Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MNP Ltd. produces a chocolate almond bar. Each bar sells for Rs. 20 . The variable cost for each bar (sugar, chocolate, almonds, wrapper, labour)

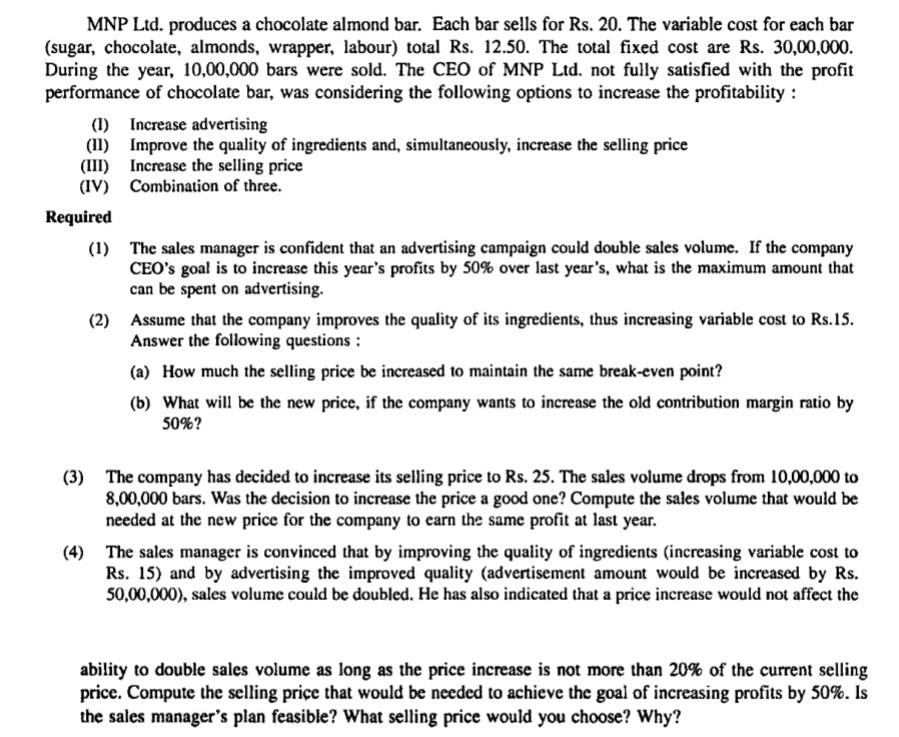

MNP Ltd. produces a chocolate almond bar. Each bar sells for Rs. 20 . The variable cost for each bar (sugar, chocolate, almonds, wrapper, labour) total Rs. 12.50. The total fixed cost are Rs. 30,00,000. During the year, 10,00,000 bars were sold. The CEO of MNP Ltd. not fully satisfied with the profit performance of chocolate bar, was considering the following options to increase the profitability : (I) Increase advertising (II) Improve the quality of ingredients and, simultaneously, increase the selling price (III) Increase the selling price (IV) Combination of three. Required (1) The sales manager is confident that an advertising campaign could double sales volume. If the company CEO's goal is to increase this year's profits by 50% over last year's, what is the maximum amount that can be spent on advertising. (2) Assume that the company improves the quality of its ingredients, thus increasing variable cost to Rs.15. Answer the following questions : (a) How much the selling price be increased to maintain the same break-even point? (b) What will be the new price, if the company wants to increase the old contribution margin ratio by 50% ? (3) The company has decided to increase its selling price to Rs. 25 . The sales volume drops from 10,00,000 to 8,00,000 bars. Was the decision to increase the price a good one? Compute the sales volume that would be needed at the new price for the company to earn the same profit at last year. (4) The sales manager is convinced that by improving the quality of ingredients (increasing variable cost to Rs. 15) and by advertising the improved quality (advertisement amount would be increased by Rs. 50,00,000 ), sales volume could be doubled. He has also indicated that a price increase would not affect the ability to double sales volume as long as the price increase is not more than 20% of the current selling price. Compute the selling price that would be needed to achieve the goal of increasing profits by 50%. Is the sales manager's plan feasible? What selling price would you choose? Why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started