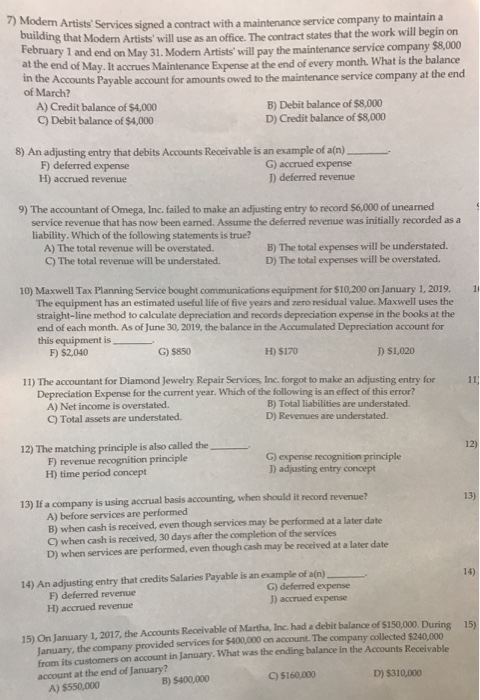

' Mod Artists' Services signed a contract with a maintenance service company to maintain a building that Modern Artists' will use as an office. The contract states that the work w February 1 and end on May 31. Modem Artists' will pay the maintenance service company $8,000 at the end of May. It accrues Maintenance Expense at the end of every month. What is the balance in the Accounts Payable account for amounts owed to the maintenance service company at ill begin on of March? A) Credit balance of $4,000 C) Debit balance of $4,000 B) Debit balance of $8,000 D) Credit balance of $8,000 8) An adjusting entry that debits Accounts Receivable is an example of a(n) F) deferred expense H) accrued revenue G) accrued expense ) deferred revenue 9) The accountant of Omega, Inc. failed to make an adjusting entry to record $6,000 of uneamed service revenue that has now been eaned. Assume the deferred revenue was initially recorded as a liability. Which of the following statements is true? A) The total revenue will be overstated. C) The total revenue will be understated. B) The total expenses will be understated. D) The total expenses will be overstated. 10) Maxwell Tax Planning Service bought communications equipment for $10,200 on January 1, 2019 The equipment has an estimated useful life of five years and zero residual value. Maxwell uses the straight-line method to calculate depreciation and records depreciation expense in the books at the end of each month. As of June 30, 2019, the balance in the Accumulated Depreciation account for this equipment is F) $2.040 G) $850 H) $170 D $1,020 11) The accountant for Diamond Jewelry Repair Services, Inc. forgot to make an adjusting entry for Depreciation Expense for the current year. Which of the following is an effect of this error? A) Net income is overstated O) Total assets are understated B) Total liabilities are understated. D) Revenues are understated. s also called the ___. 12) G) expense recognition F) revenue recognition principle H) time period concept ) adjusting entry concept 13) 13) If a company is using accrual basis accounting when should it record revenue? A) before services are performed B) when cash is received, even though services may be performed at a later date O) when cash is received, 30 days after the completion of the services D) when services are performed, even though cash may be received at a later date 14 14) An adjusting entry that credits Salaries Payable is an example of a(n) G) deferred expense D accrued expense F) deferred revenue H) accrued revenue January, the company provided services for $400,000 on account. The company collected $240,000 from its customers on account in January. What was the ending balance in the Accounts Receivable account at the end of January? 15) On January 1, 2017, the Accounts Receivable of Martha, Inc. had a debit balance of $150,000 C) $160,000 D) $310,000 B) $400,000 A) $550,000