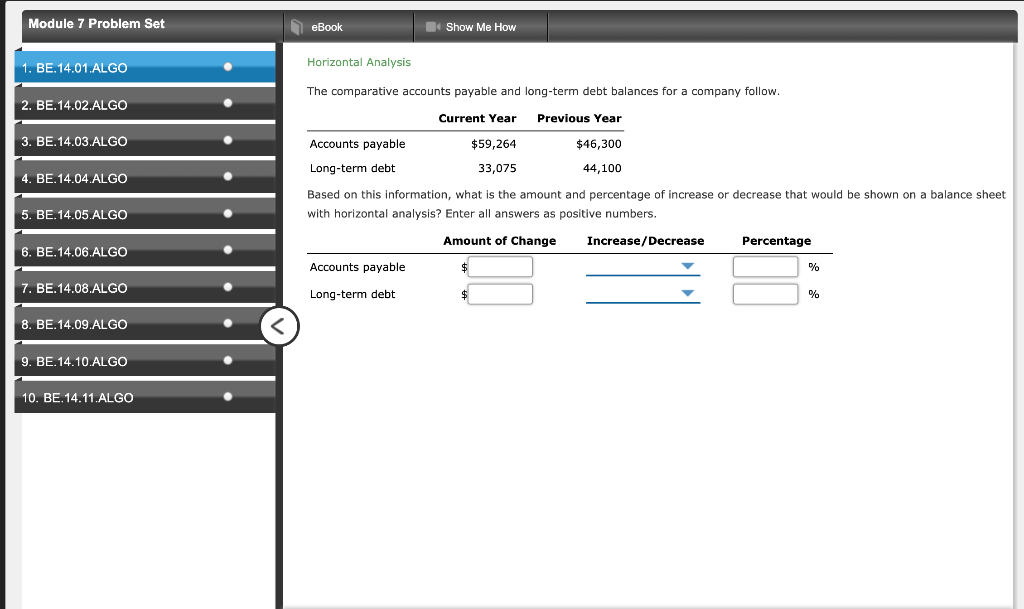

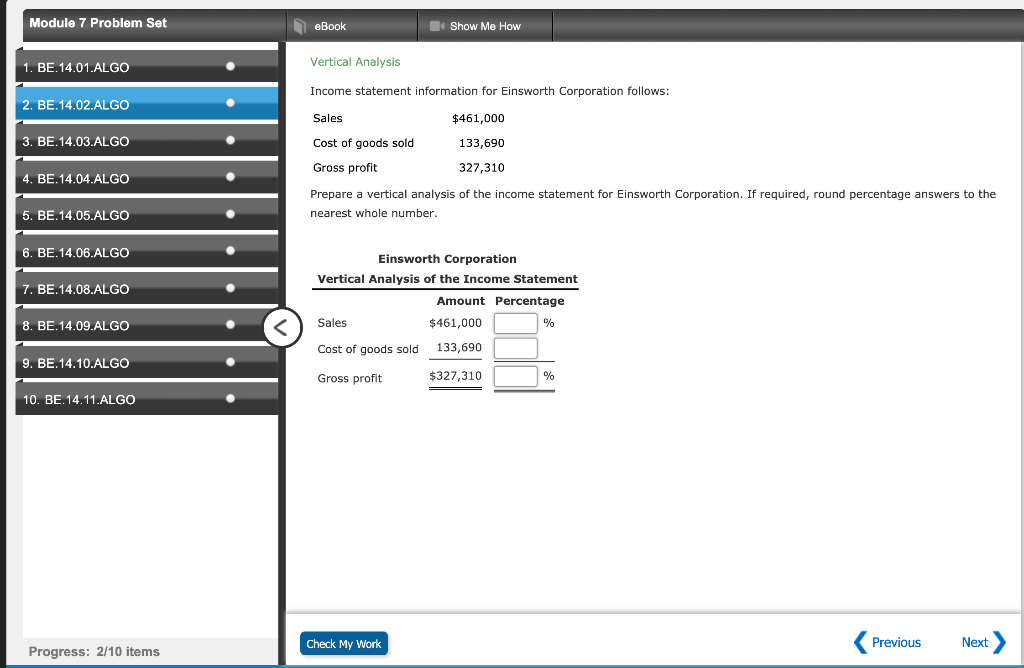

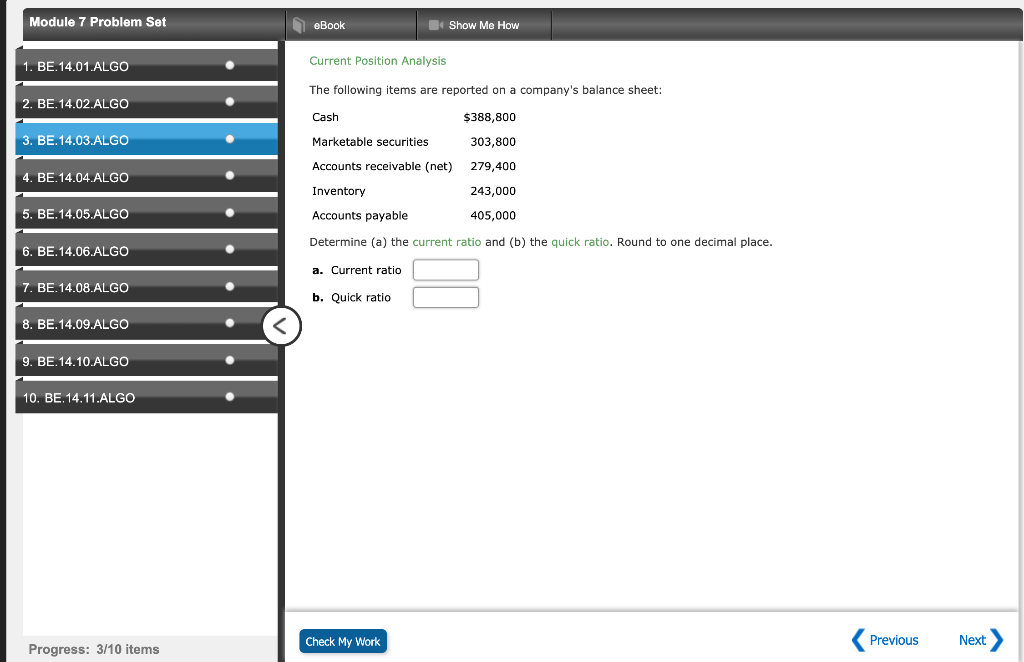

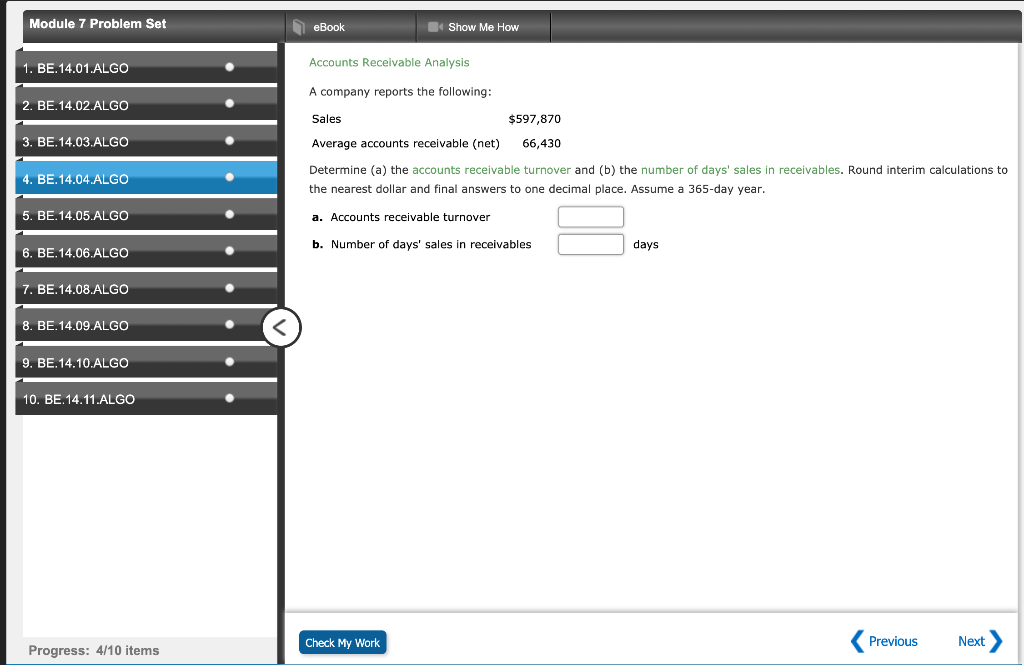

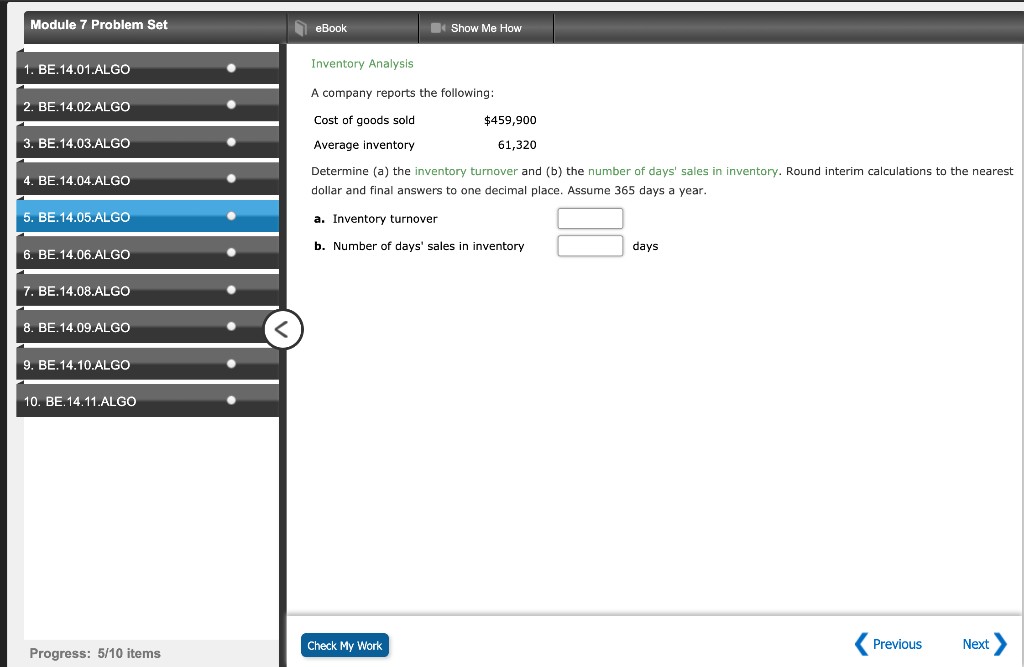

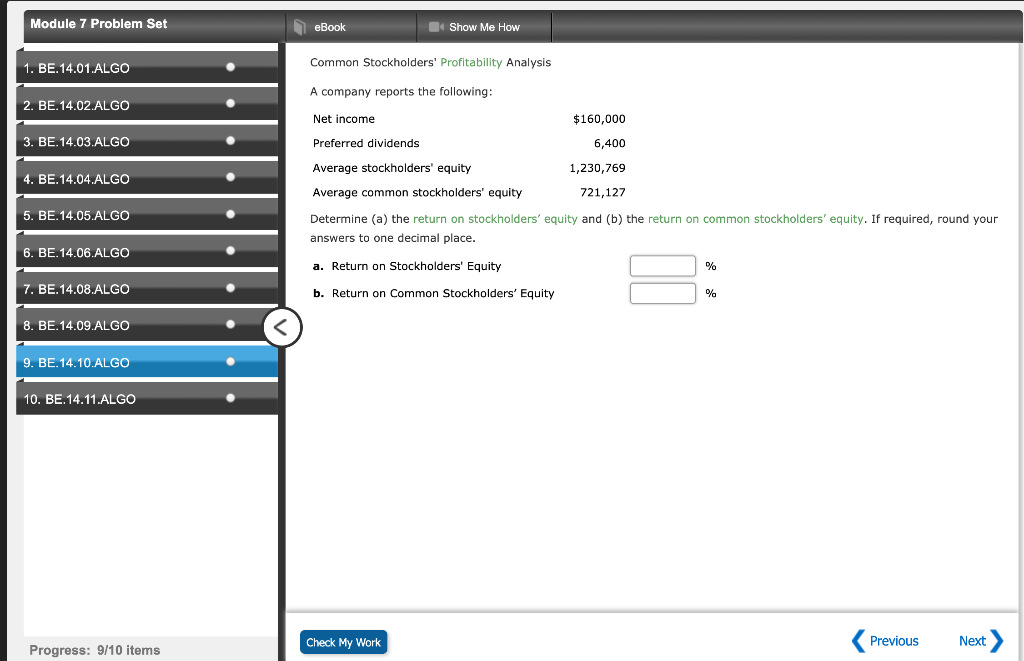

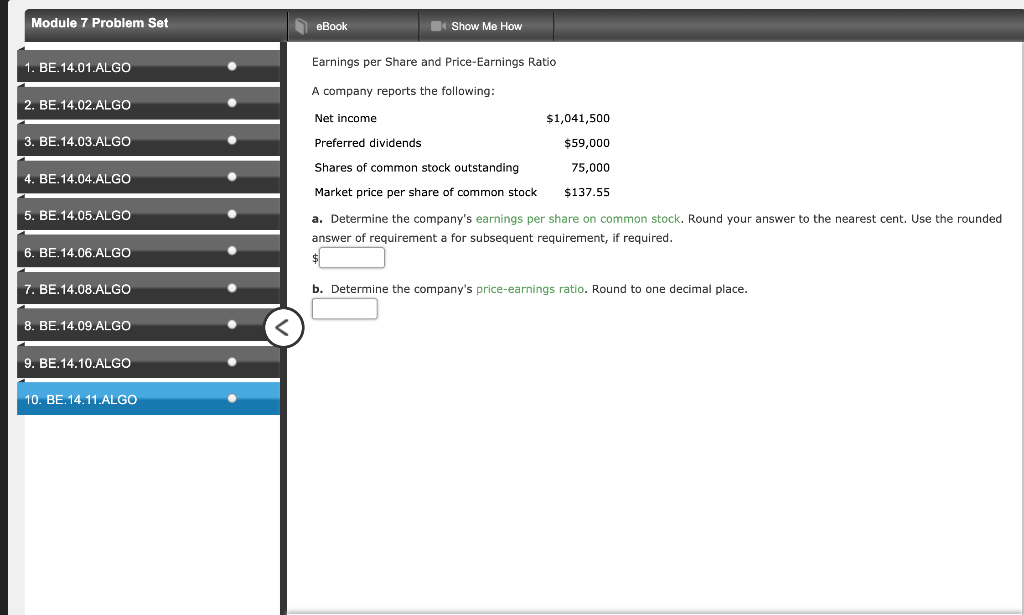

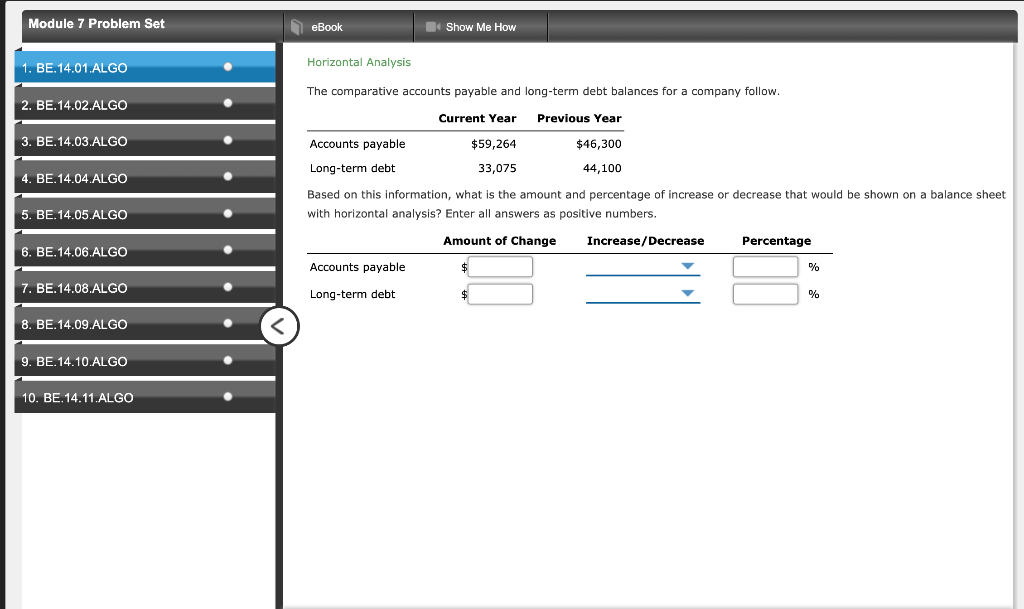

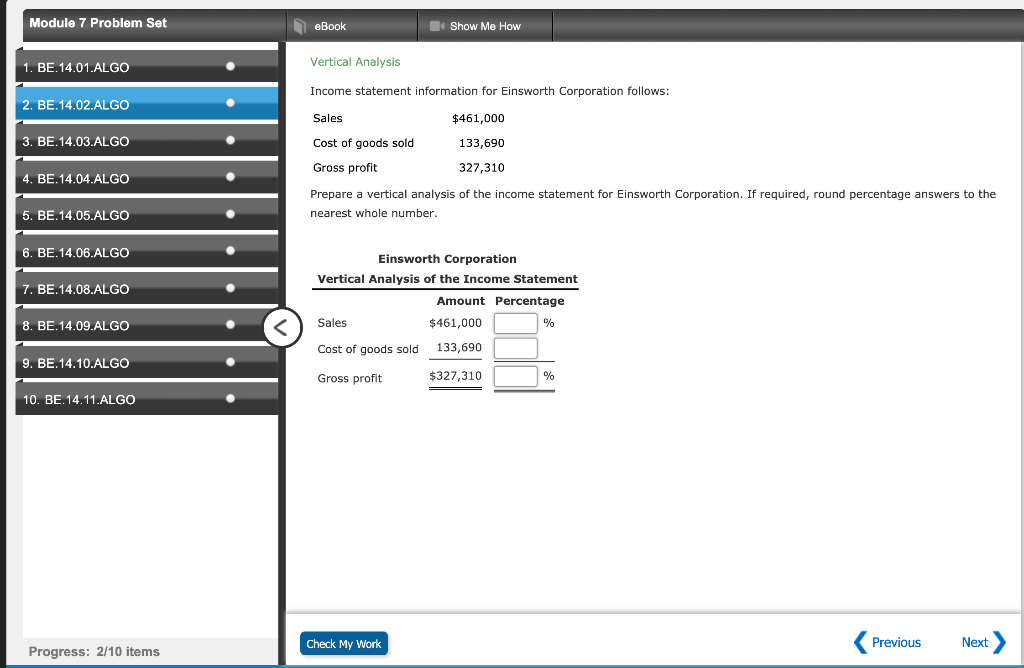

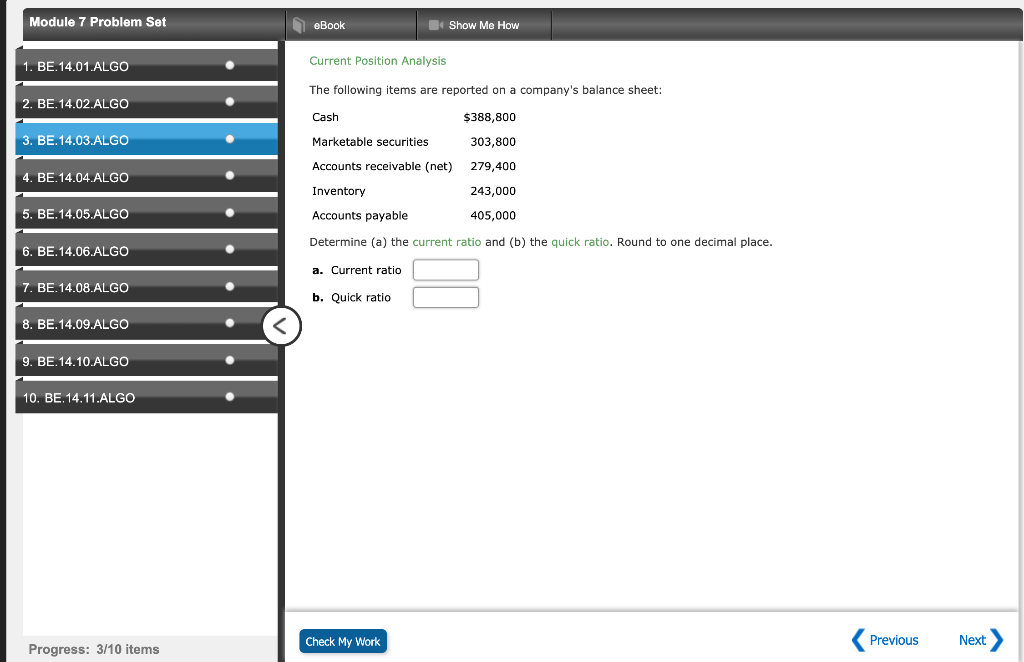

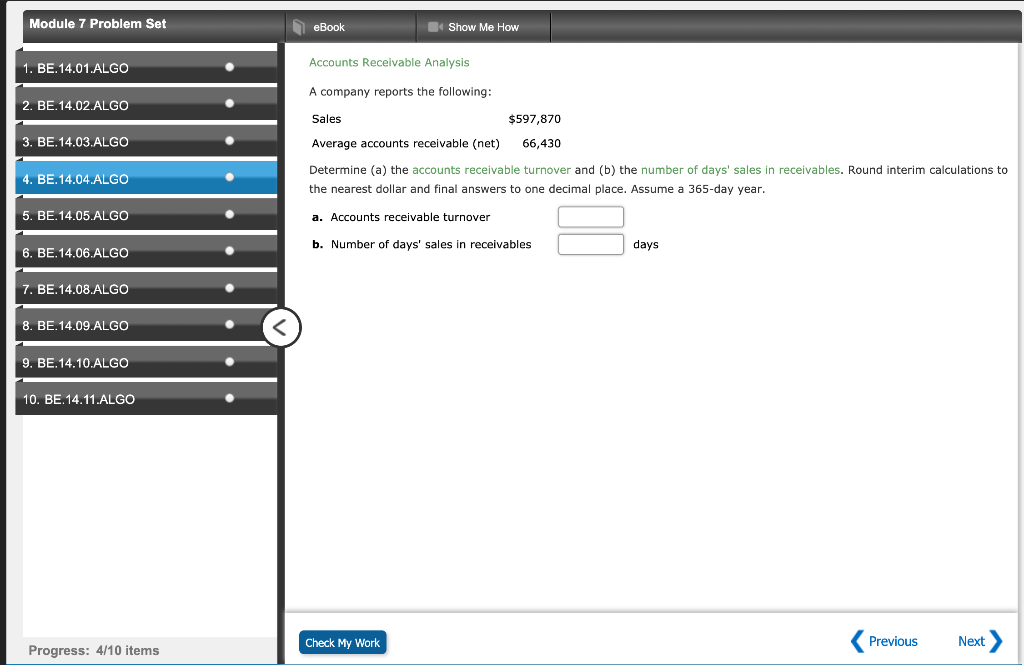

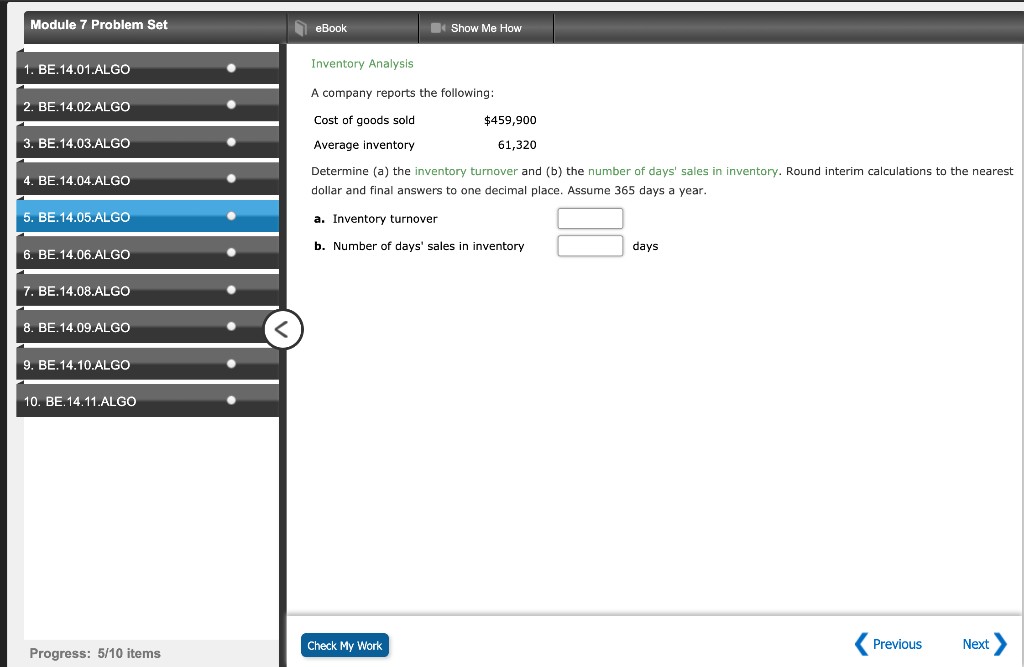

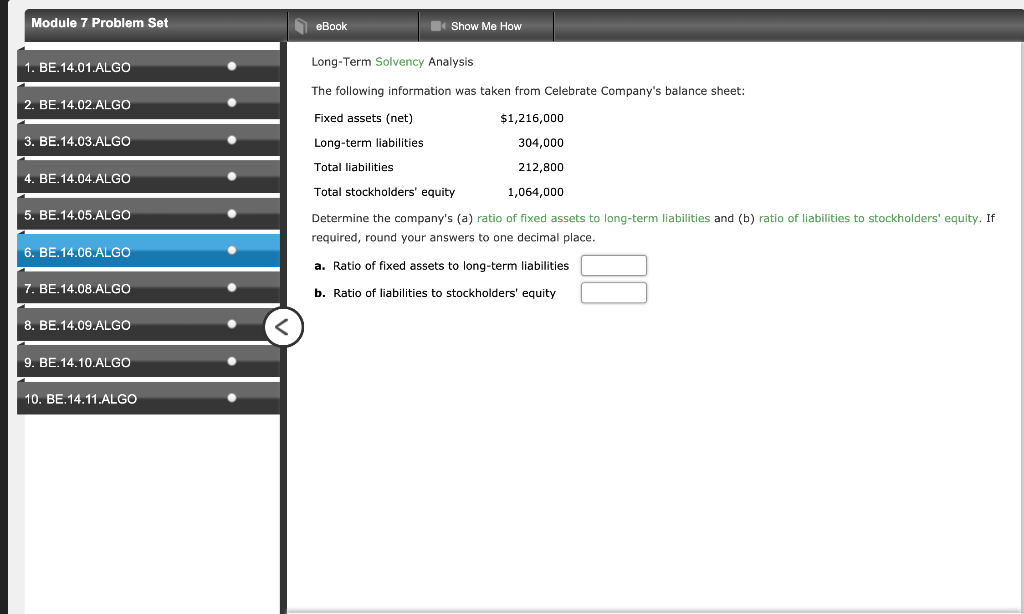

