Question

Model Assignment A pharmaceutical company is producing a drug Wozac. The demand for the drug in the current year is 50,000 doses. Assume that the

Model Assignment

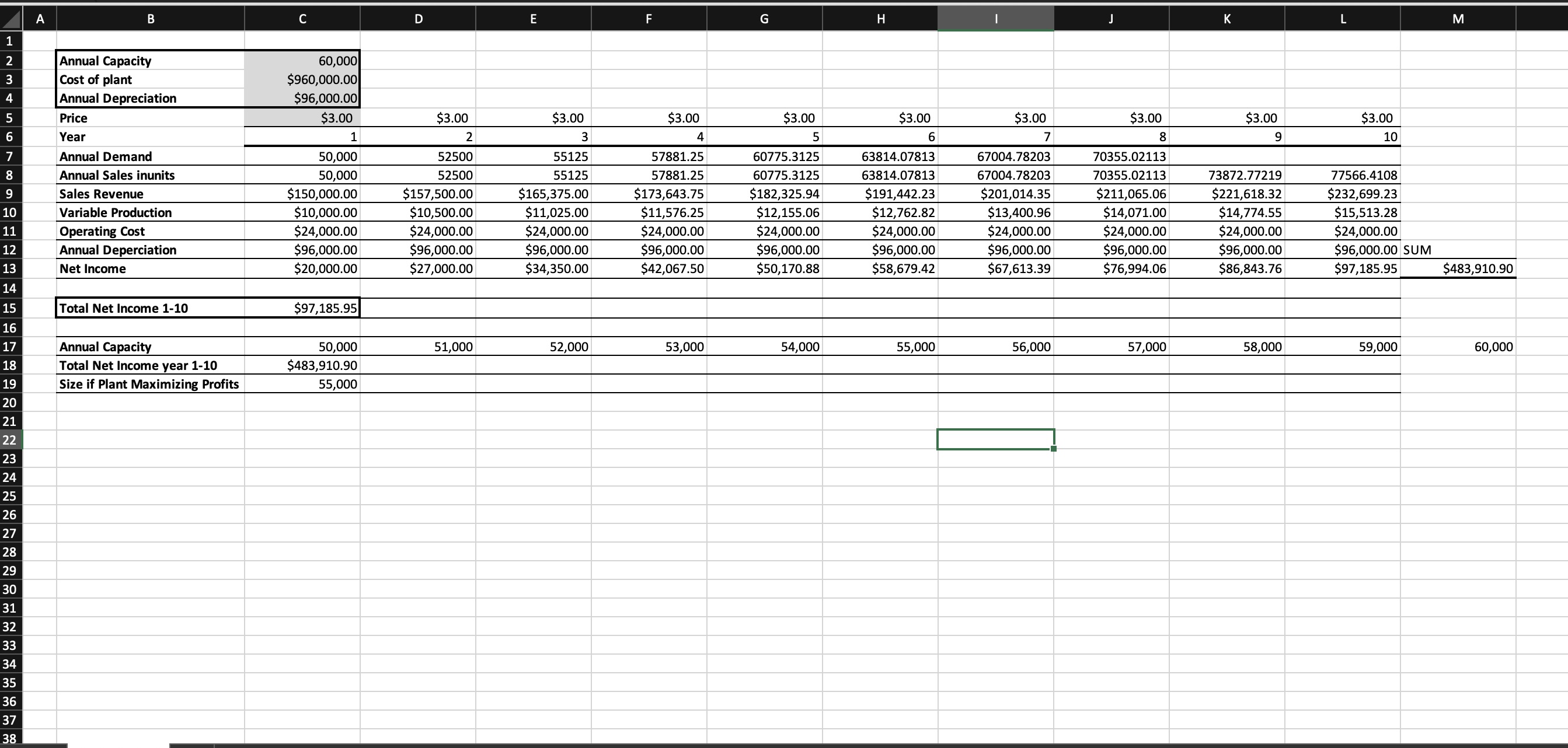

A pharmaceutical company is producing a drug Wozac. The demand for the drug in the current year is 50,000 doses. Assume that the demand will grow by 5% a year. The company is going to build a manufacturing plant to produce a certain number of doses of Wozac per year. The cost to build the manufacturing plant is $16 per dose of Wozac that can be produced each year. To produce a manufacturing plant that can produce 1,000 doses per year costs $16,000 ($16 per dose * 1,000 doses). This is a one-time expense that should be depreciated over 10 years.

Each dose of Wozac is sold for $3. The variable production cost of Wozac is $0.20. In addition, the fixed cost of Wozac is $0.40 per year per dose of production capacity. In other words, a manufacturing plant that produces 1,000 doses of Wozac per year must spend $400 per year ($0.40 per dose * 1,000 doses per year) in fixed costs.

Q6: If capacity is set to 60,000, what is the fixed cost in year 4?

Select one:

a.

$23,153

b.

$20,000

c.

$36,000

d.

$24,000

Q7: Change the capacity to 70,000. What is the fixed cost in year 8?

Select one:

a.

$24,000

b.

$28,142

c.

$36,000

d.

$28,000

Q8: With the capacity still set to 70,000, what is the variable cost in year 2?

Select one:

a.

$11,000

b.

$10,500

c.

$10,000

d.

$14,000

Q9: With the capacity still set to 70,000, what is the variable cost in year 9?

Select one:

a.

$13,000

b.

$14,775

c.

$10,000

d.

$14,000

Q10: With the capacity set back to 60,000, what price is needed to result in $1 million in profit total for the first 10 years?

Report your answer to at least two decimal places with no extra words or punctuation. Here are some acceptable answers: 3.12 2.754

These answers will be marked incorrect: 3.1 2.8With the capacity set back to 60,000, what price is needed to result in $1 million in profit total for the first 10 years?

Report your answer to at least two decimal places with no extra words or punctuation. Here are some acceptable answers: 3.12 2.754

These answers will be marked incorrect: 3.1 2.8

AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started