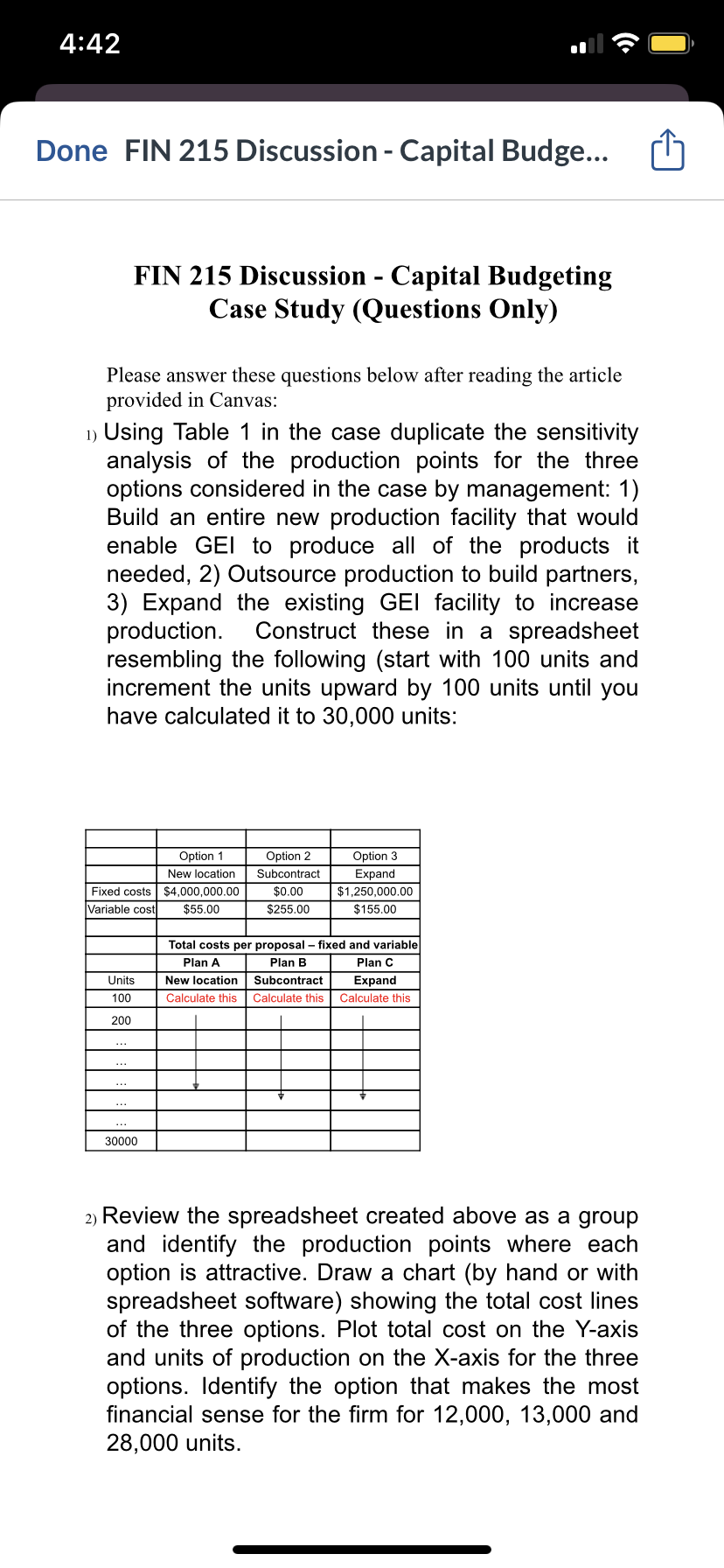

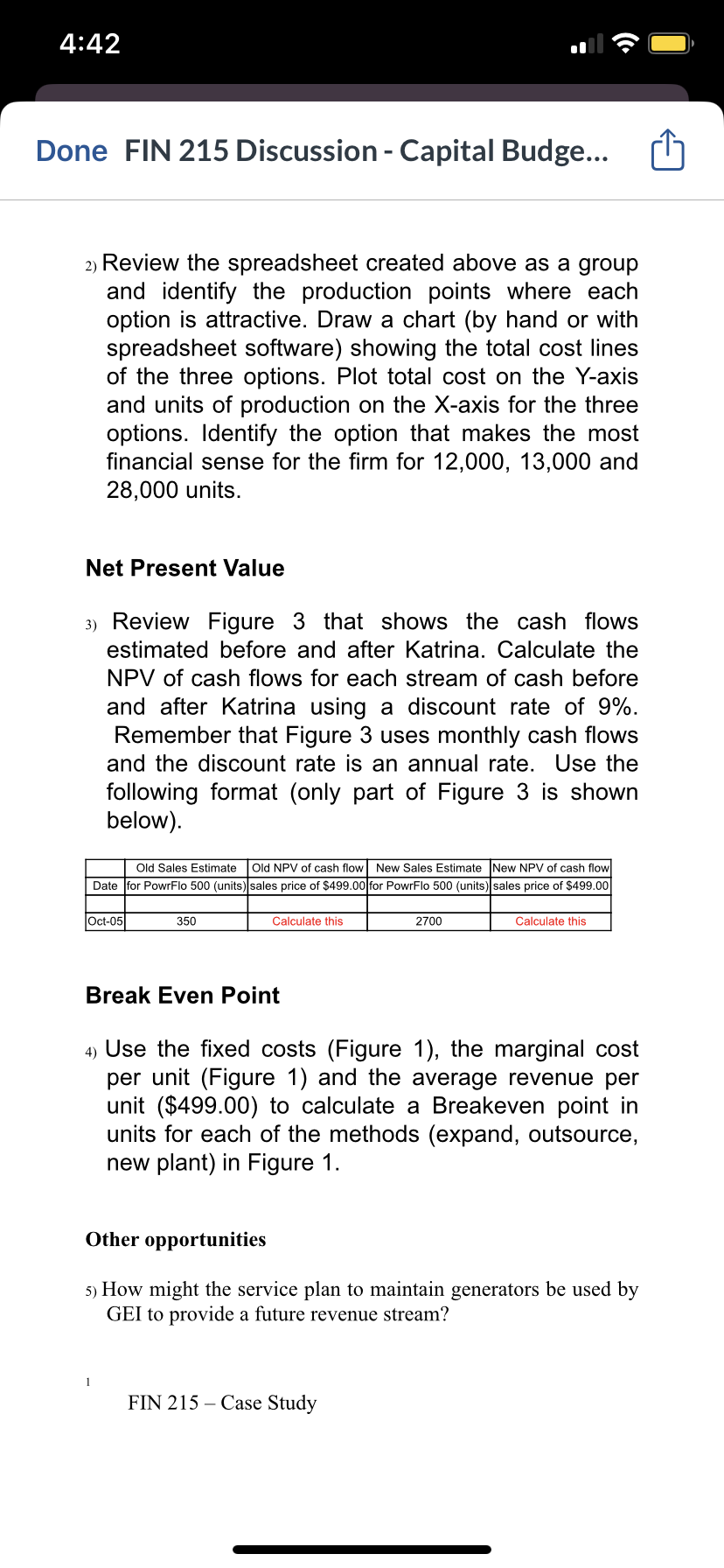

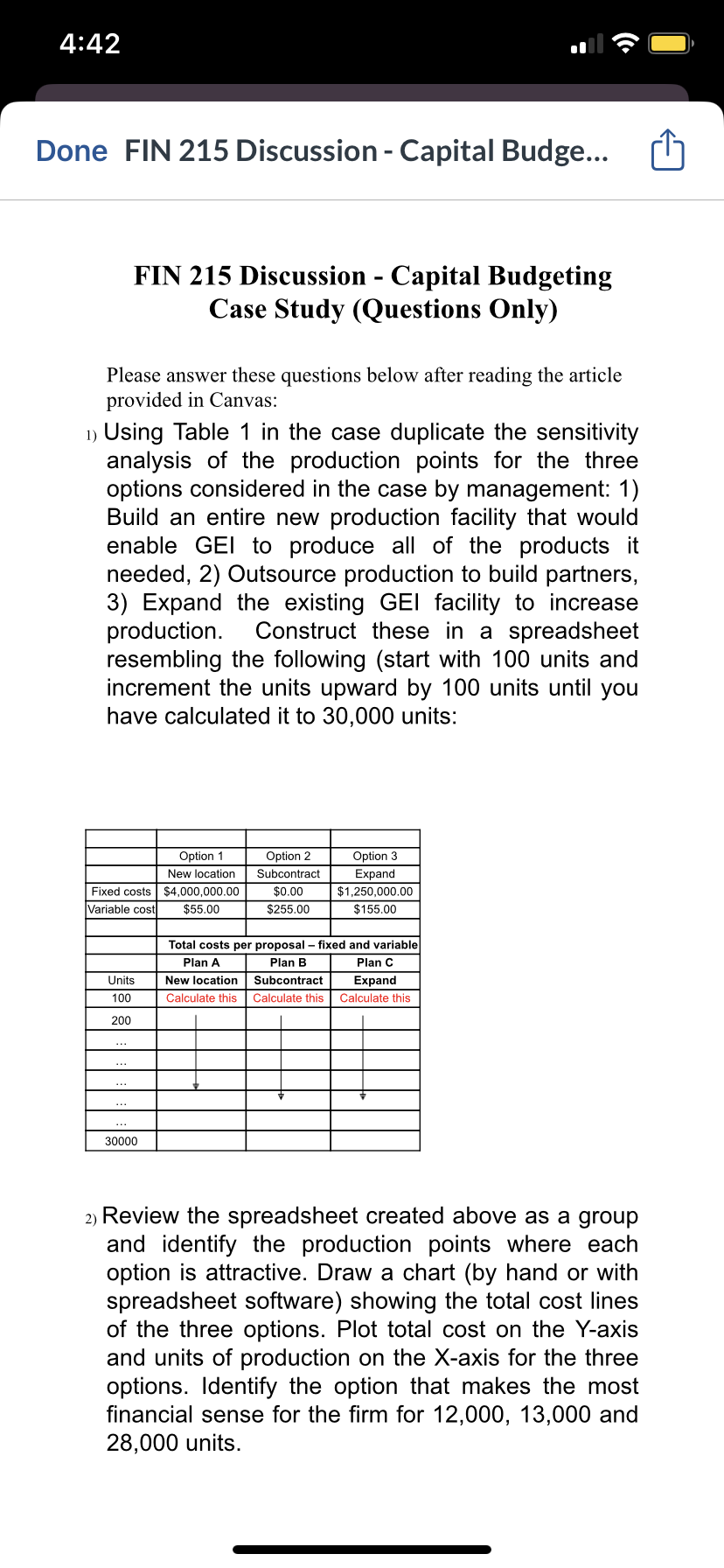

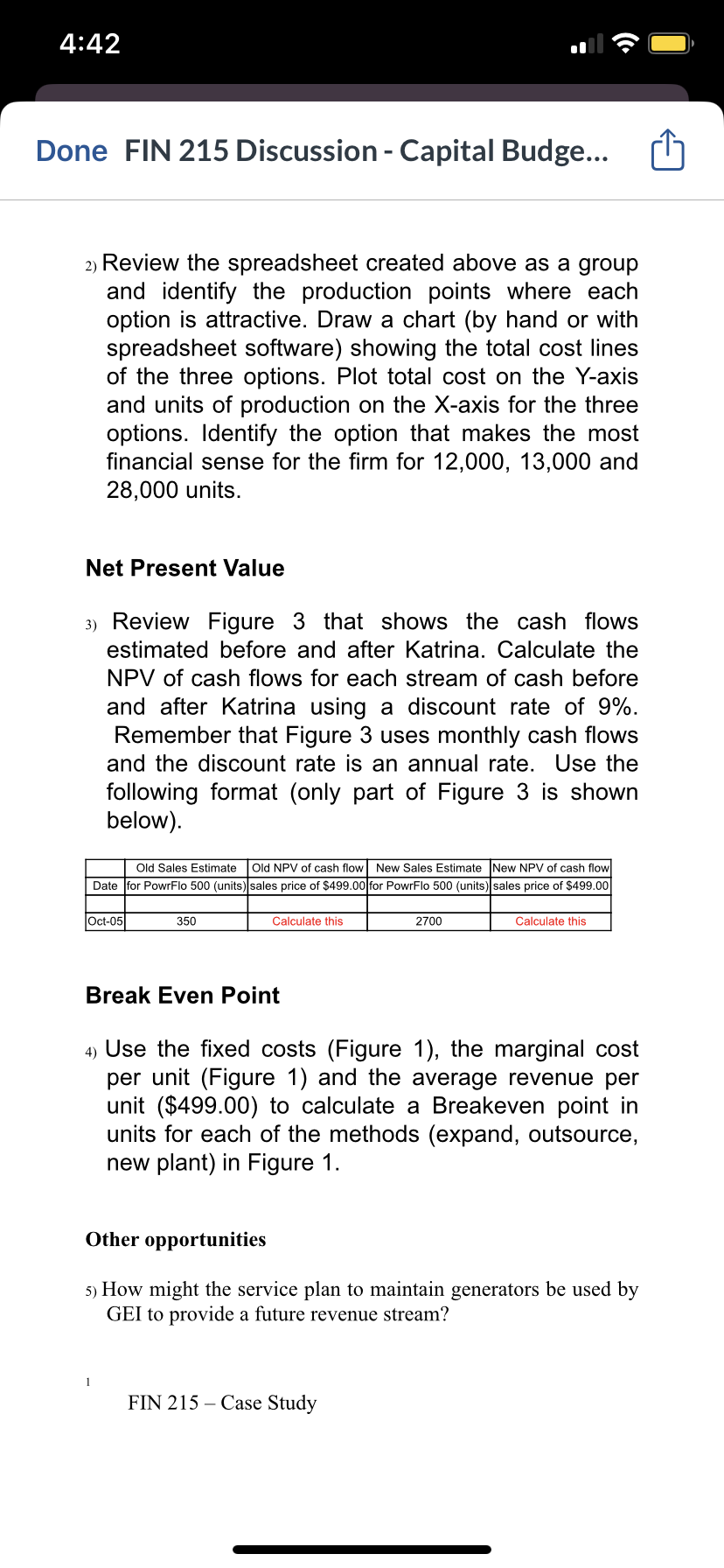

Module 08: Discussion - Capital Budgeting Case Study 50pts Direction Step I: Read the article and post your initial post 1. Please download and read this article: FIN 215 Discussion - Capital Budgeting Case Study_(article). 2. Please download and read the questions listed in this document: FIN 215 Discussion - Capital Budgeting Case Study_(questions only). 3. Create your initial post in the discussion board, and leave your answers to the questions above in your initial post. For your initial post, you must: - Compose a post of one to two paragraphs; - Take into consideration material such as course content and other discussion boards from the current module and previous modules, when appropriate. FIN 215 Discussion - Capital Budgeting Case Study (Questions Only) Please answer these questions below after reading the article provided in Canvas: 1) Using Table 1 in the case duplicate the sensitivity analysis of the production points for the three options considered in the case by management: 1) Build an entire new production facility