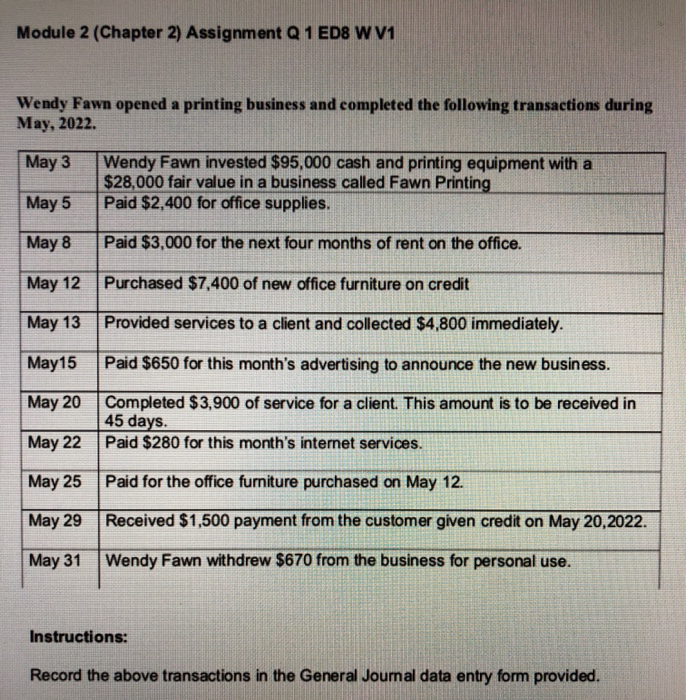

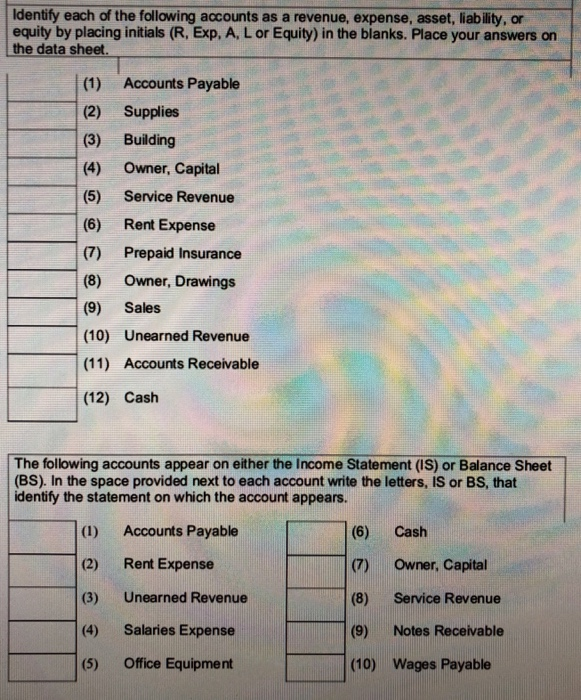

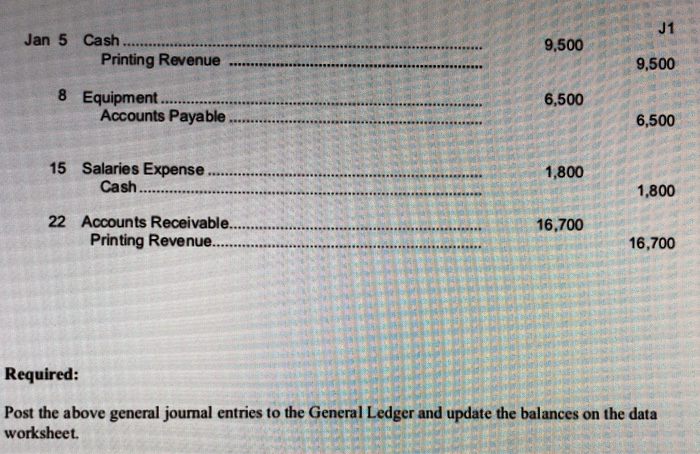

Module 2 (Chapter 2) Assignment Q 1 EDS WV1 Wendy Fawn opened a printing business and completed the following transactions during May, 2022. May 3 Wendy Fawn invested $95,000 cash and printing equipment with a $28,000 fair value in a business called Fawn Printing Paid $2,400 for office supplies. May 5 May 8 Paid $3,000 for the next four months of rent on the office. May 12 Purchased $7,400 of new office furniture on credit May 13 Provided services to a client and collected $4,800 immediately. May15 Paid $650 for this month's advertising to announce the new business. May 20 Completed $3,900 of service for a client. This amount is to be received in 45 days. Paid $280 for this month's internet services. May 22 May 25 Paid for the office furniture purchased on May 12. May 29 Received $1,500 payment from the customer given credit on May 20,2022. May 31 Wendy Fawn withdrew $670 from the business for personal use. Instructions: Record the above transactions in the General Journal data entry form provided. Identify each of the following accounts as a revenue, expense, asset, liability, or equity by placing initials (R, Exp. A, Lor Equity) in the blanks. Place your answers on the data sheet. Accounts Payable (2) Supplies (3) Building (4) Owner, Capital (5) Service Revenue (6) Rent Expense (7) Prepaid Insurance (8) Owner, Drawings (9) Sales (10) Unearned Revenue (11) Accounts Receivable (12) Cash The following accounts appear on either the income Statement (IS) or Balance Sheet (BS). In the space provided next to each account write the letters, IS or BS, that identify the statement on which the account appears. (1) Accounts Payable (6) Cash (2) Rent Expense (7) Owner, Capital (3) Unearned Revenue (8) Service Revenue Salaries Expense (9) Notes Receivable (5) Office Equipment (10) Wages Payable J1 Jan 5 Cash Printing Revenue 9,500 9,500 8 Equipment. Accounts Payable 6,500 6,500 15 Salaries Expense Cash..... 1,800 1,800 22 Accounts Receivable... Printing Revenue....... 16,700 16,700 Required: Post the above general journal entries to the General Ledger and update the balances on the data worksheet