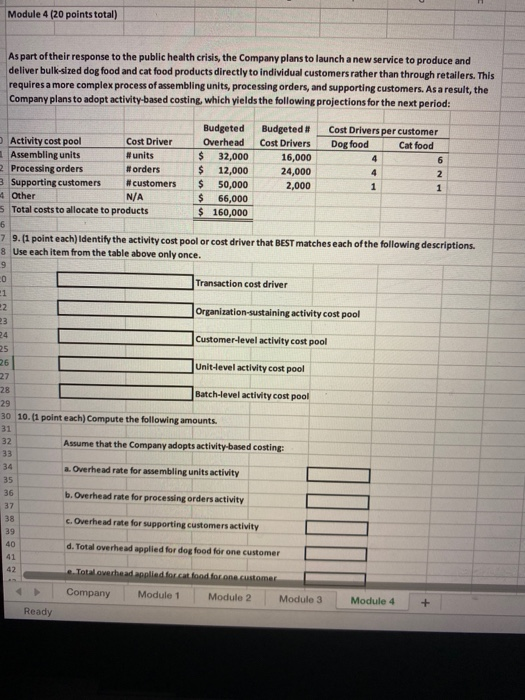

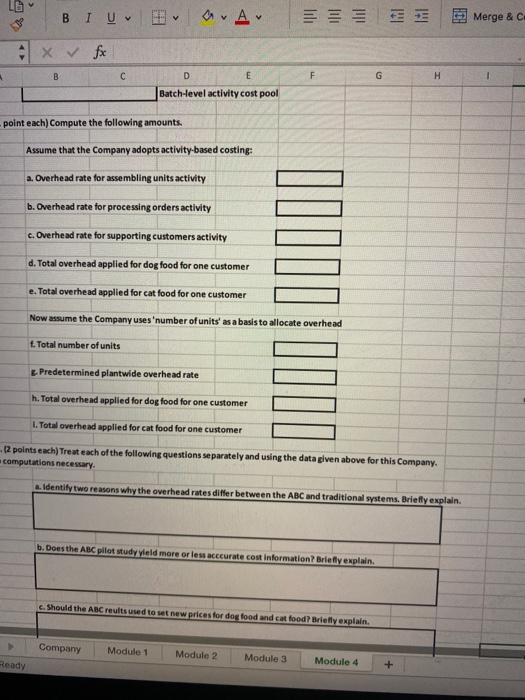

Module 4 (20 points total) As part of their response to the public health crisis, the Company plans to launch a new service to produce and deliver bulk-sized dog food and cat food products directly to individual customers rather than through retailers. This requires a more complex process of assembling units, processing orders, and supporting customers. As a result, the Company plans to adopt activity-based costing, which yields the following projections for the next period: Budgeted Budgeted # Cost Drivers per customer Activity cost pool Cost Driver Overhead Cost Drivers Dog food Cat food Assembling units #units $ 32,000 16,000 6 2 Processing orders #orders $ 12,000 24,000 4 2 3 Supporting customers #customers $ 50,000 2,000 1 4 Other N/A $ 66,000 5 Total costs to allocate to products $ 160,000 4 1 7 9. (1 point each) Identify the activity cost pool or cost driver that BEST matches each of the following descriptions. 8 Use each item from the table above only once. 0 Transaction cost driver 1 2 Organization-sustaining activity cost pool 24 Customer-level activity cost pool 25 26 Unit-level activity cost pool 27 28 Batch-level activity cost pool 29 30 10. (1 point each) Compute the following amounts. 31 32 Assume that the Company adopts activity-based costing: 33 34 a. Overhead rate for assembling units activity 35 36 b. Overhead rate for processing orders activity 37 c. Overhead rate for supporting customers activity 38 39 40 d. Total overhead applied for dog food for one customer 41 42 Total overhead applied forcat food for one customer Company Module 1 Module 2 Module 3 Module 4 + Ready LO BI U a. Av HGH Merge & C vfs B D E F G H Batch-level activity cost pool point each) Compute the following amounts. Assume that the Company adopts activity-based costing: a. Overhead rate for assembling units activity b. Overhead rate for processing orders activity c. Overhead rate for supporting customers activity d. Total overhead applied for dog food for one customer e. Total overhead applied for cat food for one customer Now assume the Company uses 'number of units' as a basis to allocate overhead . Total number of units E. Predetermined plantwide overhead rate h. Total overhead applied for dog food for one customer 1. Total overhead applied for cat food for one customer - (2 points each) Treat each of the following questions separately and using the data given above for this Company computations necessary. a. Identify two reasons why the overhead rates differ between the ABC and traditional systems. Briefly explain. b. Does the ABC pilot study yield more or less accurate cost information? Briefly explain c. Should the ABC reults used to set new prices for dog food and catfood? Briefly explain Company Module 1 Module 2 Module 3 Ready Module 4 +