Question

Module 5: Revenue Recognition X + C M Gmail YouTube 0- $ millions Accounts receivable, net Allowance for doubtful accounts Business Course Return to

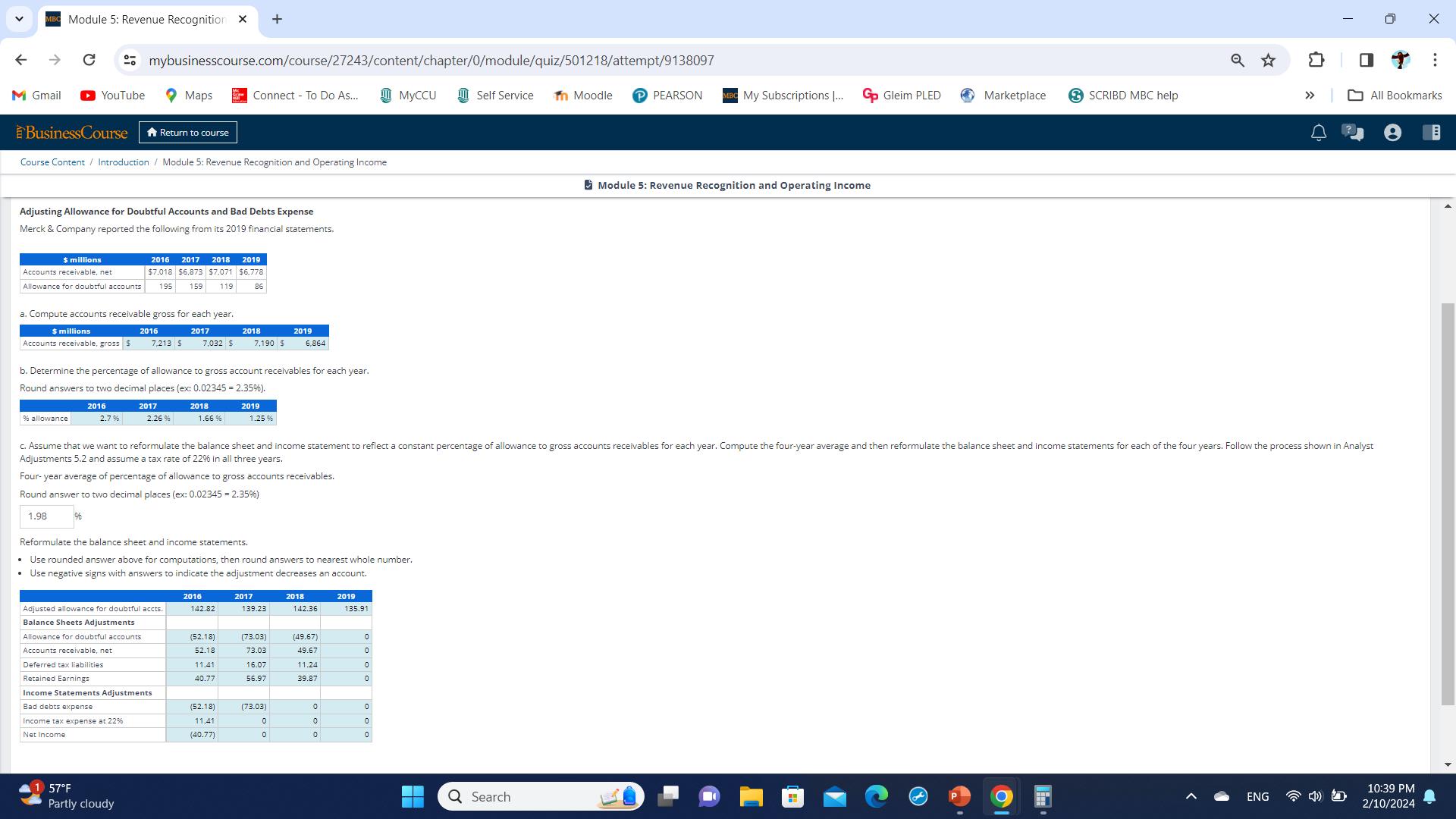

Module 5: Revenue Recognition X + C M Gmail YouTube 0- $ millions Accounts receivable, net Allowance for doubtful accounts Business Course Return to course Course Content / Introduction / Module 5: Revenue Recognition and Operating Income % allowance Adjusting Allowance for Doubtful Accounts and Bad Debts Expense Merck & Company reported the following from its 2019 financial statements. $ millions Accounts receivable, gross $ a. Compute accounts receivable gross for each year. 2017 7,032 $ 196 mybusinesscourse.com/course/27243/content/chapter/0/module/quiz/501218/attempt/9138097 2.7% 2016 7,213 S Maps 2016 2017 2018 2019 $7.018 $6,873 $7,071 $6.778 195 159 119 86 b. Determine the percentage of allowance to gross account receivables for each year. Round answers to two decimal places (ex: 0.02345 = 2.35%). 2016 2017 2.26% 57F Partly cloudy Allowance for doubtful accounts Accounts receivable, net Deferred tax liabilities Retained Earnings Adjusted allowance for doubtful accts. Balance Sheets Adjustments Income Statements Adjustments Bad debts expense Income tax expense at 22% Net Income 2018 1.66% Connect To Do As... 2016 Reformulate the balance sheet and income statements. Use rounded answer above for computations, then round answers to nearest whole number. Use negative signs with answers to indicate the adjustment decreases an account. 142.82 2018 7,190 $ (52.18) 52.18 11.41 40.77 (52.18) 11.41 (40.77) 2019 1.25 % 2017 139.23 2019 (73.03) 73.03 16.07 56.97 c. Assume that we want to reformulate the balance sheet and income statement to reflect a constant percentage of allowance to gross accounts receivables for each year. Compute the four-year average and then reformulate the balance sheet and income statements for each of the four years. Follow the process shown in Analyst Adjustments 5.2 and assume a tax rate of 22% in all three years. Four-year average of percentage of allowance to gross accounts receivables. Round answer to two decimal places (ex: 0.02345 = 2.35%) 1.98 (73.03) 0 6,864 0 2018 142.36 (49.67) 49.67 11.24 39.87 0 0 0 2019 135.91 0 0 MyCCU 0 0 0 0 0 Self Service 8 in Moodle PPEARSON Q Search My Subscriptions [... Go Gleim PLED Module 5: Revenue Recognition and Operating Income H Marketplace SCRIBD MBC help ENG T >> OOT: X All Bookmarks 10:39 PM 2/10/2024 B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started