Question

MNP is a divisionalized organization. Some of the divisions are in overseas countries. Divisional performance is assessed by the trend in the Return on Capital

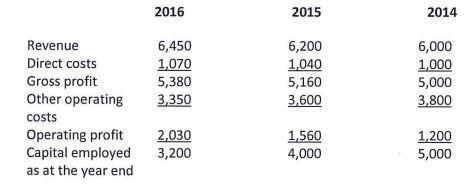

MNP is a divisionalized organization. Some of the divisions are in overseas countries. Divisional performance is assessed by the trend in the Return on Capital Employed (ROCE) and the Residual Income (RI) generated by each division based on their year—end values. The following summary financial information is available for Division M:

MNP has a cost of capital of 5% per annum. The figures shown above for the capital employed are the net book values of the division’s non—current assets.

Other operating costs include depreciation.

There have been no additions or disposals of non—current assets within Division M during the three year period. No additions or disposals are expected in 2017.

For the year ending 31 December 2017 it is expected that the revenues and costs (excluding depreciation) will be the same as those in 2016

Required:

a) Calculate the Return on Capital Employed (ROCE) and the Residual Income (RI) for 2016 and 2017 for Division M. Comment on the performance of the division

b) Assume that performance of MNP is measure based on ROCE and RI, Discuss, based on the above scenario, why the use of ROCE and RI as performance measures can cause incorrect capital investment decisions to be taken

2016 2015 2014 6,000 1,000 5,000 3,800 Revenue 6,450 1,070 5,380 3,350 6,200 1,040 5,160 3,600 Direct costs Gross profit Other operating costs Operating profit Capital employed as at the year end 2,030 3,200 1,560 4,000 1,200 5,000

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a 2016 2017 Return on Capital Employed ROCE 5639 7039 Residual Income RI 1850 1886 Explanation A Return on capital employed i Return on capital employ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started