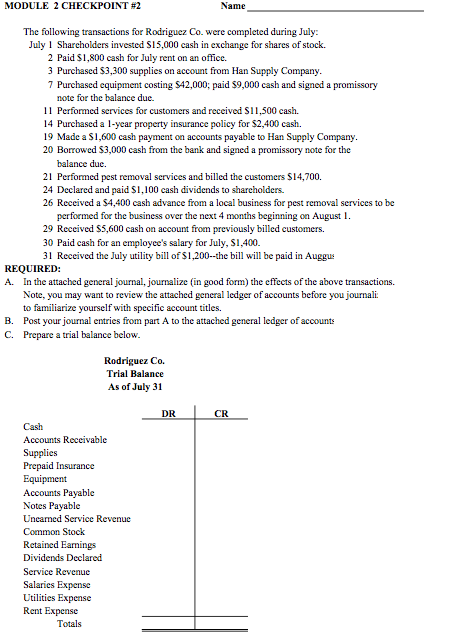

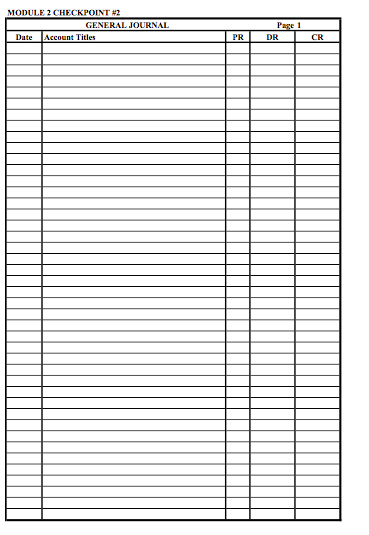

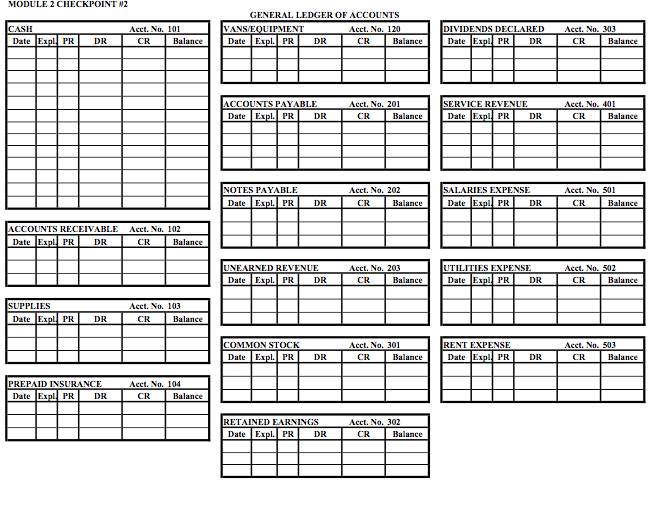

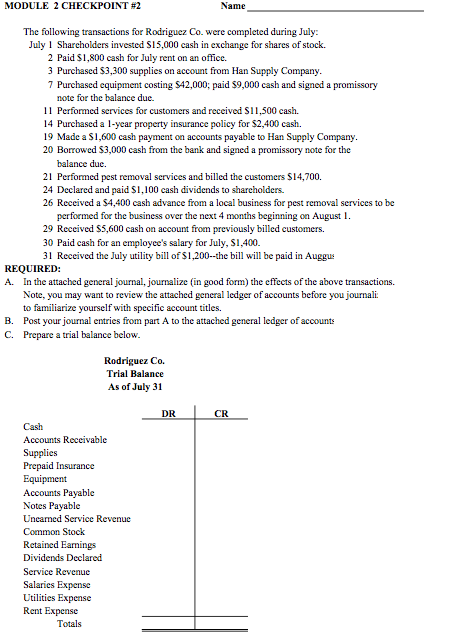

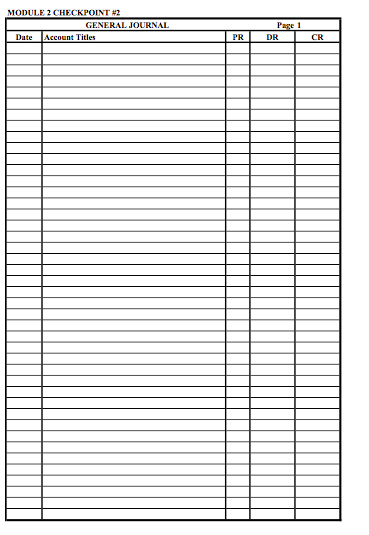

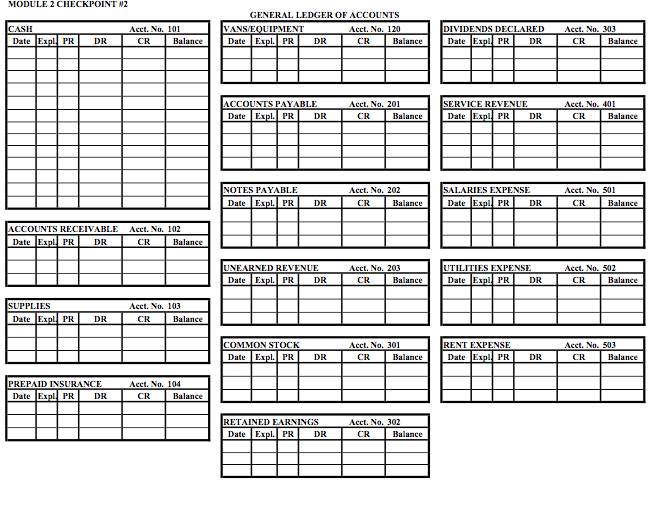

MODULE 2 CHECKPOINT #2 Name The following transactions for Rodriguez Co. were completed during July: July 1 Shareholders invested S15,000 cash in exchange for shares of stock. 2 Paid $1,800 cash for July rent on an office. 3 Purchased $3,300 supplies on account from Han Supply Company. 7 Purchased equipment costing S42,000; paid $9,000 cash and signed a promissory note for the balance due. 11 Performed services for customers and received $11,500 cash. 14 Purchased a 1-year property insurance policy for $2,400 cash. 19 Made a $1,600 cash payment on accounts payable to Han Supply Company. 20 Borrowed $3,000 cash from the bank and signed a promissory note for the balance duc. 21 Performed pest removal services and billed the customers $14,700. 24 Declared and paid $1,100 cash dividends to shareholders. 26 Received a $4,400 cash advance from a local business for pest removal services to be performed for the business over the next 4 months beginning on August I. 29 Received $5,600 cash on account from previously billed customers. 30 Paid cash for an employee's salary for July, 51,400. 