Answered step by step

Verified Expert Solution

Question

1 Approved Answer

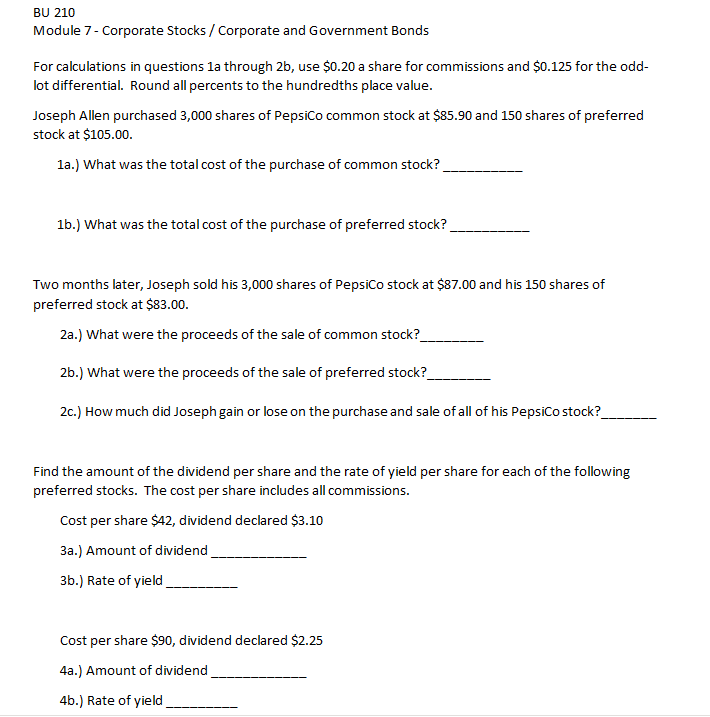

Module 7 - Corporate Stocks / Corporate and Government Bonds For calculations in questions 1 a through 2 b , use $ 0 . 2

Module Corporate Stocks Corporate and Government Bonds

For calculations in questions a through use $ a share for commissions and $ for the odd

lot differential. Round all percents to the hundredths place value.

Joseph Allen purchased shares of PepsiCo common stock at $ and shares of preferred

stock at $

a What was the total cost of the purchase of common stock?

b What was the total cost of the purchase of preferred stock?

Two months later, Joseph sold his shares of PepsiCo stock at $ and his shares of

preferred stock at $

a What were the proceeds of the sale of common stock?

b What were the proceeds of the sale of preferred stock?

c How much did Joseph gain or lose on the purchase and sale of all of his PepsiCo stock?

Find the amount of the dividend per share and the rate of yield per share for each of the following

preferred stocks. The cost per share includes all commissions.

Cost per share $ dividend declared $

a Amount of dividend

b Rate of yield

Cost per share $ dividend declared $

a Amount of dividend

b Rate of yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started