that would enable GEl to produce all of the products it needed, 2) Outsource production to build partners, 3) Expand the existing GEl facility to increase production. Construct these in a spreadsheet resembling the following (start with 100 units and increment the units upward by 100 units until you have calculated it to 30,000 units: 2) Review the spreadsheet created above as a group and identify the production points where each option is attractive. Draw a chart (by hand or with spreadsheet software) showing the total cost lines of the three options. Plot total cost on the Y-axis and units of production on the X-axis for the three options. Identify the option that makes the most financial sense for the firm for 12,000, 13,000 and 28,000 units. 2) Review the spreadsheet created above as a group and identify the production points where each option is attractive. Draw a chart (by hand or with spreadsheet software) showing the total cost lines of the three options. Plot total cost on the Y-axis and units of production on the X-axis for the three options. Identify the option that makes the most financial sense for the firm for 12,000,13,000 and 28,000 units. Net Present Value 3) Review Figure 3 that shows the cash flows estimated before and after Katrina. Calculate the NPV of cash flows for each stream of cash before and after Katrina using a discount rate of 9%. Remember that Figure 3 uses monthly cash flows and the discount rate is an annual rate. Use the following format (only part of Figure 3 is shown below). Break Even Point 4) Use the fixed costs (Figure 1), the marginal cost per unit (Figure 1) and the average revenue per unit ($499.00) to calculate a Breakeven point in units for each of the methods (expand, outsource, new plant) in Figure 1. Other opportunities 5) How might the service plan to maintain generators be used by GEI to provide a future revenue stream? Module 08: Discussion - Capital Budgeting Case Study 50pts Direction Step I: Read the article and post your initial post 1. Please download and read this article: FIN 215 Discussion - Capital Budgeting Case Study_(article). 2. Please download and read the questions listed in this document: FIN 215 Discussion - Capital Budgeting Case Study_(questions only). 