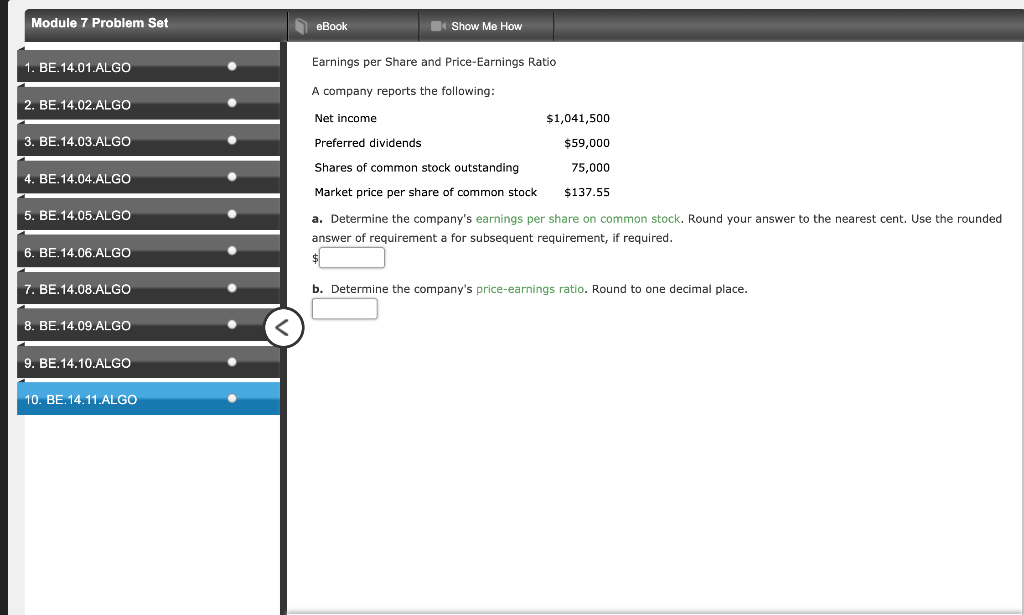

Module 7 Problem Set eBook Show Me How 1. BE.14.01.ALGO Horizontal Analysis The comparative accounts payable and long-term debt balances for a company follow. 2. BE.14.02.ALGO Current Year Previous Year 3. BE.14.03.ALGO Accounts payable $46,300 $59,264 33,075 Long-term debt 44,100 4. BE.14.04.ALGO Based on this information, what is the amount and percentage of increase or decrease that would be shown on a balance sheet with horizontal analysis? Enter all answers as positive numbers. 