Question

Module 7 Activity: Buying a House For this activity, you can use the cost of a house you would like to purchase. ************************************************************************************** Show all

Module 7 Activity: Buying a House

For this activity, you can use the cost of a house you would like to purchase.

**************************************************************************************

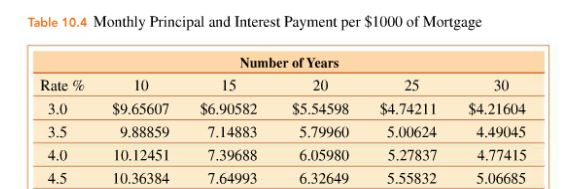

Show all work for full credit and clearly label all your answers. Use the table below for your monthly payment calculation

1.) Find a House to Purchase

a. Find a house in your town either online or in a newspaper and provide location

b. Give the list price (for this exercise we will assume the list price is also the purchase price)

2.) Percent Calculations

a. Find the down payment of 20% of the purchase price

b. Give the amount to be financed

c. Find the yearly cost of homeowners insurance. For this exercise, we will use 0.4% of the purchase price for the yearly cost of homeowners insurance.

d. Find the yearly cost of property taxes. For this exercise, we will use 0.8% of the purchase price for the yearly cost of property taxes.

3.) Monthly Mortgage Payment Calculations (Use value from part d)

a. Find Monthly Payment for 30 years at 4.0%

b. Find Monthly Payment for 30 years at 3.0%

c. Find Monthly Payment for 20 years at 3.0%

d. Calculate the Total Amount paid back over the life of the loan for each of the 3 payments in g-i.

e. How much total money is saved by choosing a 20-year at 3.0% over a 30-year at 3.0%?

4.) Total Monthly House Payment

l. Calculate the monthly house payment for g, h, and i. Include in your payment the monthly

mortgage payment, monthly cost of homeowners insurance, and monthly cost of property taxes.

Table 10.4 Monthly Principal and Interest Payment per $1000 of MortgageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started