3. Create your initial post in the discussion board, and leave your answers to the questions above in your initial post. For your initial post, you must: - Compose a post of one to two paragraphs; - Take into consideration material such as course content and other discussion boards from the current module and previous modules, when appropriate. FIN 215 Discussion - Capital Budgeting Case Study (Questions Only) Please answer these questions below after reading the article provided in Canvas: 1) Using Table 1 in the case duplicate the sensitivity analysis of the production points for the three options considered in the case by management: 1) Build an entire new production facility that would enable GEl to produce all of the products it needed, 2) Outsource production to build partners, 3) Expand the existing GEl facility to increase production. Construct these in a spreadsheet resembling the following (start with 100 units and increment the units upward by 100 units until you have calculated it to 30,000 units: 2) Review the spreadsheet created above as a group and identify the production points where each option is attractive. Draw a chart (by hand or with spreadsheet software) showing the total cost lines of the three options. Plot total cost on the Y-axis and units of production on the X-axis for the three options. Identify the option that makes the most financial sense for the firm for 12,000, 13,000 and 28,000 units. 2) Review the spreadsheet created above as a group and identify the production points where each option is attractive. Draw a chart (by hand or with spreadsheet software) showing the total cost lines of the three options. Plot total cost on the Y-axis and units of production on the X-axis for the three options. Identify the option that makes the most financial sense for the firm for 12,000,13,000 and 28,000 units. Net Present Value 3) Review Figure 3 that shows the cash flows estimated before and after Katrina. Calculate the NPV of cash flows for each stream of cash before and after Katrina using a discount rate of 9%. Remember that Figure 3 uses monthly cash flows and the discount rate is an annual rate. Use the following format (only part of Figure 3 is shown below). Break Even Point 4) Use the fixed costs (Figure 1), the marginal cost per unit (Figure 1) and the average revenue per unit ($499.00) to calculate a Breakeven point in units for each of the methods (expand, outsource, new plant) in Figure 1. Other opportunities 5) How might the service plan to maintain generators be used by GEI to provide a future revenue stream