Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Module 8: Valuing Stocks 30. You are considering purchase of a small agricultural business. Annual cash flow is $1,250,000 and there are 100,000 shares outstanding.

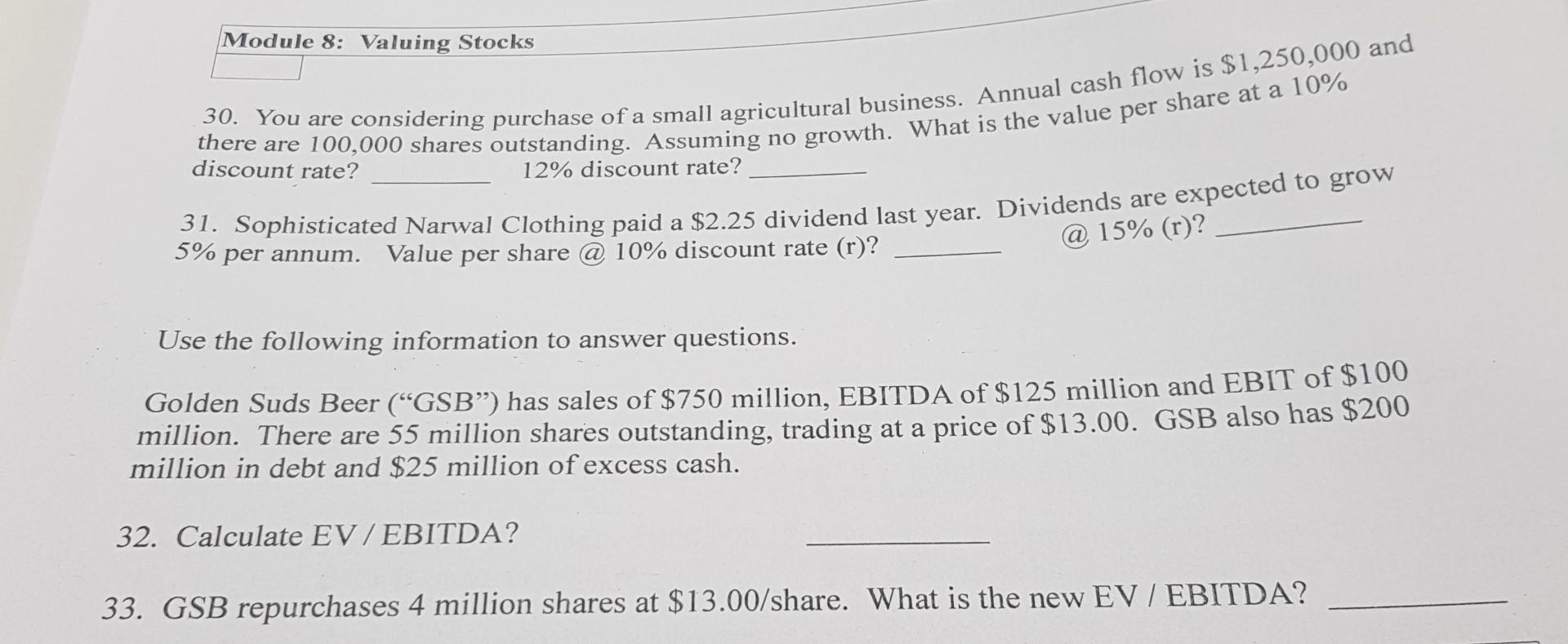

Module 8: Valuing Stocks 30. You are considering purchase of a small agricultural business. Annual cash flow is $1,250,000 and there are 100,000 shares outstanding. Assuming no growth. What is the value per share at a 10% discount rate? 12% discount rate? 31. Sophisticated Narwal Clothing paid a $2.25 dividend last year. Dividends are expected to grow 5% per annum. Value per share@10\% discount rate (r) ? (a) 15%(r)? Use the following information to answer questions. Golden Suds Beer ("GSB") has sales of $750 million, EBITDA of $125 million and EBIT of $100 million. There are 55 million shares outstanding, trading at price of $13.00. GSB also has $200 million in debt and $25 million of excess cash. 32. Calculate EV/EBITDA? 33. GSB repurchases 4 million shares at $13.00 /share. What is the new EV / EBITDA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started