Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Modigliani Miller Theorem with Corporate Taxes Consider an environment with corporate taxes similar to the example in slides 1 1 - 1 6 , Lecture

Modigliani Miller Theorem with Corporate Taxes

Consider an environment with corporate taxes similar to the example in slides

Lecture Assume that corporate tax is and the required rate of returns on

Nodebt shares is

a Nodebt is an allequityfinanced company with total market value of

$ and shares outstanding. Nodebt generates EBITs of $M

$$ in a bad year, a normal year, and a good year respectively

with equal probabilities Calculate the rate of return on equity of Nodebt

in the three scenarios.

b Somedebt is an identical company except that management issue $

worth of corporate debt at interest rate and use the proceed to

repurchase some shares. Calculate the market value of Somedebt's equity

and the number of shares outstanding.

c Calculate the rate of return on equity of Somedebt in the three scenarios of

earnings.

d Use the formula in slide Lecture to calculate the required rate of

return on the equity of Somedebt Corporation. Show that this is the same

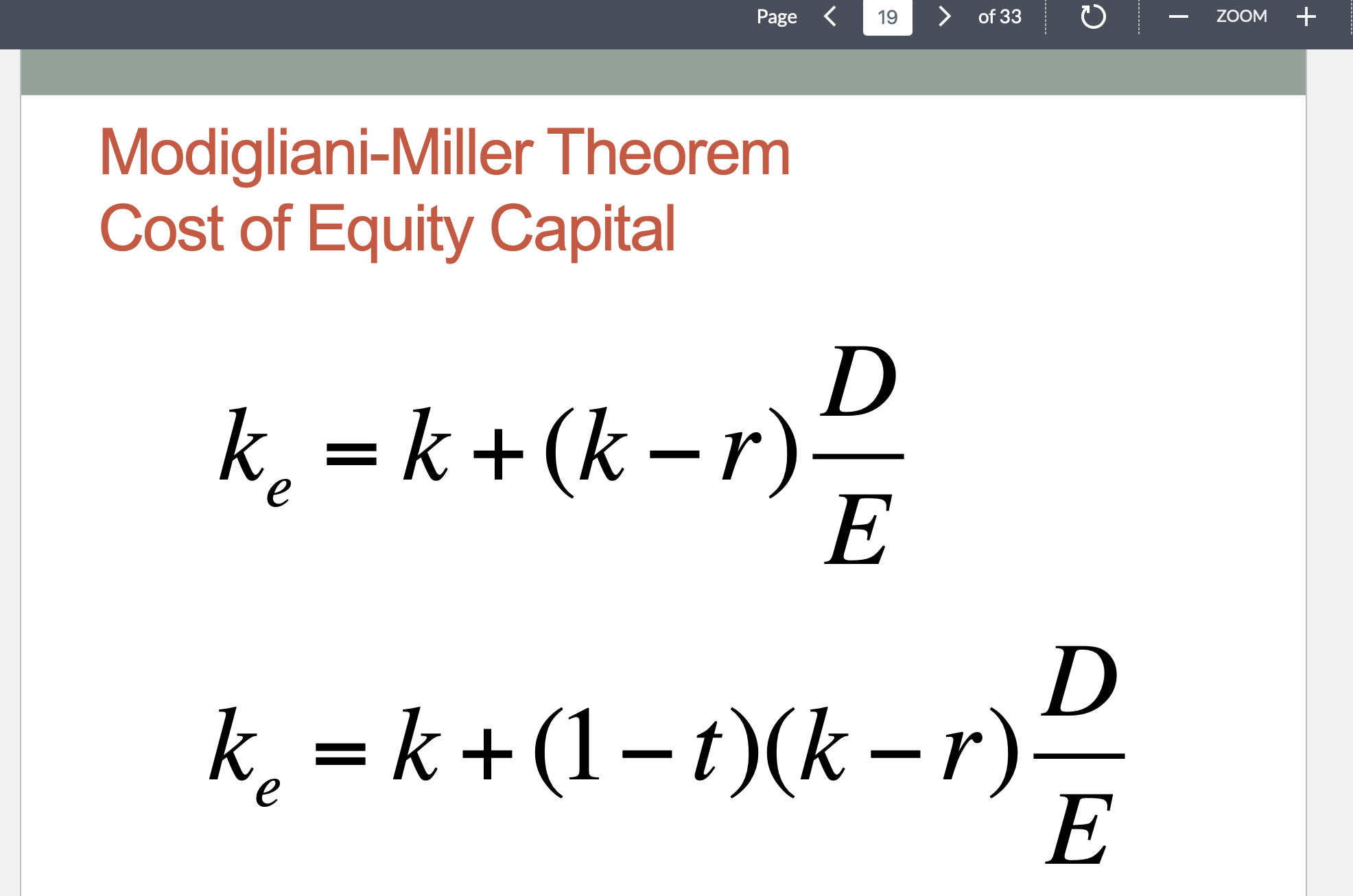

as the average rate of return on Somedebt shares in part cModiglianiMiller Theorem

Cost of Equity Capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started