Question

Mo, Lu, and Barb formed the MLB Partnership by making investments of $72,000, $280,000, and $448,000, respectively. They predict annual partnership net income of $477,000

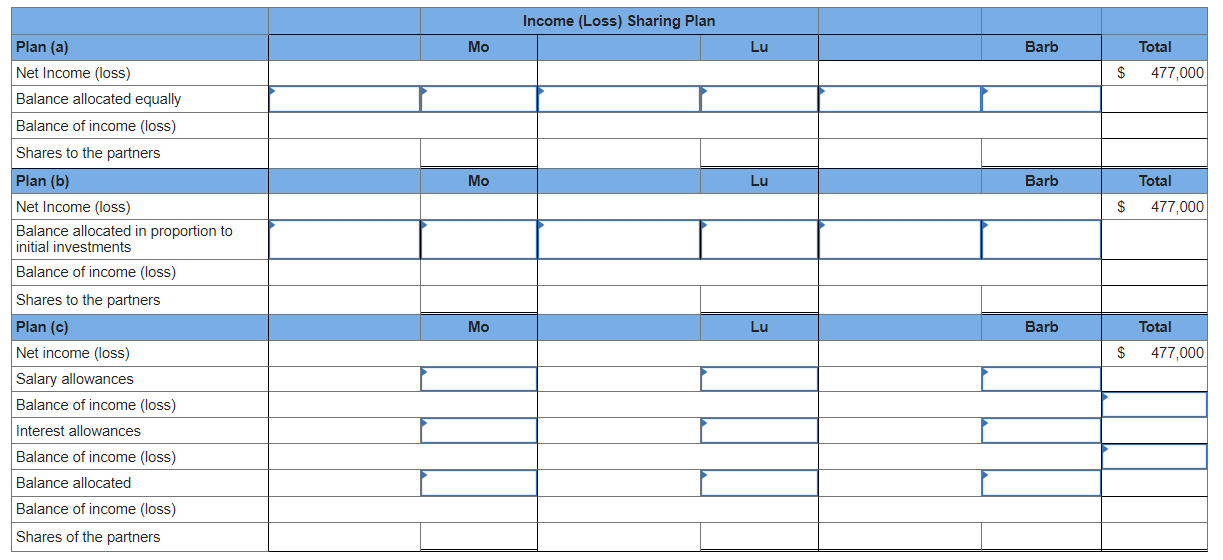

Mo, Lu, and Barb formed the MLB Partnership by making investments of $72,000, $280,000, and $448,000, respectively. They predict annual partnership net income of $477,000 and are considering the following alternative plans of sharing income and loss: (a) equally; (b) in the ratio of their initial capital investments; or (c) salary allowances of $82,000 to Mo, $61,500 to Lu, and $92,500 to Barb; interest allowances of 10% on their initial capital investments; and the remaining balance shared as follows: 20% to Mo, 40% to Lu, and 40% to Barb.

Required: 1.

Use the table to show how to distribute net income of $477,000 for the calendar year under each of the alternative plans being considered.

Note: Do not round intermediate calculations.

\begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Plan (a) } & \multicolumn{2}{|c|}{ Income (Loss) Sharing Plan } & \multirow[b]{2}{*}{ Barb } & \multirow{2}{*}{\multicolumn{2}{|c|}{ Total }} \\ \hline & Mo & Lu & & & \\ \hline Net Income (loss) & & & & $ & 477,000 \\ \hline \multicolumn{6}{|l|}{ Balance allocated equally } \\ \hline \multicolumn{6}{|l|}{ Balance of income (loss) } \\ \hline \multicolumn{6}{|l|}{ Shares to the partners } \\ \hline Plan (b) & Mo & & Barb & & Total \\ \hline Net Income (loss) & & & & $ & 477,000 \\ \hline \multicolumn{6}{|c|}{\begin{tabular}{l} Balance allocated in proportion to \\ initial investments \end{tabular}} \\ \hline \multicolumn{6}{|l|}{ Balance of income (loss) } \\ \hline \multicolumn{6}{|l|}{ Shares to the partners } \\ \hline Plan (c) & Mo & & Barb & & Total \\ \hline Net income (loss) & & & & $ & 477,000 \\ \hline \multicolumn{6}{|l|}{ Salary allowances } \\ \hline \multicolumn{6}{|l|}{ Balance of income (loss) } \\ \hline \multicolumn{6}{|l|}{ Interest allowances } \\ \hline \multicolumn{6}{|l|}{ Balance of income (loss) } \\ \hline \multicolumn{6}{|l|}{ Balance allocated } \\ \hline \multicolumn{6}{|l|}{ Balance of income (loss) } \\ \hline Shares of the partners & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started