Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Modigliani & Miller Propositions NoLeverage is a firm financed entirely with equity and Leverage is a firm financed with 5050 equity and debt, but otherwise

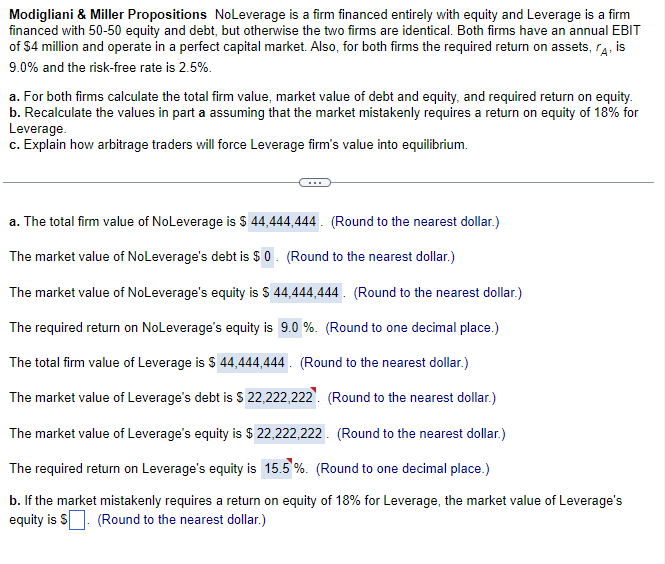

Modigliani \& Miller Propositions NoLeverage is a firm financed entirely with equity and Leverage is a firm financed with 5050 equity and debt, but otherwise the two firms are identical. Both firms have an annual EBIT of $4 million and operate in a perfect capital market. Also, for both firms the required return on assets, rA, is 9.0% and the risk-free rate is 2.5%. a. For both firms calculate the total firm value, market value of debt and equity, and required return on equity. b. Recalculate the values in part a assuming that the market mistakenly requires a return on equity of 18% for Leverage. c. Explain how arbitrage traders will force Leverage firm's value into equilibrium. a. The total firm value of NoLeverage is g The market value of NoLeverage's debt is q (Round to the nearest dollar.) (Round to the nearest dollar.) The market value of NoLeverage's equity is $44,444,444. (Round to the nearest dollar.) The required return on NoLeverage's equity is \%. (Round to one decimal place.) The total firm value of Leverage is $44,444,444. (Round to the nearest dollar.) The market value of Leverage's debt is $22,222,222. (Round to the nearest dollar.) The market value of Leverage's equity is $22,222,222. (Round to the nearest dollar.) The required return on Leverage's equity is \%. (Round to one decimal place.) b. If the market mistakenly requires a return on equity of 18% for Leverage, the market value of Leverage's equity is $. (Round to the nearest dollar.)

Modigliani \& Miller Propositions NoLeverage is a firm financed entirely with equity and Leverage is a firm financed with 5050 equity and debt, but otherwise the two firms are identical. Both firms have an annual EBIT of $4 million and operate in a perfect capital market. Also, for both firms the required return on assets, rA, is 9.0% and the risk-free rate is 2.5%. a. For both firms calculate the total firm value, market value of debt and equity, and required return on equity. b. Recalculate the values in part a assuming that the market mistakenly requires a return on equity of 18% for Leverage. c. Explain how arbitrage traders will force Leverage firm's value into equilibrium. a. The total firm value of NoLeverage is g The market value of NoLeverage's debt is q (Round to the nearest dollar.) (Round to the nearest dollar.) The market value of NoLeverage's equity is $44,444,444. (Round to the nearest dollar.) The required return on NoLeverage's equity is \%. (Round to one decimal place.) The total firm value of Leverage is $44,444,444. (Round to the nearest dollar.) The market value of Leverage's debt is $22,222,222. (Round to the nearest dollar.) The market value of Leverage's equity is $22,222,222. (Round to the nearest dollar.) The required return on Leverage's equity is \%. (Round to one decimal place.) b. If the market mistakenly requires a return on equity of 18% for Leverage, the market value of Leverage's equity is $. (Round to the nearest dollar.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started