets Current liabilities Accounts payable Total liabilities Equity Share capital Retained earnings Total Equity Total liabilities and equity