31 Received the July utility bill of $1,200--the bill will be paid in Auggu REQUIRED: A. In the attached general journal, journalize (in good form) the effects of the above transactions. Note, you may want to review the attached general ledger of accounts before you journali: to familiarize yourself with specific account titles. B. Post your journal entries from part A to the attached general ledger of accounts C. Prepare a trial balance below. Rodriguez Co. Trial Balance As of July 31 DR CR Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Notes Payable Uneamed Service Revenue Common Stock Retained Earings Dividends Declared Service Revenue Salaries Expense Utilities Expense Rent Expense Totals MODULE 2 CHECKPOINT #2 GENERAL JOURNAL Date Account Titles Page 1 DR PR CR MODULE 2 CHECKPOINT N2 CASH Date ExpU PR Acct. No. 101 CR Balance GENERAL LEDGER OF ACCOUNTS VANS/EQUIPMENT Acct. No, 120 Date Expl. PR DR CR Balance DIVIDENDS DECLARED Date Expl PR DR Acet. No, 203 CR Balance DR ACCOUNTS PAYABLE Date Expl. PR DR Acct. No. 201 CR Balance SERVICE REVENUE Date Expl PR DR Aect. No. 401 CR Balance NOTES PAYABLE Date Expl. PR Acct. No. 202 CR Balance SALARIES EXPENSE Date Expl PR DR Acet. No. 501 CR Balance DR ACCOUNTS RECEIVABLE Date Expl PR DR Acct. No. 102 CR Balance UNEARNED REVENUE Date Expl. PR DR Acct. No, 203 CR Balance UTILITIES EXPENSE Date Expl PR DR Acet. No. 502 CR Balance SUPPLIES Date Expll PR Acct. No. 103 CR Balance DR COMMON STOCK Date Expl. PR Acct. No. 301 CR Balance RENT EXPENSE Date Expl PR Aeet. No. 503 CR Balance DR DR PREPAID INSURANCE Date Expl PR DR Aect. No. 104 CR Balance RETAINED EARNINGS Date Expl. PR DR Aect. No. 302 CR Balance