5. BE.14.05.ALGO 1 Amount of Change Increase/Decrease Percentage 6. BE.14.06.ALGO Accounts payable % 7. BE.14.08.ALGO Long-term debt % 8. BE.14.09.ALGO 9. BE.14.10.ALGO 10. BE.14.11.ALGO Module 7 Problem Set eBook Show Me How 1. BE.14.01.ALGO Vertical Analysis Income statement information for Einsworth Corporation follows: 2. BE.14.02.ALGO Sales $461,000 3. BE.14.03.ALGO 4. BE.14.04.ALGO Cost of goods sold 133,690 Gross profit 327,310 Prepare a vertical analysis of the income statement for Einsworth Corporation. If required, round percentage answers to the nearest whole number. 5. BE.14.05.ALGO 6. BE.14.06.ALGO 7. BE.14.08.ALGO Einsworth Corporation Vertical Analysis of the Income Statement Amount Percentage Sales $461,000 % 8. BE.14.09.ALGO Cost of goods sold 133,690 9. BE.14.10.ALGO Gross profit $327,310 % 10. BE.14.11.ALGO Check My Work Previous Next Progress: 2/10 items Module 7 Problem Set eBook Show Me How Current Position Analysis 1. BE.14.01.ALGO The following items are reported on a company's balance sheet: 2. BE.14.02.ALGO Cash $388,800 3. BE.14.03.ALGO 303,800 Marketable