Question: Alex Plc is a newly-established company with interests in retailing and property development. Its current market capitalisation is 75m. The company trades exclusively in

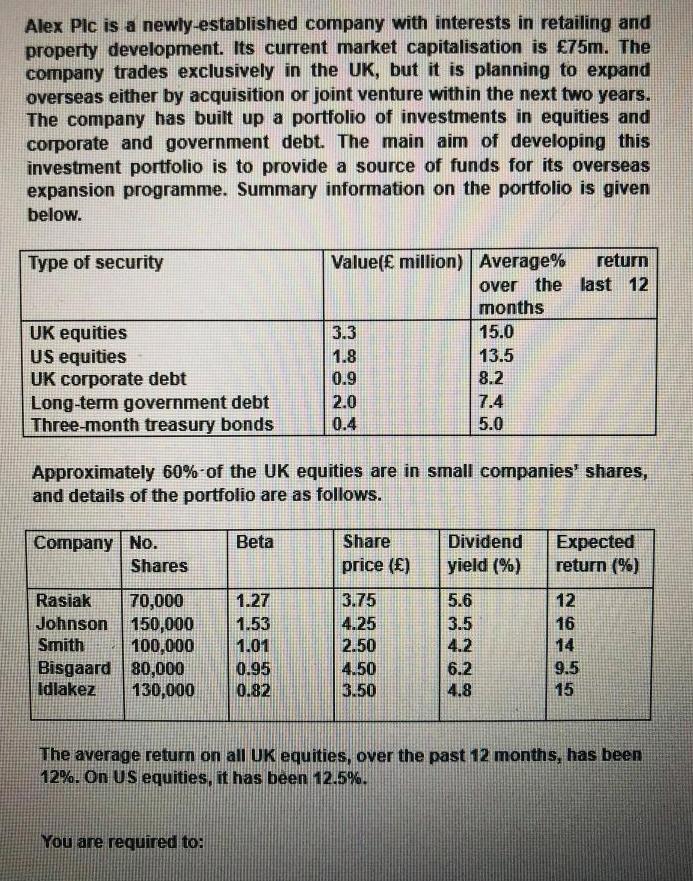

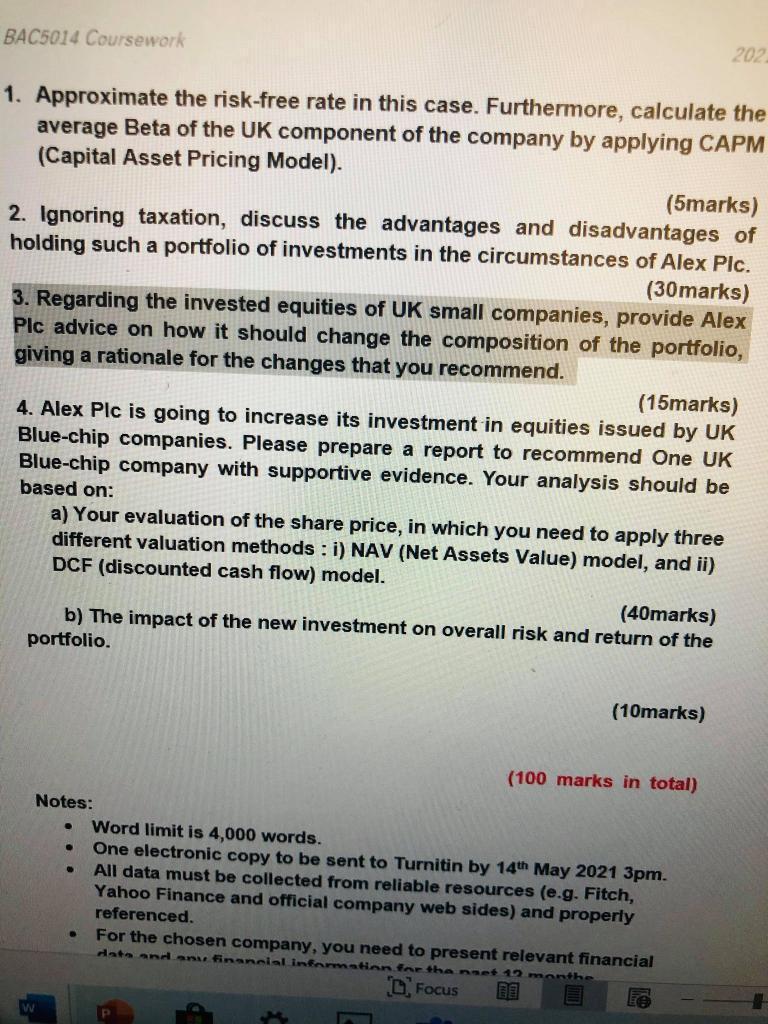

Alex Plc is a newly-established company with interests in retailing and property development. Its current market capitalisation is 75m. The company trades exclusively in the UK, but it is planning to expand overseas either by acquisition or joint venture within the next two years. The company has built up a portfolio of investments in equities and corporate and government debt. The main aim of developing this investment portfolio is to provide a source of funds for its overseas expansion programme. Summary information on the portfolio is given below. Type of security Value( million) Average% return over the last 12 months 15.0 UK equities US equities UK corporate debt Long-term government debt Three-month treasury bonds 3.3 1.8 13.5 0.9 8.2 2.0 7.4 0.4 5.0 Approximately 60% of the UK equities are in small companies' shares, and details of the portfolio are as follows. Company No. xpected return (%) Beta Share Dividend Shares price () yield (%) Rasiak 12 70,000 150,000 100,000 Bisgaard 80,000 130,000 1.27 3.75 5.6 Johnson 1.53 4.25 3.5 16 Smith 1.01 2.50 4.2 14 0.95 0.82 9.5 15 4.50 6.2 Idlakez 3.50 4.8 The average return on all UK equities, over the past 12 months, has been 12%. On US equities, it has been 12.5%. You are required to: 202 BAC5014 Coursework 1. Approximate the risk-free rate in this case. Furthermore, calculate the average Beta of the UK component of the company by applying CAPM (Capital Asset Pricing Model). (5marks) 2. Ignoring taxation, discuss the advantages and disadvantages of holding such a portfolio of investments in the circumstances of Alex Plc. (30marks) 3. Regarding the invested equities of UK small companies, provide Alex Plc advice on how it should change the composition of the portfolio, giving a rationale for the changes that you recommend. (15marks) 4. Alex Plc is going to increase its investment in equities issued by UK Blue-chip companies. Please prepare a report to recommend One UK Blue-chip company with supportive evidence. Your analysis should be based on: a) Your evaluation of the share price, in which you need to apply three different valuation methods : i) NAV (Net Assets Value) model, and ii) DCF (discounted cash flow) model. (40marks) b) The impact of the new investment on overall risk and return of the portfolio. (10marks) (100 marks in total) Notes: Word limit is 4,000 words. One electronic copy to be sent to Turnitin by 14th May 2021 3pm. All data must be collected from reliable resources (e.g. Fitch, Yahoo Finance and official company web sides) and properly referenced. For the chosen company, you need to present relevant financial data and any finsancial information.for the nset 12 monthe D Focus

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

PageNoat Answer Given data The advantage of holding Such a Po... View full answer

Get step-by-step solutions from verified subject matter experts