securities Accounts receivable (net) 279,400 4. BE.14.04.ALGO Inventory 243,000 5. BE.14.05.ALGO Accounts payable 405,000 Determine (a) the current ratio and (b) the quick ratio. Round to one decimal place. 6. BE.14.06.ALGO a. Current ratio 7. BE.14.08.ALGO b. Quick ratio 8. BE.14.09.ALGO 9. BE.14.10.ALGO 10. BE. 14.11.ALGO Check My Work Previous Next > Progress: 3/10 items Module 7 Problem Set eBook Show Me How 1. BE.14.01.ALGO Accounts Receivable Analysis A company reports the following: 2. BE.14.02.ALGO Sales $597,870 3. BE.14.03.ALGO Average accounts receivable (net) 66,430 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. 4. BE.14.04.ALGO 5. BE.14.05.ALGO a. Accounts receivable turnover b. Number of days' sales in receivables days 6. BE.14.06.ALGO 7. BE.14.08.ALGO 8. BE.14.09.ALGO 9. BE.14.10.ALGO 10. BE. 14.11.ALGO Check my work Check My Work Previous Next > Progress: 4/10 items Module 7 Problem Set eBook Show Me How 1. BE.14.01.ALGO Inventory Analysis 2. BE.14.02.ALGO A company reports the following: Cost of goods sold $459,900 Average inventory 61,320 3. BE.14.03.ALGO 4. BE.14.04.ALGO Determine (a) the inventory turnover and (b) the number of days' sales in inventory. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume 365 days a year. 5. BE.14.05.ALGO a. Inventory turnover b. Number of days' sales in inventory days 6. BE.14.06.ALGO 7. BE.14.08.ALGO 8. BE.14.09.ALGO 9. BE.14.10.ALGO 10. BE. 14.11.ALGO Check my work Check My Work Progress: 9/10 items Module 7 Problem Set eBook Show Me How 1. BE.14.01.ALGO Earnings per Share and Price-Earnings Ratio A company reports the following: 2. BE.14.02.ALGO Net income $1,041,500 3. BE.14.03.ALGO Preferred dividends $59,000 Shares of common stock outstanding 75,000 4. BE.14.04.ALGO OO Market price per share of common stock $137.55 5. BE.14.05.ALGO a. Determine the company's earnings per share on common stock. Round your answer to the nearest cent. Use the rounded answer of requirement a for subsequent requirement, if required. 6. BE.14.06.ALGO 7. BE.14.08.ALGO b. Determine the company's price-earnings ratio. Round to one decimal place. 8. BE.14.09.ALGO 9. BE.14.10.ALGO 10. BE.14.11.ALGO